US government bonds rallied sharply on Friday and stocks pulled back after a gloomy report on America’s factory sector intensified concerns over the outlook for the world’s biggest economy.

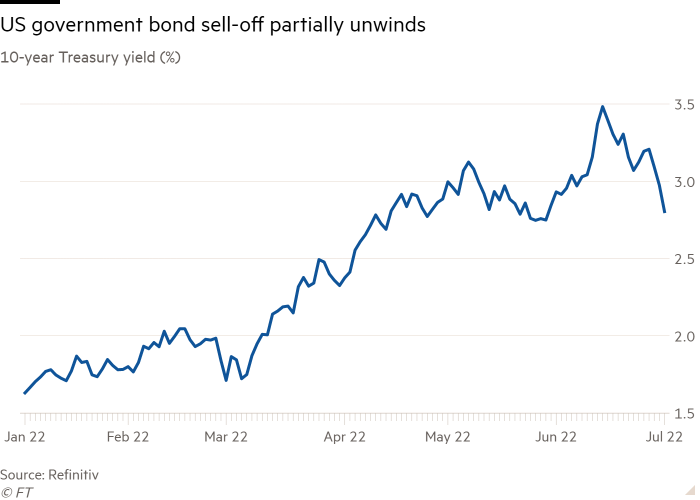

The yield on the 10-year Treasury note, a benchmark for global government bond markets as well as consumer loans and mortgages, dropped 0.1 percentage points to 2.86 per cent in thin trading before a holiday weekend in the US. The yield has fallen around 0.3 percentage points over the past three days in the biggest such move since 2020.

In equities, the benchmark S&P 500 index fell 0.5 per cent following its worst performance for the first half of a year since 1970.

A closely watched survey from the Institute for Supply Management on Friday showed the pace of growth in the US manufacturing sector declined sharply in June from May. At the same time, executives polled by the organisation indicated new orders submitted to factories and employment conditions both deteriorated because of long lead times and high prices.

“The ISM report, along with many other business surveys, points to recent weakening in the economy,” said Daniel Silver, economist at JPMorgan.

The data came after automaker General Motors announced a 15 per cent drop in quarterly sales and a report showed the annual rate of eurozone inflation climbed to a record high of 8.6 per cent last month.

Investors are becoming increasingly worried that measures by central banks including the US Federal Reserve, European Central Bank and the Bank of England to tamp down intense inflation will also derail major global economies.

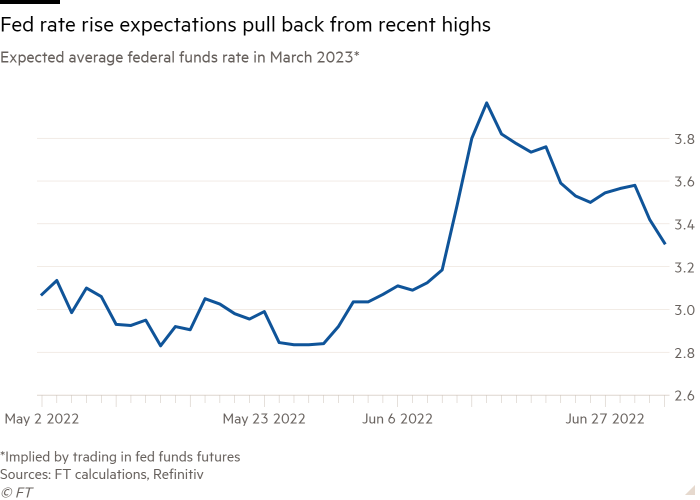

The US Federal Reserve lifted its benchmark interest rate by an extra-large 0.75 percentage points last month to a range of 1.5 to 1.75 per cent. Markets expect the funds rate to reach 3.3 per cent by next March, although these forecasts derived from trading in the futures market have been scaled back significantly from close to 4 per cent weeks ago.

The declining expectations for rate rises and worsening economic outlook have also pushed US bond yields from recent highs. The US 10-year yield has fallen around 0.6 percentage points from a mid-June high of nearly 3.5 per cent.

“It’s a continuation of the recession worries that we have seen this week. The market is questioning the Fed’s commitment to hike,” said Ben Jeffery, a strategist at BMO Capital Markets.

Fed chair Jay Powell conceded last week that a US economic downturn was “certainly a possibility” and avoiding it depended largely on factors outside the central bank’s control.

A rally in European bonds on Friday also accelerated after the ISM report. Germany’s 10-year Bund yield fell by 0.15 percentage points to 1.22 per cent, with yields on UK and French government bonds also declining.

“We’re seeing demand coming back for bonds as a haven asset,” said Aneeka Gupta, research director at ETF provider WisdomTree.

“There are concerns that central banks globally, in order to try and tame inflation, are now engineering not just a soft landing but pushing economies into recession,” she added. That, Gupta explained, could lead to a “policy mistake that forces them to reverse course” on interest rates.

In currencies, the dollar index, which measures the US currency against six others and rises in times of economic stress, rose 0.6 per cent.