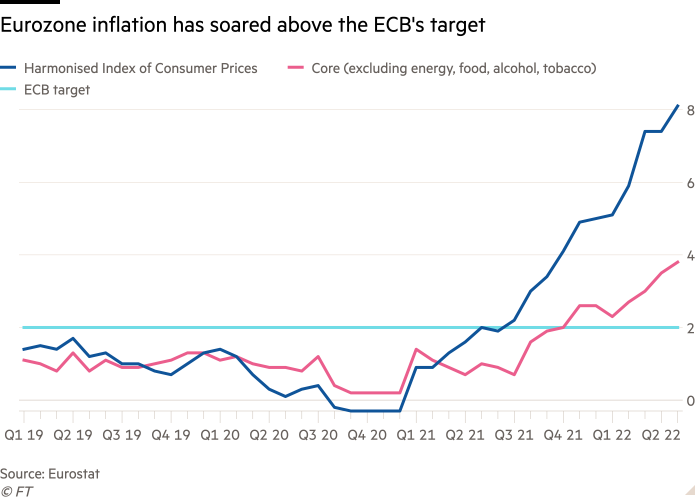

The European Central Bank is set this week to strengthen its commitment to propping up vulnerable eurozone countries’ debt markets if they are hit by a sell-off, as policymakers prepare to raise rates for the first time in more than a decade.

Most of the 25 governing council members are expected to support a proposal to create a bond-buying programme to prevent borrowing costs for member states, such as Italy, from spiralling out of control, according to several people involved in the discussions.

Even without a new scheme, the ECB already has an additional €200bn to spend on purchasing stressed government debt under its existing bond-buying programme. Those funds would come from bringing forward reinvestments of maturing assets by up to a year.

Rate-setters, who meet in Amsterdam this week, are likely to clash over when to stop buying more bonds. Some plan to call for purchases to be halted as soon as Thursday, weeks ahead of schedule, although they conceded that only a minority may support the idea.

Almost all of the council members accept that the ultra-loose monetary policy the bank has pursued for over a decade will end, with a rate rise of at least 25 basis points all but certain at the ECB’s next policy meeting on July 21.

Thanks for reading FirstFT Europe/Africa. Have any feedback on the newsletter? Let us know at firstft@ft.com. Here’s the rest of today’s news. — Jennifer

Five more stories in the news

1. US and European IPOs drop 90% in value this year The value of initial public offerings in the US and Europe has tumbled this year as Russia’s war in Ukraine and rising inflation and interest rates have forced businesses to shelve plans to go public.

“Once things stabilise, we will see a return of activity, even if it does not reach last year’s levels. People are not abandoning ship — they are pausing” — Martin Glass, a partner at law firm Jenner & Block

2. Ukraine rejects Macron’s warning against ‘humiliating’ Putin President Volodymyr Zelensky’s chief of staff hit back yesterday after the French president said it was important not to “humiliate” Russia over the war in Ukraine, saying “the aggressor’s responsibility is not humiliation, but justice” and pointing to the shelling of Ukrainian cities.

3. Demand falls for CFA financial analyst qualification A professional qualification known as the “hardest exam in finance” is falling out of fashion, with applicants for the chartered financial analyst programme running well below pre-pandemic levels for a third consecutive year.

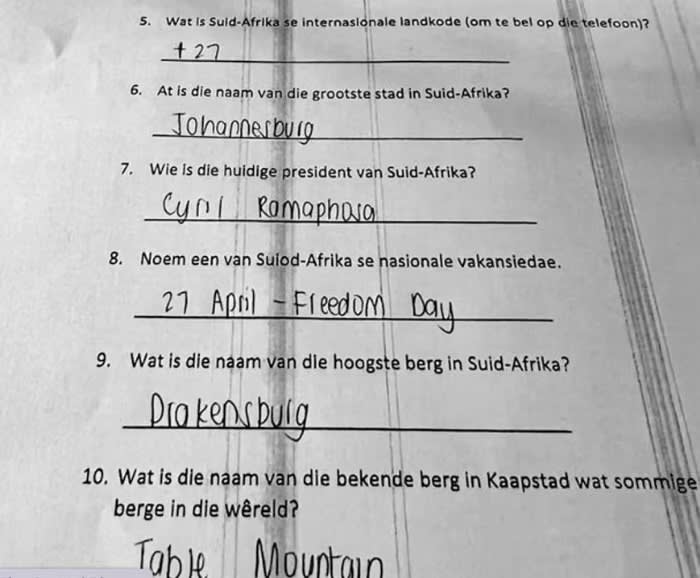

4. Ryanair forces South African customers to take Afrikaans test In a crackdown on fake passports, the airline is barring South African nationals from boarding flights if they fail a quiz in Afrikaans, a language they may not speak with a history of enforced use under apartheid. The unannounced test has drawn accusations of racial discrimination.

5. UK companies trial four-day working week About 70 companies with more than 3,300 workers will this week start a six-month trial to test whether a shorter working week — with no reductions to staff pay — can be adopted without a loss of productivity, after the pandemic caused a rethink of approaches to work.

The day ahead

Sunak questioned on cost of living UK chancellor Rishi Sunak will appear before the Treasury Committee to answer questions on his recently announced support package. A strike is planned by 4,000 rail, maritime and transport union members after the RMT criticised Transport for London for threatening 600 job losses.

D-Day anniversary It’s the 78th anniversary of the 1944 landings in Normandy, one of the largest amphibious military assaults in history, in which Allied forces began liberating mainland Europe from Nazi Germany during the second world war.

Apple’s WWDC Apple’s annual Worldwide Developers Conference begins. The iPhone maker will announce updates to its software platforms and may unveil or tease new products.

Summit of Americas Heads of state from across the Americas will gather in Los Angeles for a meeting overshadowed by arguments over who should be invited, who might boycott the event and what it can achieve.

What else we’re reading

Can buy now, pay later survive the cost of living crisis? The sector was supercharged by the ecommerce boom during Covid-19 and has become a ubiquitous lending choice in retail. But its business model is now under intense pressure as high energy and household prices cause customers to tighten their budgets, threatening their ability to maintain payments.

-

Some think yes: Investors are betting on start-ups that allow customers to defer or split payments into instalments as companies seek to manage stretched cash flows.

Ukraine’s ‘lost’ oligarchs The war is changing the fortunes of Ukraine’s business elite. Some of the country’s richest men played a vital role in propping up the country against Russian aggression in 2014, cementing their political influence and their financial interests. But eight years later, they have become more marginalised and their economic clout has waned.

Crunch time for Boris Johnson The UK prime minister faces a crucial by-election in rural Devon this month and mounting pressure to quit. His reputation has been battered by a partying scandal during Covid lockdowns and the worst cost-of-living squeeze in a generation, with allies conceding that rebel Tory MPs could trigger a vote of no confidence this week.

There is another act to come in this market drama US stocks have pulled back from the cliff edge — the 20 per cent drop that defines a bear market. Many are wondering how this drama, the worst start of any year since 1970, will end. Ruchir Sharma’s view is that this is an intermission, and the next act will bring another step down.

How ESG investing came to a reckoning The acronym is less than two decades old, but it may already be coming to the end of its useful life. With allegations of greenwashing at the highest levels, should funds still package together environmental, social and governance factors?

Travel

On an angling trip by train, Ruaridh Nicoll swaps the London rush hour for Hampshire’s tranquil, trout-filled streams that run as clear as air.