aeduard/iStock via Getty Images

The Q1 Earnings Season for the precious metals sector is finally over, and surprisingly, one of the regular dogs of the sector finally managed to put up a decent performance. This was Americas Gold and Silver (NYSE:USAS), which like Great Panther (GPL), Pure Gold (OTCPK:LRTNF), and Excellon (EXN), has been regularly diluting shareholders and struggling to put together one decent quarter. While this has lowered the risk of immediate share dilution for USAS, its track record is among the worst for producers, still making this a very high-risk bet. So, while USAS does trade at a discount to its peer group, I see this discount, and I think there are better ways to get exposure to precious metals.

Cosala Operations (Company Presentation)

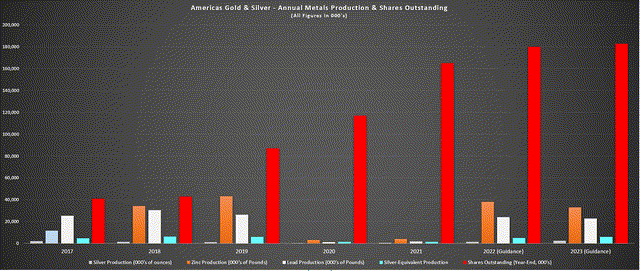

Just over two months ago, I wrote on Americas Gold and Silver (“Americas”), noting that while the company was touting itself as “high-growth”, this was not growth at all but simply a recovery to past production levels. Just as important, production growth per share has fallen off a cliff, given that the company has diluted shareholders by ~300% since Q1 2017 in a period where production is actually lower. Based on this, I noted that any sharp rallies above US$1.15 before April would be a profit-taking opportunity.

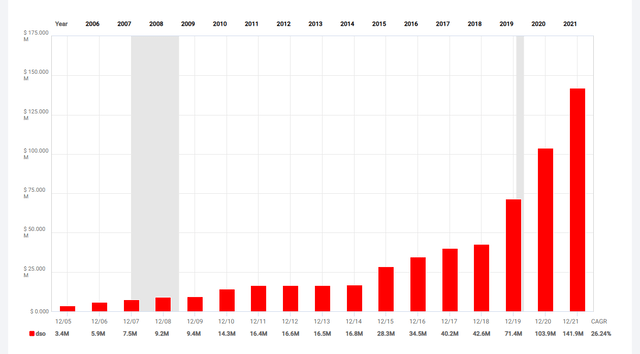

Americas Gold and Silver – Annual Metals Production & Shares Outstanding (Company Filings, Author’s Chart)

Since heading above US$1.15 in March, USAS has hit new lows, which might have some investors scratching their heads. This is because the company reported a triple-digit increase in revenue in its most recent quarter (154%) and a nearly 100% increase in silver production. However, it’s important to note that Americas was up against very favorable comps, lapping a period (Q1 2021) of no production from Cosala due to an extended strike at the operation. In addition, while Americas is targeting higher production, this tune has been sung for years, and the only consistent growth has been in the share count. Let’s take a look at the Q1 results below:

Production & Costs

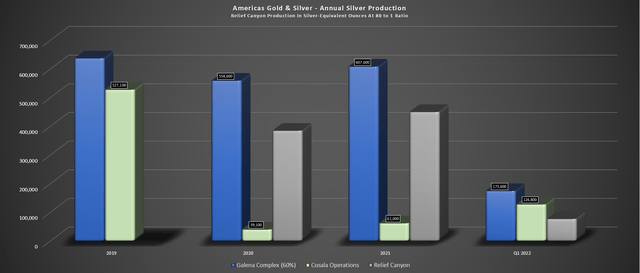

Americas Gold and Silver released its Q1 results last month, reporting quarterly production of ~300,300 ounces of silver, a more than 90% increase from the year-ago period (~151,300 ounces). This was helped by ~127,000 ounces of production from Cosala, which did contribute in the year-ago period (temporarily suspended), and ~174,000 attributable ounces from its 60% owned Galena Complex in Idaho. The company also saw silver-equivalent production of ~76,000 ounces from leaching operations at Relief Canyon.

Americas Gold and Silver – Silver Production (Company Filings, Author’s Chart)

As the chart shows, these numbers are tracking ahead of 2020/2021 levels, suggesting meaningful growth. However, this is simply because Cosala (green bar) was not contributing much in 2020/2021, meaning that this is a recovery to previous production levels, not growth. Besides, this production profile was supposed to look much different after the commissioning of Relief Canyon, with company guidance of 100,000 gold-equivalent ounces in 2020, or ~8.0 million silver-equivalent ounces. Unfortunately, Relief Canyon has been a massive failure, with the identification of carbonaceous material in the Relief Canyon pit, leading to a suspension of mining activities.

The good news, if one is willing to overlook the significant share dilution related to Relief Canyon that has accomplished next to nothing from a production growth standpoint, was the fact that costs came in at industry-leading levels in Q1. This was based on Americas’ all-in sustaining costs of negative $2.67 per ounce in Q1 2022, helped by higher base metals production and higher base metals prices that aided with by-product credits. This has stopped the constant cash burn, helping Americas to pause its constant share dilution.

Galena Complex Operations (Company Presentation)

Meanwhile, although Galena hasn’t been a meaningful contributor with less than 1.0 million attributable silver ounces per annum, the company plans to commission its newly purchased hoist in Q4 2022. This should boost production and improve unit costs at the operation, which remain elevated, coming in at $26.44/oz in Q1 2022, and $31.79/oz after including Galena Recapitalization Plan costs. A return to more reasonable costs at this operation would be a step in the right direction, reducing the reliance on Cosala for cash generation.

Finally, Americas noted that it would be heading towards the Upper Zone at Cosala in H2, looking to increase silver production with much higher silver grades in this area. This will make Americas more of a silver producer vs. a silver/base metal producer currently due to the choice to focus on areas with higher zinc and lead resources to maximize cash flow and improve liquidity. So, while silver production will be relatively insignificant, albeit, at very attractive costs in 2022, the goal is to ramp up silver production through increased hoisting capacity at Galena and higher grades at Cosala.

Financial Results

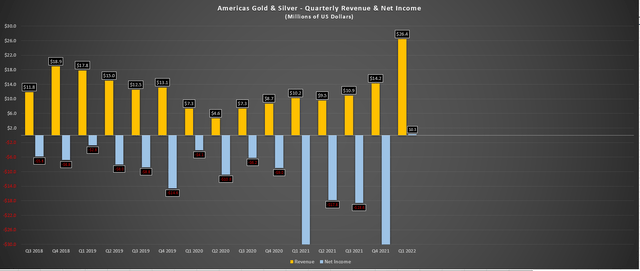

Given the higher production at significantly lower costs, Americas reported a 154% increase in revenue, with quarterly revenue coming in at $26.4 million. Meanwhile, with significant by-product credits that drove down unit costs, the company nearly reported a net profit, with its net loss shrinking from $91.8 million in Q1 2021 (write-down) to $0.3 million in Q1 2022. This led to an improvement in working capital, with its working capital deficit sitting at negative $4.5 million, down from negative $22.1 million in Q4 2021. While this isn’t a glowing working capital position, it’s at least a step in the right direction, reducing the reliance on the At-The-Market Equity facility to pay the bills.

During the past 12 months, Americas Gold and Silver issued 39.5 million shares under its ATM at a share price of $1.06, leading to ~20% share dilution.

Americas Gold and Silver – Quarterly Revenue & Net Income (Company Filings, Author’s Chart)

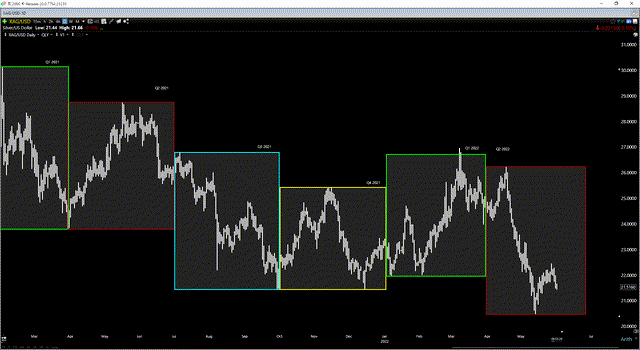

While this turnaround is certainly encouraging, the company hasn’t got any help from the silver price in Q2, with the average realized silver price looking like it will come in below $22.50/oz in Q2 vs. $23.90/oz in Q1. While this isn’t a huge deal for Americas, which is producing at a negative AISC currently due to by-product credits, it will be a small headwind from a margin and cash flow standpoint. Still, the fact that Americas doesn’t have to dilute shareholders constantly is an upgrade to the story, even if it’s a very low bar to measure performance against for a producing miner.

Silver Futures Price (TC2000.com)

Assuming silver prices remain above $22.00/oz and base metals prices can hold up, Americas should be able to generate well over $100 million in revenue this year, a more than 100% increase from last year’s levels ($44.8 million). This would be a significant improvement, and this triple-digit increase might lure some investors back into the story, especially with the company labeling itself a “high-growth” company. However, it’s important to look at the background of the company and track record to see if a stock is worthy of investment. In my view, this spotty track record helps explain why Americas trades at a discount to peers.

Track Record

Before digging into the valuation, which will be discussed in a little more detail below, it’s worth looking into the track, which is among the worst sector-wide. Just a decade ago, Scorpio Mining (now Americas Gold and Silver) had one mine (Nuestra Señora) in the Cosala District of Mexico and reported 2011 production of ~2.8 million silver-equivalent ounces. The company had ~213 million fully diluted shares, which is relatively high, but was at least profitable and had a solid working capital position ($40+ million).

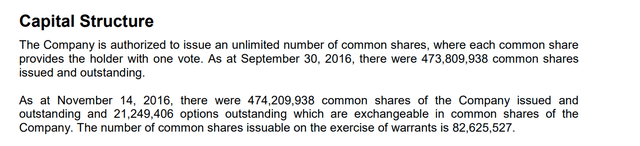

In 2014, the company merged with US Gold & Silver, adding the Galena asset in Idaho and announcing plans to increase production to a combined 4.5 – 5.0 million SEOs per annum. While this came with meaningful share dilution (an increase to ~335 million shares outstanding), it wasn’t a terrible move since it added growth to the story. Although AG&S came just shy of the 5.0 million ounce mark in 2015 and 2016, costs were relatively high at a two-year average of more than $14.00/oz, with net losses reported in both years. Given the lack of sustainable free cash flow generation, the share count continued to increase.

Americas Gold and Silver Share Count – Q4 2016 (Company Filings)

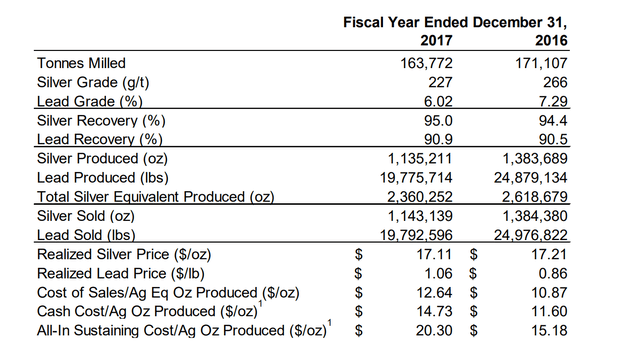

Following a more than doubling in the fully diluted share count since 2011, Americas did a 12 for 1 share consolidation, reducing its share count to ~40 million shares in 2017. This made it appear as if the company had a tight share structure and didn’t have a track record of steady share dilution for those unfamiliar with the story. The plan was to continue to maintain a respectable production profile from its new San Rafael Mine in the Cosala District and work to improve costs at Galena, where costs had crept up to $20.30/oz in 2017 (2016: $15.18/oz), well above the average realized silver price.

Americas Gold and Silver – Galena Operations (2016/2017) (Company Filings)

In the Q1 2018 Conference Call, CEO Darren Blassutti said that its strategy was to move production from silver to base metals and be ready for the silver price to increase to bring on silver production cheaply. This wasn’t a bad decision and would have worked out well, given that the silver price recovered in 2019 and 2020. However, perhaps growing impatient for a recovery in silver, the decision was made to complete another business combination with Pershing Gold (PGLC), a company with a gold development project in Nevada. Shortly after, a decision was made to construct Relief Canyon without completing its own study.

Relief Canyon Operations (Company Presentation)

To make a long story short, this led to further share dilution, with the share count more than doubling again to over 90 million fully diluted shares as of mid-2019. In the same year, Americas announced a joint-venture to recapitalize Galena, losing 40% of its ownership in the asset (60% vs. 100%). Unfortunately, Relief Canyon did not work out as planned and has produced less than 10% of its expected annual gold production, and mining activities are currently suspended while metallurgical work continues.

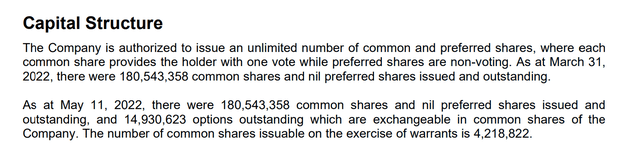

Americas Gold and Silver – Current Share Count (Company Filings)

The end result? Americas will be lucky to produce 5 million SEOs this year, a goal it had nearly a decade ago, but with a share count that’s gone from ~30 million shares (pre 12 for 1 consolidation) to ~195 million shares. Hence, there’s been a precipitous decline in production per share and two of the past acquisitions have struggled to generate any shareholder value. The gold/silver producer space is known for value destruction, and even the largest companies have made their missteps. However, few producers have diluted shareholders to this extent with such little progress (declining production in the same period).

Americas Gold and Silver – Share Count (FASTGraphs.com)

Now that some background has been provided into the lack of success over the past decade, especially relative to sector leaders who have managed to create meaningful shareholder value despite wading through a secular bear market, let’s look at the valuation.

Valuation

Based on ~195 million fully diluted shares and a share price of US$0.80, Americas may look cheap, trading at a market cap of just ~$156 million. This is because the company has very low all-in sustaining costs as it benefits from improved base metals prices, and Relief Canyon is no longer a drag on the company with mining activities suspended and the write-down out of the way. However, while Americas is cheap for a producer, it’s a relatively small producer, producing ~1.6 million ounces of silver per annum, one of the smaller production profiles among its publicly traded peers.

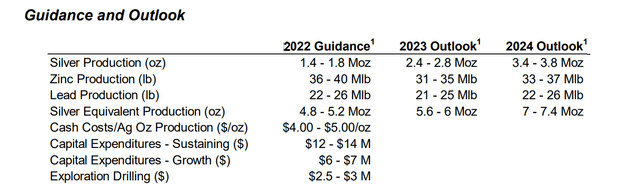

Americas Gold and Silver – Guidance & Outlook (Company Filings)

The goal is to increase this production rate to more than 3.0 million ounces per annum, which would help to justify a slightly higher multiple, assuming it can keep costs under control. However, one must put the previous track record in context before relying on these figures, which certainly hasn’t inspired any confidence. Hence, while Americas might trade at a discount to its peers at less than 0.55x P/NAV vs. an emerging producers average of more than 0.75x P/NAV, some of this discount likely has to do with the fact that investors have lost confidence in management’s ability to execute successfully.

In addition to this poor track record, Galena is a relatively high-cost asset currently with AISC above $31.00/oz in Q1 2022, meaning that the key to retaining profitability is Cosala. While Cosala is a solid asset with a massive land package, it’s in Mexico, which has been a more difficult jurisdiction lately. This is evidenced by tax trouble for First Majestic (AG) from SAT, permitting headaches for Fortuna (FSM) at San Jose, and more permitting headaches for Great Panther (GPL) at GMC. In fact, Cosala just had an extended strike (~2 years).

In my view, the outlook for operating in Mexico is not as attractive as it was previously, and with Cosala being Americas workhorse and free cash flow generator, this is a risk. For now, there are no issues to report, and the mine is putting up very solid results. However, with this being the only asset generating free cash flow, any upcoming issue here would deliver a significant blow. So, given Americas’ lack of diversification with Relief Canyon having an uncertain future and Galena still needing further work to reach consistent profitability, I believe a discount is more than justified.

Americas Gold and Silver Operations (Company Presentation)

Americas had a solid start to 2022, helped by a return to commercial production at Cosala and higher silver prices. Meanwhile, the company’s long-term outlook looks solid, suggesting significant production growth over the coming years. However, the most important metric is production growth per share, and Americas has failed miserably in this department, and its inferior track record, evidenced by above-average share dilution, makes it difficult to trust the company. Hence, while USAS may be cheap and may be working on a turnaround, I think there are several better places to park one’s money if they are looking for precious metals exposure.