chonticha wat/iStock via Getty Images

Integra Resources (ITRG) finally released the results of the long-awaited PFS (pre-feasibility study) for its DeLamar project. DeLamar had very good PEA results and it was believed that the PFS will outline an even more attractive mining project. The expectations were further boosted in October when Integra announced that the PFS will present an increased scope of the project. The company stated:

The augmented scope and increased throughput at DeLamar, subject to on-going studies, is expected to result in a 50% or greater increase in gold and silver production profile over a longer time-frame relative to the 2019 Preliminary Economic Assessment (“PEA”) which showed 124,000 oz gold equivalent (“AuEq”) per year over 10 years.

It should be noted that the Company does anticipate an increase in capex for the upcoming PFS; however, the expectations are that the increase in capex will be in-line with the larger production profile presented.

Unfortunately, the promises haven’t been fulfilled. As a result, the share lost around 14% of its value since the news release. And there is no reason to expect the long-term bearish trend to end anytime soon.

Integra Resources

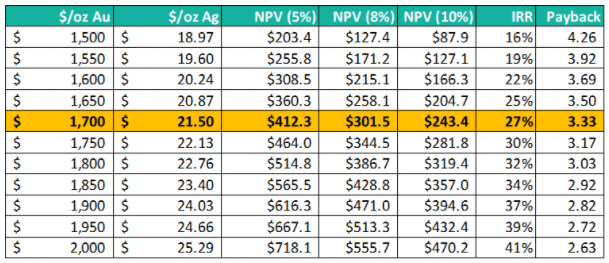

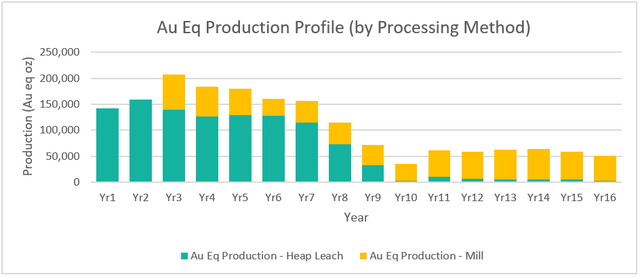

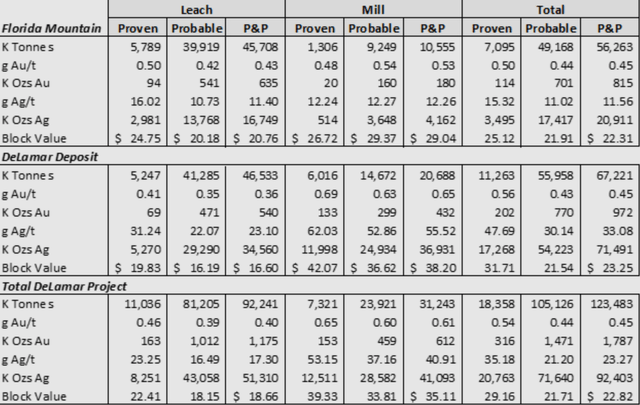

According to the PFS, DeLamar should be developed in two stages. The first stage should consist of a heap leach operation with a throughput rate of 35,000 tpd, and stage 2 involves the construction of a 6,000 tpd mill. The mine should be able to produce 121,000 toz gold and 3.3 million toz silver (163,000 toz of gold equivalent) per year over the first 8 years and 71,000 toz gold and 3.1 million toz silver (110,000 toz of gold equivalent) over the 16-year mine life. The AISC should be $955/toz of gold equivalent (silver is a co-product), or $547/toz gold (silver is a by-product). The CAPEX is projected at $282 million. At a base-case gold price of $1,700/toz and silver price of $21.5/toz, the after-tax NPV(5%) equals $412.3 million and the after-tax IRR equals 27%.

Integra Resources

Integra Resources

At a first sight, the numbers don’t look bad. The problem is that the expectations were notably higher. There are several points where the PFS disappointed:

- The production is lower than expected. Integra promised at least 50% higher production volumes compared to the PEA. It would mean more than 186,000 toz of gold equivalent per year. However, the life of mine average annual production should be only 110,000 toz of gold equivalent, which is even less than 124,000 toz of gold equivalent projected by the PEA. Even the first 8 years when the production should be 163,000 toz of gold equivalent per year don’t approach the 186,000 toz mark. Yes, the mine life increased from 10 to 16 years, but as can be seen in the chart above, during the second half of its mine life, DeLamar should become only a marginal gold mining operation.

- The CAPEX grew from $161 million to $282 million or by 63%. DeLamar was originally expected to be a relatively cheap, easy-to-finance project. But a $282 million CAPEX is relatively high for a mine with an annual production of 110,000 toz of gold equivalent. It has a negative impact on the economics of the project and on Integra’s ability to finance the mine construction. Yes, it probably will be able to obtain the financing, but the shareholders must prepare for a much bigger share dilution.

- The economics of the project have worsened significantly. The PEA presented an after-tax NPV(5%) of $604.9 million at a gold price of $1,700/toz and a silver price of $21.28/toz. At the same gold price and even slightly higher silver price ($21.5/toz), the PFS projects an after-tax NPV(5%) of only $412.3 million. The after-tax IRR declined from a really great value of 67% to a good, but much less impressive value of 27%.

Integra Resources

But there are also some positives. The maiden reserves were outlined (table above). The combined reserves of the Florida Mountain and DeLamar deposits contain 1.787 million toz gold and 92.403 million toz silver. And the AISC declined. The PEA projected it at $619/toz gold. But due to the higher silver by-product credits, the AISC declined to $547/toz gold in the PFS.

Conclusion

As can be seen in the chart below, Integra has been in a bearish trend for more than 1.5 years. The current sell-off pushed the share price down to the lower boundary of the trading channel. The share price is safely below the 10-day as well as the 50-day moving average and the RSI hasn’t reached the oversold levels yet. There are no signs of an imminent trend reversal.

TradingView

The question is whether Integra’s shares still offer some upside potential. The answer is yes. Unfortunately, it is lower than before the PFS was released. Integra’s market capitalization is $105 million. It is well below the after-tax NPV(5%) of $570 million, valid for the current gold and silver prices. But given the notably higher CAPEX, the share dilution will have to be much bigger than originally expected. Moreover, after the disappointment, many investors may lose their trust in the company and leave the ship, which means that the share price decline may continue. Therefore, I don’t think that it is a good time for purchasing the shares of Integra Resources. Much better buying opportunities may be ahead.