New home prices in China fell 0.2 per cent in October amid continued weakness in the property sector, official data showed on Monday.

Separately, property investment grew 7.2 per cent in the first 10 months of the year over the same period in 2020, with residential investment rising 9.3 per cent, the National Bureau of Statistics said.

“The sales prices of newly built residential buildings in first-tier cities remained flat month-on-month,” said Sheng Guoqing, NBS chief statistician, referring to Shanghai, Beijing, Guangzhou and Shenzhen.

New home prices rose 3.4 per cent year-on-year in October, slower than the growth of 3.8 per cent in September, according to Reuters. The NBS data are compiled from real estate price statistics in 70 large and medium-sized cities.

Property sales by floor area rose 7.3 per cent overall from January to October from the same period a year earlier. Residential sales by floor area rose 7.1 per cent but commercial sales by floor area shrank 0.6 per cent.

Central China posted 12.1 per cent investment growth, while eastern China showed a 6.8 per cent rise. Western China posted 5 per cent growth, while the north-east lagged with an increase of just 0.8 per cent.

New construction starts measured by floor area fell 7.7 per cent year-on-year in the first 10 months of 2021.

Real estate developments raised 8.8 per cent more in funds during the period compared with the first 10 months of 2020.

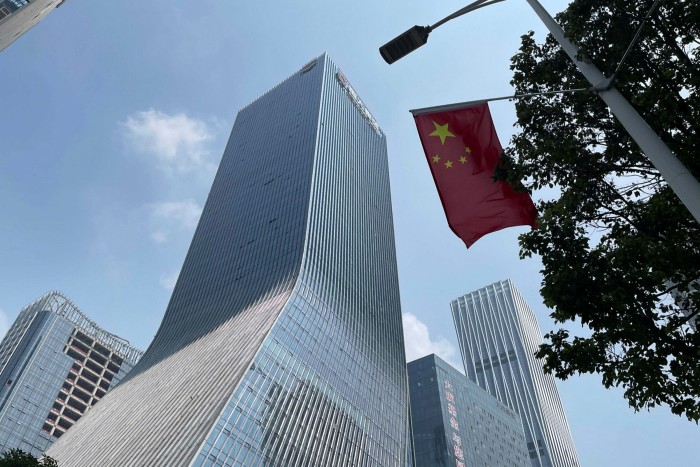

China’s real estate sector has been rocked in recent months by concerns over massive debts, with investors fretting over a string of missed bond payments by larger developers such as Evergrande, Sinic and Fantasia.

A bout of selling last week in junk bonds issued by riskier Chinese property developers has sent borrowing costs soaring to the highest level in a decade and imperilled companies’ ability to access an important funding source.