Funds raised by technology start-ups’ public listings in mainland China are on track for the first annual drop in seven years as Beijing’s crackdown on the lucrative sector sends investors in search of alternative markets.

Initial public offerings by tech companies on mainland China’s stock exchanges have raised about $14bn in 2021, according to data from Dealogic, trailing last year’s total by $2.3bn as bankers in Shanghai and Shenzhen head into what is typically a quiet period for deals.

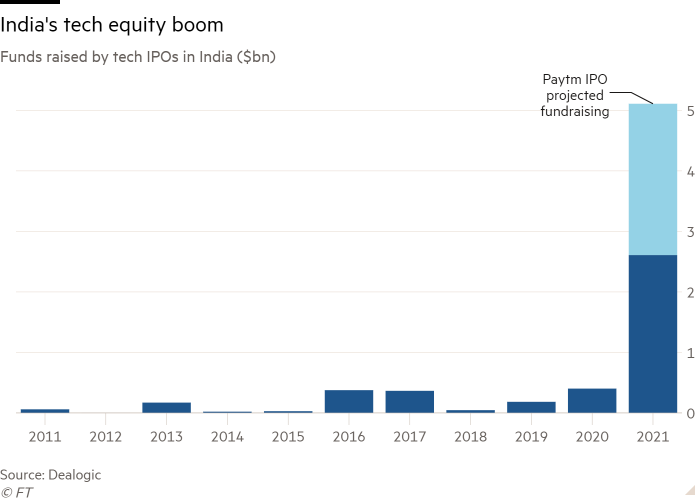

Tech listings in India, meanwhile, have raised $2.6bn this year, a jump of 550 per cent compared to last year’s total and an all-time high even before the IPO of Paytm, which is expected to bring in a record $2.5bn this week after pricing at the top end of its range on Friday.

The substantial gap between the countries’ fundraising totals reflects China’s head start in fostering an ecosystem of homegrown tech champions.

But analysts said the record volume of Indian share sales demonstrated that the market was maturing, with regulatory changes allowing lossmaking companies to list in Mumbai encouraging more start-ups to look at the public markets.

The first test of those rules came in July with the listing of food delivery company Zomato, the country’s first big tech IPO. Shares in the cash-burning start-up have almost doubled from their issue price, which valued the company at about $12bn.

China’s regulatory whirlwind has depressed the share prices of its biggest tech brands and unsettled investors, including those looking at state-backed groups favoured by authorities for fast-track listings.

“International investors are beginning to understand that many Chinese internet companies will struggle to maintain the profits they have made in the past,” said Wong Kok Hoi, founder of APS Asset Management.

“If major investors such as private equity funds that have a mandate to invest in the internet sector in emerging Asia believe the game is over in China, they will simply look elsewhere, and India is the main alternative.”

Bhavish Aggarwal, chief executive of Ola, the SoftBank-backed ride-sharing group, told the Financial Times last month that India’s entrepreneurs should exploit China’s regulatory upheaval to entice global funds.

Analysts and strategists said many factors have weighed on share sales in China this year, including more stringent enforcement of listings requirements and the poor performance of domestic stocks. China’s benchmark CSI 300 index of Shanghai- and Shenzhen-listed stocks is down about 6 per cent this year.

But the biggest blow has come from Beijing’s crackdown on tech companies, which has scared many investors away from new listings.

High-profile tech listings touted this year have failed to materialise, such as artificial intelligence start-up Megvii, which filed for IPO in March on Shanghai’s Star Market.

“So much of the oxygen has been sucked out of the room by the regulatory firestorm,” said Thomas Gatley, an analyst at Gavekal Dragonomics in Beijing.

He added that the biggest Chinese tech groups suited to onshore markets, including those of battery maker CATL and chipmaker SMIC, had already gone public, leaving few large deals in the pipeline.

Additional reporting by Benjamin Parkin in New Delhi