Hello from Brussels, where the sense of safety from the use of Covid-19 vaccination certificates to enter restaurants and so on means the city is returning to its usual café-society buzz, albeit somewhat disjointedly. Today’s Trade Secrets author went to the much-loved annual Museum Night Fever event last Saturday, where the city’s museums open till the small hours complete with pop-up bars, music, events and so on, and was somewhat surprised to find massive queues outside them. We Bruxellois clearly have a lot of pent-up thirst for culture (and also blanches and tripels) to slake.

In other Brussels-entertainment news, the tribute to video games that the European Commission came up with to celebrate its work on enforcing trade rules is either brilliant or insane or perhaps both, decide for yourself. Today’s main piece is on another clodhopping American attempt to push China out of tech supply chains, which like various similar efforts undertaken during the Trump era is proving counterproductive and causing some face-palming in Europe. Charted waters looks at free trade with the EU, or rather the lack thereof.

No transatlantic tech meeting of minds on 5G

Remember how trade is all about tech these days, and the big thing is transatlantic co-operation and the building of alliances? Right, well, a test of this is going on right now, and to be honest it’s not going that well.

Here’s the story. 5G broadband technology is dominated by China (Huawei, ZTE) with important supporting roles for Europe (Ericsson, Nokia) and South Korea (Samsung). The US doesn’t like either Huawei’s dominance or the relative lack of US presence in 5G, and has been trying to intimidate European governments in particular into pushing Huawei out of their systems. Enter Open RAN (Radio Access Network), a new open source-type technological approach, which could be a supplement and potentially a rival to the systems of established companies such as Huawei.

Those who understand these things — we strongly advise you to follow the writings of Hosuk Lee-Makiyama of the European Centre for International Political Economy, who’s been all over it for a while — say that the idea of Open RAN as a big threat to Huawei is unrealistic and that it might gain perhaps 10 per cent of the market by 2025. Nonetheless, the idea of a Huawei rival — particularly one that could give US companies a chance to get into the 5G game — is catnip to Washington. Congress and the Trump and Biden administrations have suggested shovelling public money into Open RAN research and promoting it as an international standard.

Just a couple of tiny problems. Any company can apply to join the O-RAN Alliance, the main consortium developing the technology. And when we say anyone, the current roster includes several Chinese companies who are on the US Entity List or otherwise labelled a potential security threat because of their links with the defence industry, the military or the Chinese Communist party. This includes, for example, Inspur, a data and cloud computing group, and Phytium, a supercomputing entity. Nokia actually suspended its participation in the O-RAN Alliance in August (it has since rejoined) because it feared it would be hit with US sanctions for working with companies deemed to be security risks.

As Lee-Makiyama says: “US sanctions aim at continuing to keep US networks ‘China-free’ and undermine Huawei, which makes much of its claim to be a private company. Meanwhile, US diplomats are endorsing a consortium that includes companies that are confirmed as Chinese state-owned defence contractors.”

If the US government wants to give subsidies to the O-RAN Alliance and make it a formal standards-setting body, it needs to be open to all rather than a self-governing private grouping if the funding is not to fall foul of World Trade Organization rules. But that of course means losing control over its membership further.

As regards transatlantic co-operation on this issue, well, there’s not much sign of it yet. With 5G, there’s an odd reversal of the norm in tech matters. Here, it’s the EU that has the dominant companies (Ericsson and Nokia) and is generally in favour of a thousand-flowers-blooming laissez-faire attitude (which in this particular area we heartily endorse). This report on the future of 5G lays out the EU’s views nicely and gives some potential future scenarios. It’s the US that wants to manage the technology via a closed circle of companies and, if necessary, some big dollops of government cash. Open RAN was discussed at the recent EU-US Trade and Technology Council meeting, but there was no particular convergence on the issue, with similarly little agreement at the recent G7.

So that transatlantic tech co-operation thing’s off to an uneasy start. The Biden administration may be less mindlessly combative towards China (or indeed all trading partners, including the EU) than was Donald Trump. It hasn’t come up with truly loopy ideas like former attorney-general Bill Barr’s boneheaded wheeze of the US government taking equity stakes in Ericsson and Nokia to bolster it against Huawei, which would of course lead to those companies being expelled from the Chinese market. But on the strength of episodes such as 5G and Open RAN, the US still has the same one-dimensional view of the world combined with a clumsy handling of policy that can end up being counterproductive. Gentle attempts at suasion from the EU about the benefits of pluralism and openness haven’t yet moderated Washington’s approach.

Charted waters

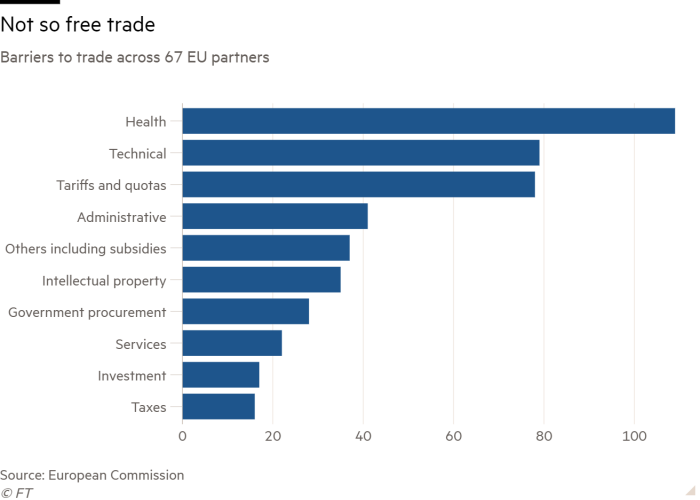

Andy Bounds in our Brussels bureau has an interesting story looking into a new report by the European Commission, which finds that 66 countries, including many with trade deals with Brussels, have put up unjustified barriers.

Expect more on this in Trade Secrets next week. For now, here’s a chart summing up why trade, even with your partners, is anything but free. Claire Jones

Trade links

The nominee for US ambassador to the WTO says she wants to restore the institution’s frozen Appellate Body of its dispute settlement process, though adding it must return to what the US says is the its original purpose.

Yesterday’s UK government Budget included some funding to ease the country’s acute shortage of truck drivers, but the logistics industry said it was inadequate to address Britain’s severe problem with supply chains.

Apple’s push to decarbonise its supply chain by 2030 is trickling down to Asia, where Foxconn, SK Hynix and Japan Display count among the 110 suppliers that have committed to a renewable energy transition, according to Nikkei ($)

Samsung plans (Nikkei) to triple chip production capacity by 2026 and may build a factory in the US to meet rising demand. Porsche, meanwhile, has an order backlog of 10,000 for its new electric Taycan. Alan Beattie and Francesca Regalado