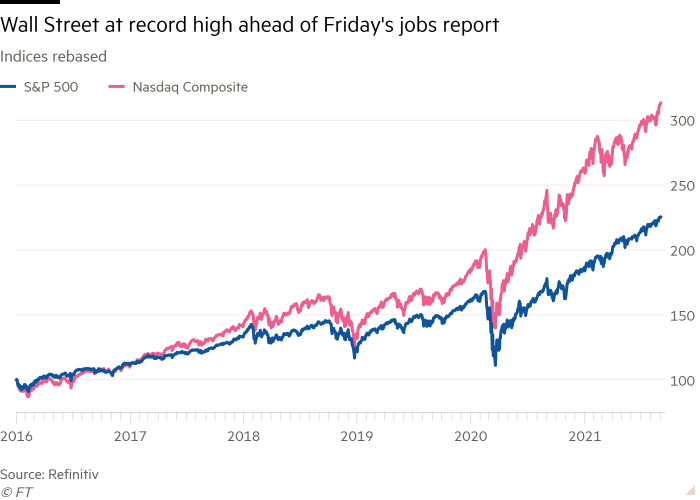

Wall Street’s leading stock benchmark hit record highs on Thursday ahead of Friday’s keenly watched US labour market report which will help set the path of monetary policies that have shored up markets during the pandemic.

The blue-chip S&P 500 was up 0.1 per cent by mid-afternoon in New York, hitting a high, while the tech-focused Nasdaq Composite traded flat.

Economists polled by Bloomberg expect that Friday’s non-farm payrolls report, a monthly data release scrutinised by traders, will show US employers added 725,000 jobs in August.

Anything around this level is “something that markets would be comfortable with”, Invesco multi-asset fund manager Sebastian Mackay said, as it would support a popular narrative that the US economy is recovering strongly from the pandemic at the same time that the nation’s central bank is willing to continue its crisis-era stimulus.

Analysts have also noted that unemployment rates will continue to fall as pandemic-related stimulus comes to a halt. The unemployment rate in the US reached 5.4 per cent in July, with Bloomberg economists predicting it would continue its downward trend to 5.2 per cent in August.

But a miss on those US jobs numbers would spark fears of stagflation, added Mackay, as investors worry that, alongside the spread of the Delta variant of Covid-19, wages increases will fuel price rises. US consumer price inflation steadied at a 13-year high in July, while one in five states reported record levels of Covid-19 hospitalisations in August.

“Market moves since June are consistent with downgrades to growth expectations in the US, Europe and particularly China,” strategists at Goldman Sachs commented, as investors expected the economic boost from industries reopening to fade while supply chain bottlenecks made inflation likely to linger for longer.

Investors have hedged their bets in recent weeks by topping up their holdings in companies viewed as relatively insulated from slowdowns, such as tech and healthcare groups.

“When you have fears about growth, tech stocks usually show up as a means of defence,” said Patrick Spencer, vice-chair of equities at RW Baird, particularly after these stay-at-home businesses thrived through last year’s lockdowns.

In Europe, the continent’s tech subsector is up more than 13 per cent so far this quarter, outperforming the broader Stoxx 600 benchmark, which has risen 4.8 per cent for the same period, having climbed 0.3 per cent on Thursday.

London’s FTSE 100 closed up 0.2 per cent, while Frankfurt’s Xetra Dax and the CAC 40 in Paris both edged up 0.1 per cent.

The yield on the 10-year US Treasury note, which moves inversely to its price and is sensitive to perceived changes in the future path of interest rates, was steady at 1.29 per cent. Germany’s equivalent Bund yield fell by 0.01 percentage points to minus 0.39 per cent.

The dollar index, which measures the US currency against six peers, was down 0.2 per cent. The euro gained 0.3 per cent to $1.187. Sterling added 0.5 per cent to $1.383.

Brent crude, the international oil benchmark, rose 2.2 per cent to $73.13 a barrel after Opec and its allies agreed on Wednesday to pump an extra 400,000 barrels a day each month between now and late 2022 in a sign of optimism about future demand.

“Opec+ went ahead with its planned supply hike . . . as demand is seen to be improving,” said analysts at Citigroup. “However, we expect the group to remain vigilant at each upcoming meeting amid demand uncertainty.”