US stocks have doubled from a closing low hit during the depths of the pandemic last year, underscoring the resilience of a market that has repeatedly blown past expectations as the country’s economy has rebounded.

The benchmark S&P 500 — the closely followed barometer of the $51tn US stock market — rose 0.3 per cent on Monday, its fifth consecutive gain. The small advance lifted the index 100 per cent from its March 2020 closing low, when investors were dumping stocks as the gravity of the pandemic sent many scrambling for cash.

But intervention from policymakers at the Federal Reserve and trillions of dollars worth of stimulus signed into law by the White House have helped revive the country’s economic fortunes, as well as the US stock market.

Earnings figures from corporate America have broadly eclipsed Wall Street expectations, with data late-last month showing the country’s economic output returned to pre-pandemic levels in the second quarter.

The strength has prompted top strategists at Goldman Sachs and Morgan Stanley to lift their forecasts for just how high the S&P 500 could run this year.

“The numbers are phenomenal,” Phil Orlando, a strategist at asset manager Federated Hermes, said of the second-quarter earnings figures. “Maybe we’ve just lived through and seen the best fundamental picture that we’re going to see from a corporate revenue and earnings standpoint.”

The gains have been broad-based since the March lows, even as investors have rotated between different sectors they believe will benefit most from the recovery.

Tech has been among the biggest beneficiaries. While the Nasdaq Composite slipped 0.2 per cent on Monday, it had already doubled from its pandemic lows in February.

The uptick by the S&P 500 late in the trading day on Monday followed a relatively dour start to the day. Figures from the Federal Reserve Bank of New York showed that business growth had decelerated in August from a month prior and economic data from China also disappointed on Monday.

China’s National Bureau of Statistics said industrial production rose 6.4 per cent year on year in July, lower than market expectations of 7.8 per cent. Retail sales were also far weaker than expected.

These figures revealed “that the world’s second-biggest economy is cooling off rapidly”, said Jeroen Blokland, head of research at True Insights, and “could also be a harbinger of the economic trend in other regions, especially because supply-chain disruptions remain abundant”.

The CSI 300 index of large Shanghai- and Shenzhen-listed stocks fell 0.1 per cent while Hong Kong’s Hang Seng ended the day 0.8 per cent lower.

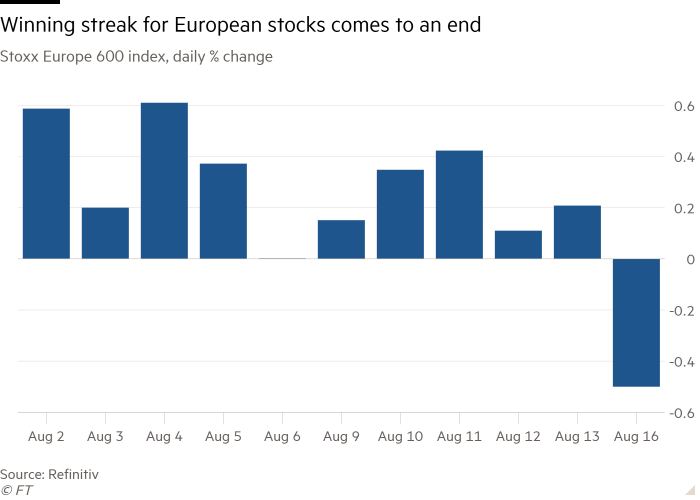

The hit to investor sentiment ended a 10-session winning streak for the region-wide Stoxx Europe 600 benchmark, which fell 0.5 per cent, its first fall this month.

“The bears have come back into the European markets, owing to concerns over the Chinese slowdown as well as geopolitical risk emanating from the Taliban in Afghanistan,” said Aneeka Gupta, director of research at WisdomTree.

All big European bourses fell, with London’s FTSE 100 down 0.9 per cent, Frankfurt’s Xetra Dax off 0.3 per cent and the CAC 40 in Paris 0.8 per cent weaker.

Treasuries rallied on Monday, with the yield on the 10-year US Treasury falling 0.02 percentage points to 1.26 per cent.