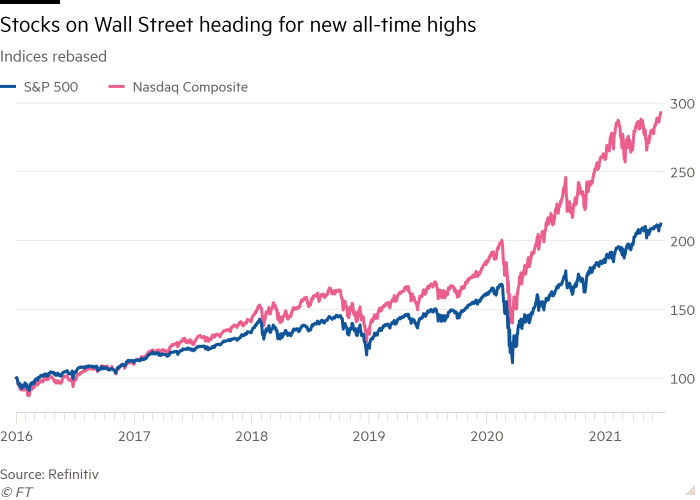

Stocks on Wall Street hit highs on Thursday, after the Biden administration secured an infrastructure deal worth about $1tn.

The tech-heavy Nasdaq Composite rose 0.7 per cent, notching another record close. It was the third consecutive day of gains for the index. Electric carmaker Tesla and tech-enabled fitness group Peloton were among the biggest winners, rising 3.5 per cent and 3.7 per cent, respectively. The broader blue-chip S&P 500 was also at a high, climbing 0.6 per cent.

The gains come as President Joe Biden gained bipartisan backing for a deal, which will focus on upgrading roads, bridges and broadband networks over the next eight years. While the package is smaller than the initial $2.3tn plan announced in March, it clears up a significant uncertainty for investors, who have long waited for further clarity about the prospects of additional government spending.

It follows a period of volatility across financial markets, after Federal Reserve officials brought forward their projections for the first post-pandemic interest rate rise by a year last week. Trading has since calmed after Jay Powell, Fed chair, made dovish reassurances that high hurdles remained for the tightening of monetary policy.

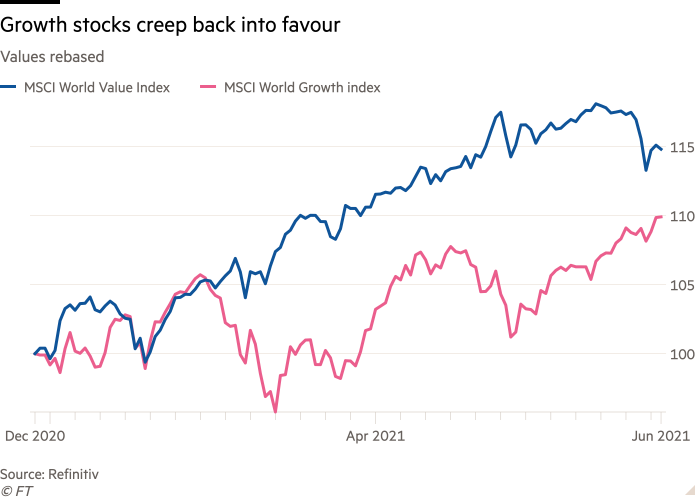

Investors have also tweaked their portfolios to be less reliant on the economically sensitive “value” stocks in industries such as energy and banking that have dominated equity market growth since drugmakers announced effective Covid-19 vaccines in November.

“Markets have priced in an economic cycle that will be relatively shorter than previously expected,” said Bastien Drut, strategist at CPR Asset Management, referring to the period between the recovery from the shock of the pandemic and the next recession.

Tech shares and other so-called growth companies, whose valuations are influenced by estimates of future profits, have also been flattened by a drop off in long-term government bond yields that set a marker on how much investors will pay for companies’ cash flows.

Fed officials’ projections last week depressed prices of five-year Treasury bonds and raised those of 30-year bonds. The yield on the 30-year Treasury, which moves inversely to its price, has dropped from more than 2.2 per cent last Wednesday to 2.11 per cent.

“The amplitude of this particular move for growth stocks has been very high,” said Roger Lee, strategist at Investec.

Elsewhere, sterling dropped back from its strongest level against the euro since early April after the Bank of England said its pandemic-era monetary policy “remained appropriate”.

The BoE stated the UK would “experience a temporary period of strong” growth and above-target inflation “after which growth and inflation will fall back”.

The pound, which traded at €1.17 ahead of the BoE’s monetary policy meeting on Thursday, lost 0.4 per cent against the single currency to €1.1664. Against the dollar, sterling also fell 0.3 per cent to $1.3912.

London’s FTSE 100 index, which is stacked with exporters that benefit from a weaker pound, closed up 0.5 per cent.

The yield on the 10-year UK government bond, which moves inversely to its price, dropped 0.04 percentage points to 0.74 per cent.

In Europe, the Stoxx Europe 600 share index rose 0.9 per cent after the Ifo Institute’s business climate index climbed to a higher than expected reading of 101.8 in June, from 99.2 last month, highlighting optimism among company bosses in Germany, the eurozone’s economic powerhouse. Frankfurt’s Xetra Dax ended the session up 0.9 per cent.

Brent crude, the global oil benchmark, rose 0.3 per cent to $75.52 a barrel.