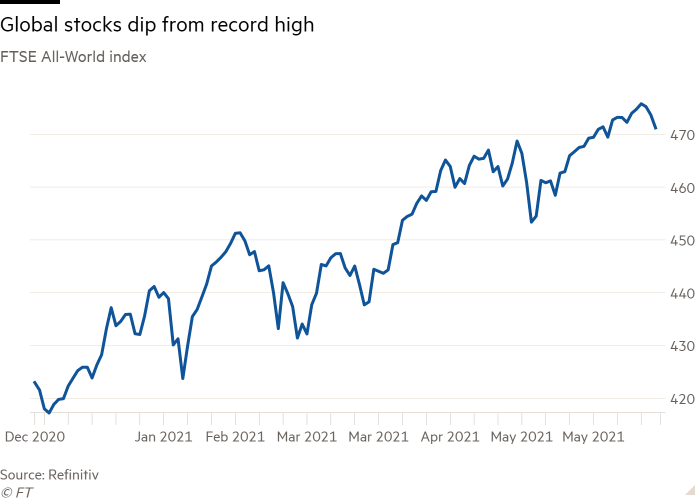

Global stocks continued a steady descent from record highs reached earlier in the week and the dollar strengthened after the US central bank brought forward the anticipated timing of its first post-pandemic interest rate rise.

The FTSE All-World index of developed and emerging market stocks, which hit a closing record on Monday, headed for its third session of small losses on Thursday, dropping 0.5 per cent.

The Stoxx Europe 600 index, which rallied to an all-time high on Wednesday, fell 0.3 per cent on Thursday. Shares in European banks, which benefit from higher interest rates that enable lenders to make wider profit margins, gained 1.2 per cent.

Following its latest monthly meeting, the Federal Reserve said on Wednesday evening that most officials expected a rate rise in 2023, up from a previous projection of 2024.

The announcement has not roiled markets because “of an expectation that this will be happening at a time when the [global] economy is able to stand on its feet”, said Zehrid Osmani, manager of Martin Currie’s global portfolio trust.

“If there was not any expectation by the central bank of a rate rise in the next two years, there would actually be more to worry about,” Osmani said. “We could be at risk of overheating or inflation getting out of control.”

Futures markets signalled the blue-chip S&P 500 index would drop 0.4 per cent at the New York opening bell, while the top 100 stocks on the technology-focused Nasdaq Composite would lose 0.5 per cent.

The dollar index, which measures the greenback against trading partners’ currencies, jumped 0.6 per cent after gaining a similar amount on Wednesday as traders anticipated higher returns from holding the world’s reserve currency. The euro lost 0.4 per cent against the dollar to $1.194.

US Treasuries, which weakened sharply after the Fed’s announcement because higher interest rates on cash weaken the appeal of fixed interest securities such as government bonds, steadied on Thursday. The yield on the benchmark 10-year US Treasury, which moves inversely to its price, was flat at 1.563 per cent.

The Federal Open Market Committee on Wednesday also kept its bond purchasing programme, introduced last year to cushion the economic blow from Covid-19, unchanged at $120bn a month. Jay Powell, Fed chair, said the process of winding down the programme would be “orderly, methodical and transparent”, adding that any changes would be signalled “well in advance”.

While fears of such tapering knocked stock and bond markets in the first quarter of this year, there was now “quite some complacency” about the future path of US interest rates and inflation, said Juliette Cohen, strategist at CPR Asset Management.

Consumer prices in the US rose at a headline rate of 5 per cent in the 12 months to May, driven by higher costs of used cars, fuel and utilities and transport services in what many investors viewed as a temporary effect of coronavirus lockdowns being eased. Labour shortages, however, have convinced some analysts that wages will rise and result in a longer period of price increases.

“Inflation could continue to run higher than current expectations, with a rate hike in 2022,” Cohen said.

Elsewhere in markets, the Norwegian krona rose 0.1 per cent against the euro to €0.984 despite the Norges Bank saying it was likely to raise interest rates in September. Some traders had expected an increase on Thursday.

Brent crude, the international benchmark, rose 0.1 per cent to $74.48 a barrel.