When poets, literati and courtiers fell out of favour with China’s emperors, they were banished to the island of Hainan to fend for themselves among wild jungles and indigenous tribes.

Today, the tropical resort destination known as China’s Hawaii has become a rare bright spot in the global luxury market, which has been hit hard by the coronavirus pandemic.

“Hainan Island is on fire,” John D Idol, who heads Capri Holdings, owner of the Michael Kors and Versace brands, told analysts in February.

To boost domestic consumption, the Chinese government has turned the island into a duty-free shopping hub. Visitors can indulge in fashion from Gucci and Prada, jewellery from Cartier, beauty products from Estée Lauder or premium whisky from The Macallan.

Hainan became even more popular when Covid-19 travel restrictions meant Chinese consumers, who have driven luxury sector growth in recent years, could no longer go on shopping trips to Paris, London, Milan or Hong Kong.

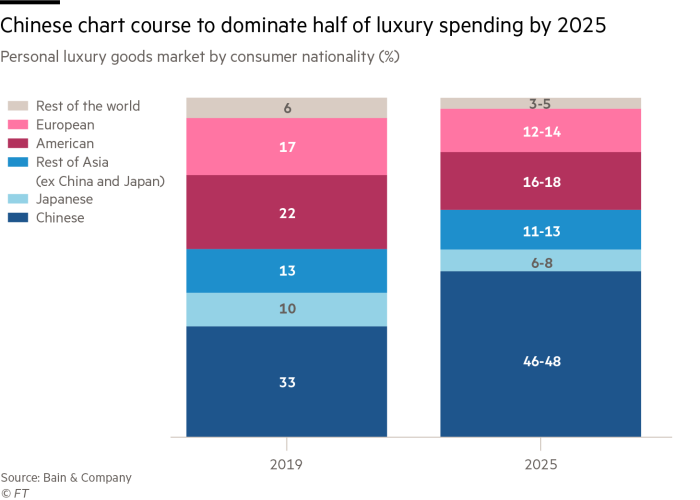

The island is a powerful symbol of how luxury’s centre of gravity is tilting towards China, mirroring the “repatriation” trend in earlier decades of Japanese shoppers who used to buy Louis Vuitton and Balenciaga abroad but now do so at home.

Nowhere is this clearer than at sector leader LVMH, whose accelerating recovery has been fuelled in large part by China. The company said on Tuesday that its first-quarter sales in Asia excluding Japan were 26 per cent higher than in the corresponding period of 2019, before the pandemic.

Even when Chinese shoppers can travel again, analysts expect they will continue to buy at home as brands open bricks-and-mortar stores and expand ecommerce offerings, such as virtual stores on Alibaba’s Tmall Luxury Pavilion.

The share of Chinese consumers’ high-end purchases within the country soared from 32 per cent in 2019 to more than 70 per cent in 2020, according to consultancy Bain, and is expected to be about 55 per cent by 2025 once the pandemic effect fades.

Amy Dai is emblematic of the consumer those brands have been able to attract. The 30-year-old resident of Chongqing used to make pilgrimages to Europe to buy luxury goods, one of China’s 170m annual overseas travellers whose spending accounted for more than a third of all global luxury sales before the pandemic struck.

But last year, Dai took a two-hour flight to the Hainan city of Sanya to shop, and to do so turned to online platforms. Her spending on luxury items topped Rmb1m ($150,000) last year, more than in 2019.

“Before the pandemic, I did prefer going abroad or occasionally I would buy from overseas purchasing agents,” she said. “Since the pandemic started I’ve switched to domestic retailers, because otherwise I can’t get the latest editions in time.”

The luxury sector is counting on Chinese consumers to fuel the recovery after a difficult 2020 in which sales contracted by roughly a fifth to €217bn globally, according to Bain.

China’s comparatively successful suppression of the virus and rapid economic recovery — gross domestic product growth returned to pre-pandemic levels in the fourth quarter — played a pivotal role in maintaining optimism.

The recovery was initially spurred by “revenge shopping”, or indulging after the world’s most populous country emerged from a nationwide lockdown, but has since given way to something more durable.

“There are plenty of rich people who have benefited from the pandemic as they work in high-growth industries or own well-performing stocks,” said a Beijing-based employee of a European brand. High-end jewellery, the person added, was “selling like crazy”.

The pandemic also accelerated shifts that were under way in China’s luxury market, such as the expansion of ecommerce, lower import duties and tighter controls over the grey market driven by daigou, professional shoppers who buy watches, jewellery, clothes and cosmetics overseas on behalf of mainland Chinese. Brands had already begun narrowing the price differential that had made goods sold in China more expensive than those stocked in Europe or the US.

Such trends have prompted luxury brands to invest more in China.

A report from Jefferies analysts found that only Louis Vuitton, Burberry and Gucci had stores in all of China’s 25 biggest cities, suggesting that others might need to expand their footprints.

Planting a flag in Hainan could be an effective way to get in front of more Chinese consumers.

Shiseido, the Japanese beauty brand, plans to double its sales counters on the island to 60 by the end of the year. Estée Lauder also said it was experiencing strong demand.

Beauty and cosmetics products account for almost half of all duty free sales in Hainan, according to Bernstein Research, while luxury goods make up about one-third of sales. But the latter are growing rapidly with the number of luxury brands on the island up 80 per cent in the past six years. “We expect more are going to come,” Bernstein analysts wrote.

Chen Xin, an analyst at UBS, said Hainan’s duty free sales more than doubled in 2020 from the previous year to Rmb30bn, and she forecast a compound annual growth rate of 40 per cent from 2019-25.

Further underpinning this growth were policy changes intended to build up duty free shopping on the island.

Last year, the Chinese government tripled the amount that consumers could buy annually duty free in Hainan to Rmb100,000 and scrapped a cap of Rmb8,000 for a single item. It also issued three licences to companies to operate duty-free shops, a significant increase from the seven licences that had previously been given since the 1980s.

But some luxury brands were wary of betting too much on Hainan, given that they could only sell there via wholesale agreements with state-backed companies and cannot open their own stores. That gives brands less control over pricing and customer experience.

Others worry that the island risks being abused by daigou.

“We believe the development of Hainan is positive but we must remain careful and work together to ensure that it does not become a hub for the grey market in China,” said Jean Jacques Guiony, chief financial officer of LVMH, the world’s biggest luxury group.

“If consumers travel to Hainan and come to our boutiques, then we are ready to serve them. But if it is to buy in bulk and then resell to intermediaries, then no.”

Despite those concerns, LVMH has expanded on Hainan via DFS, its travel retail division. The company has partnered with Shenzhen Duty Free Group on a duty free mall called Haikou Mission Hills located in a popular resort. It opened in January but will be expanded over the next two years to reach more than 30,000 sq m of retail space.

Such destinations could help alleviate the crowds that Sharron Zhou, a 35-year old marketing executive from Shanghai, ran into during her trip to Hainan over the lunar new year. She was so put off she did not buy anything. “You couldn’t find salespeople . . . People were stepping on my feet,” she said.

Additional reporting by Xueqiao Wang in Shanghai, Sun Yu in Beijing, and Alice Woodhouse in Hong Kong