A Roth IRA is a magnificent planning tool that offers some huge opportunities:

· Growth and income can be tax-free

· There are no Required Minimum Distributions for the owner, a spouse beneficiary and a ten- year distribution window for most non-spouse beneficiaries

· Basis on assets from a Roth are automatically stepped-up. Roth assets are tax-free and are distributed at their market value. With a possible change in basis rules for inherited assets to a ‘carryover basis,’ this is a significant advantage. For example, if you held Widget.com stock in your Roth that you bought at $10 a share and it was worth $100 a share, you’d receive it on distribution with a $100 basis. If carryover basis were enacted and Widget.com was in a taxable investment account rather than a Roth IRA, your heirs would inherit it at $10 a share and pay capital gains taxes (either when they sold, or possibly earlier).

The purpose of this piece is to discuss how to build, invest and distribute a big Roth IRA.

First Question: Why Do You Want One? A good place to start on the Roth question is why you may want one. Here are a couple of possible reasons you may want to consider:

1. Let’s say that you think tax rates will go up and you want to save for that eventuality. Roths are ideal when the recipient is in a higher tax bracket than the contributor. This is why funding a Roth for a child or grandchild at the beginning of their earning careers is a great idea. They may be in a very low bracket at the outset and a significantly higher bracket later.

2. You want to build a legacy for human beneficiaries. Roths are an excellent intergenerational wealth transfer tool. However, using a Roth to fund a charity is counterproductive, since both charities and Roths are tax-free entities.

Second Question: What is a Big Roth? Big, like beauty, is in the eye of the beholder. In 2012, Mitt Romney made news with a $102 million IRA. A GAO study in 2014 showed that for tax year 2011 (yes, ten years ago), there were over 1,000 IRAs with more than $10 million and 279 IRAs with more than $25 million. Size is a function of three factors: contribution, time, and return.

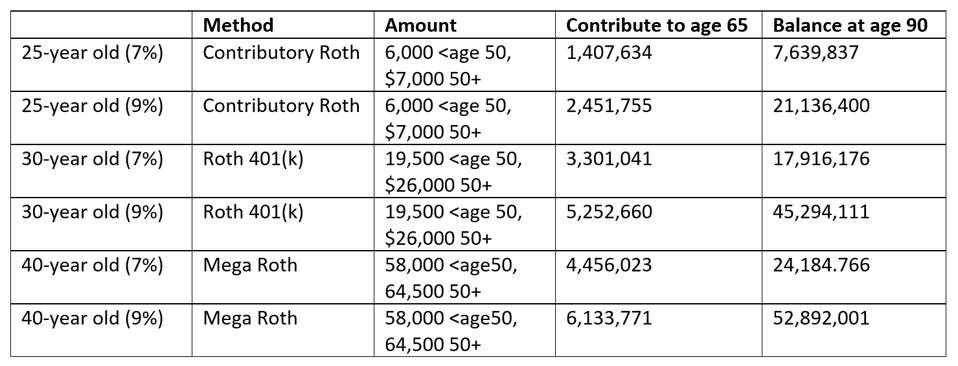

Method one: Contribute to it. If a young person starts funding a Roth option at age 25 and continues until retirement (or some later date), it accumulates over a long period of time and it will grow significantly. You can also fund a Roth 401(k) (DRAC) at a much higher level than a contributory Roth IRA like $19,500 under age 50, $26,000 50 and over. On a giant level, you can do a ‘Mega-Roth’ through after-tax contributions.

A comparison of common IRA accounts and their balances

Leon LaBrecque

Method 2: Invest well. Mitt Romney’s IRA shot skyward, one of the possible explanations would be that he used some private equity interest. Allegedly, Max Levichin, friend of PayPal founder Peter Thiel, had 3.9 million shares of Yelp in his Roth IRA in 2012. If he kept the investment, it would be worth about $150 million. Thiel had 1.7 million shares of PayPal he bought for $.30 a share in his Roth. It was sold to Google for $19 a share. Some investments can go ballistic, but ‘regular joes’ are hard pressed to do IPOs (that they drove) in a Roth. We are likely stuck with ‘ordinary’ investments, however, you might have bought Tractor Supply Company or Philip Morris twenty years ago. Those are a couple of top performing stocks for the last 20 years. There are also some mutual funds that have significant long term double-digits returns. A take-away idea would be to invest Roth dollars in higher growth assets. You likely don’t want to put all your eggs in one basket, like the private equity/IPO folks, but invest hard.

Question Three: How do you keep it? Once you have a big Roth, you will want to protect it. Here are a few of the risks you’ll want to consider:

· The law can change. They can change the Roth rules, and in particular, they can change the Roth rules on a needs or size base. Giant Roths could be at risk of taxation.

· Roths, like other assets, may be subject to estate taxes. The current estate tax rate maxes out at 40%, so a $10 million dollar Roth could be effectively shrunk by $4 million.

· Your heirs could squander the Roth. Under the SECURE Act, most non-spouse heirs must take assets out of an inherited IRA within 10 years of death of the IRA owner. Accordingly, a Big Roth should be protected with a trust that allows asset protection and tax-advantaged distributions. Effective trust language could hold the Roth assets as well after the ten-year period once they are distributed from the IRA, but the trust may pay taxes on undistributed income earned by the former Roth assets.

· You can become too aggressive and lose money on your investments. Trying too hard to hit the ball out of the park with meme stocks or risky investments, can crush the Roth.

Bottom Line: I Love Big Roths and I Cannot Lie. I am a raving fan of Roths as an accumulation tool. There are some great reasons to build a Roth component into your financial strategy:

· You can accumulate assets for yourself on a tax-free basis. If tax rates to you go up, you will have a tax-free pool to draw from.

· You are not encumbered by the tax friction and RMD friction of a traditional IRA/401(k).

· You can build a substantial tax-free legacy for heirs.

· You can protect Roth assets via a trust to enable tax-advantaged distributions for the heirs.

These advantages, and others, make Roth IRAs an attractive and useful savings vehicle to help propel you into your financial future. In reality, it’s probably not that important how big your Roth is, it’s more relevant that you understand how to use the tool effectively. If you have questions, I’ll try to answer them. You can email me here: llabrecque@sequoia-financial.com. If you’d like to download our free e-book on IRAs (2020 version), and our SECURE White paper, click here.