- Silver drops to the lowest since January 28.

- Downward sloping RSI, support break favor silver sellers.

- Medium-term support line, 100-day SMA challenge further downside.

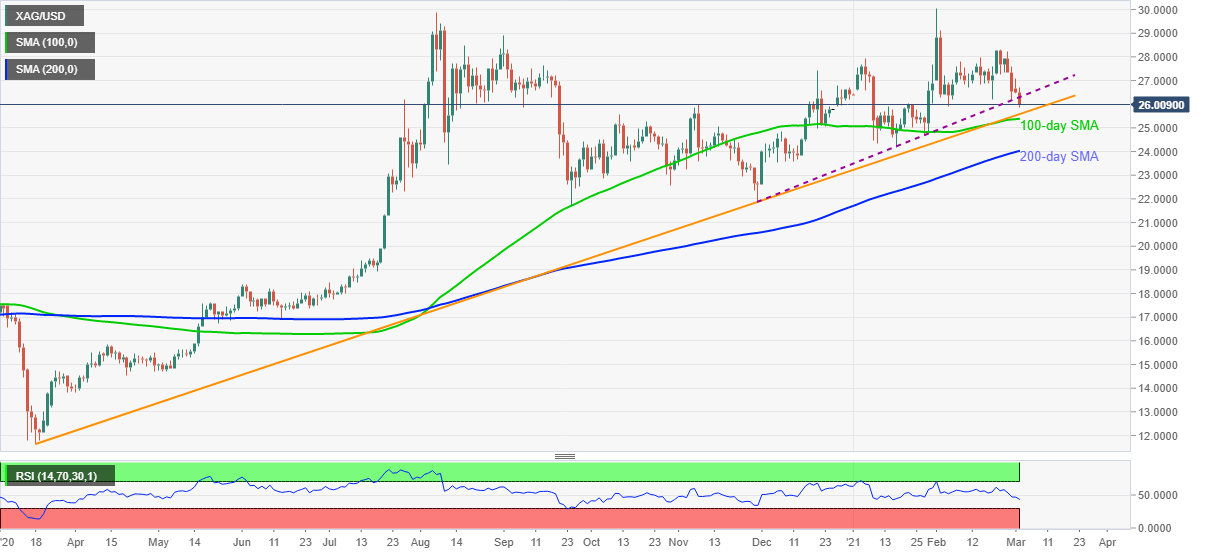

Silver prices stand on a slippery ground after breaking a short-term support line, currently down 1.92% to $26.00, ahead of Tuesday’s European session. In doing so, the white metal declines to the lowest since January 28.

Although a downside break of the previous key support line favors silver sellers, a confluence of 100-day SMA and an ascending trend line from March 18, 2020, around $25.60-40, challenge the quote’s further weakness. It’s worth mentioning that the descending RSI line, not oversold, suggests the extra downside of the metal.

It should, however, be noted that the 200-day SMA close to $24.05 and the $24.00 offer additional downside filters to the precious metal ahead of dragging it to November lows near $21.90.

Meanwhile, corrective pullback needs a daily closing beyond the previous support line, at $26.30 now, before attacking the $26.85 hurdle.

Also likely to challenge the silver buyers is the late February top near $28.35 and the previous month’s high of $30.06.

To sum up, silver bears are waiting for confirmation to portray notable downside.

Silver daily chart

Trend: Further weakness expected