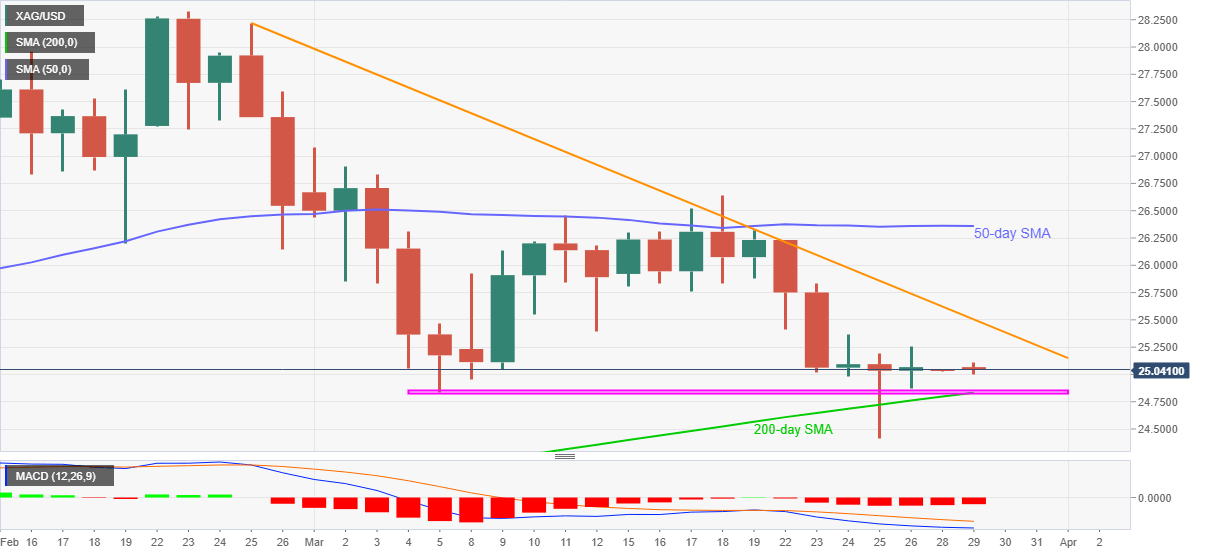

- Silver prints mild losses but stays above the key support zone comprising 200-day SMA.

- Bearish MACD failures to extend last week’s recovery favor sellers.

- Monthly resistance line, 50-day SMA restrict immediate upside.

Silver trims intraday losses from $24.88 while taking rounds to $25.00, down 0.13% on a day, during Monday’s Asian session. Even so, the white metal keeps bounce off $24.85-80 support zone comprising lows marked on March 05 and 26 as well as 200-day SMA.

It’s should, however, be noted that the MACD flashes bearish signals and the bulls are hesitant to enter amid fears of the key hurdles to the north.

Hence, silver prices may remain weak while targeting the $24.80-85 as immediate support. Though, a clear break below $24.80 will not refrain from refreshing the monthly low below $24.40.

On the flip side, a downward sloping trend line from February 25, around $25.50 guards the quote’s immediate upside ahead of highlighting the 50-day SMA level of $26.36.

Overall, silver prices can extend the latest weakness but the key supports will challenge the bears.

Silver daily chart

Trend: Further weakness expected