María Antonia Llull’s Mallorca-based hotel chain is losing at least €1.5m a month, but she hopes this summer will be its salvation.

The coronavirus pandemic has shuttered almost all of its 30 hotels for months and the group, Hipotels, has put nearly all its 3,000 staff on furlough. Only its Cancún establishment — its sole hotel outside Spain — is open.

Llull is not alone: southern Europe’s tourist industry — a large part of the region’s economy — has been left in limbo as the slow rollout of vaccinations and the latest rise in cases make a second lost summer increasingly likely.

Easter might offer Llull a modicum of relief, bringing planeloads of German tourists to Mallorca, but it is the summer season that will be crucial.

“The Easter season is like coming up for air, before the water sucks you in again,” said Llull, who hopes to open eight hotels in Mallorca for the holiday. “What we need is the summer, because with another lost summer many businesses will disappear.”

Last year’s tourism slump wreaked devastation on the Spanish economy. Income from foreign tourists during the peak July to September season was down 78 per cent last year on the same three months in 2019, according to Bank of Spain estimates published this week.

In normal times tourism contributes about 12 per cent of Spain’s gross domestic product, so the collapse contributed to an 11 per cent economic output contraction last year — deeper than any other EU country.

Although Spain is the centre of the crisis, the sector accounts for 11 per cent of southern European economic output and one in six jobs in southern European nations, including France.

These countries had already been hit harder than those in the north by the fallout from the pandemic and had higher debt levels, constraining their capacity to support struggling businesses and jobs, said Nadia Gharbi, senior economist at Pictet Wealth Management.

“The risk of another lost summer will only exacerbate these problems and put more strain on policy,” she warned.

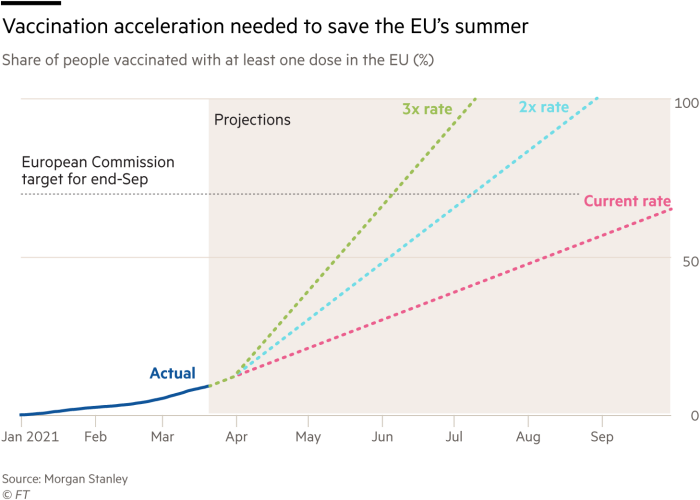

Jacob Nell, head of European economics at Morgan Stanley, said vaccination programmes were not moving quickly enough: “There is a real risk that [European countries] have been so slow with the vaccinations that they lose another summer . . . That leaves the south of Europe at risk of further [economic] decoupling from the north.”

The Bank of Spain’s baseline scenario is that the economy will grow 6 per cent this year, aided by receipts from foreign tourists reaching 56 per cent of their 2019 levels. While it said that tourism and the economy could significantly outperform these expectations, the central bank also set out a “severe scenario” in which Spain manages only 3 per cent growth and tourism slumps even below 2020, to just 14 per cent of 2019 levels.

There are early indications that the recovery will be slow. Although Lufthansa’s flights from Germany to Mallorca are almost fully booked over Easter, it expects overall bookings this year to reach only 40 to 50 per cent of pre-pandemic levels.

Other European countries are also bracing for continuing economic damage. According to the Greek Tourism Confederation, revenues from tourism, which supports one in five Greek jobs, fell 77 per cent last year.

This year has so far proved equally grim: Greek hotel bookings fell 74 per cent year on year in February and internet searches for rooms fell 63 per cent, according to data published this week. Harry Theoharis, Greece’s tourism minister, recently expressed optimism for “a better year than last year” but admitted “bookings are depressed”.

According to analysts at Allianz, the European independent hotel sector’s sales halved last year, and will regain only a quarter of that decline this summer.

Goldman Sachs has forecast a sharp rebound in tourism, adding 1.4 per cent to Spain’s total output this year and 1 per cent to Greek output — but that assumes most restrictions are lifted by June. It warned of a downside scenario in which restrictions remain throughout the summer, knocking 1.3 per cent off growth across southern Europe.

The key is vaccination, which will help stem infections in both source and destination countries, and boost governments’ readiness to allow people to travel.

The EU aims to inoculate 70 per cent of adults by summer-end, though the tourism industry was alarmed by European Commission president Ursula von der Leyen’s remark that summer lasts up to September 21. By then, the main holiday season will be all but over.

Alan French, chief executive of Thomas Cook, said that although he had “no doubt that holidays will take place probably this summer, the point in time and the criteria they will have is what we are speculating on”.

“We have to generate confidence by the beginning of summer to get the season back,” said José Luis Zoreda, vice-president of Exceltur, a Spanish tourism industry group. “If that confidence only comes back in October, perhaps that’s OK from a health point of view, but for our sector it is a disaster. There are businesses that have been closed since October 2019 . . . What industry can survive two years without revenues?”

At present, however, the industry is facing more stumbling blocks. Germany ordered Lufthansa not to add any more flights over Easter and is considering a temporary ban on holidaying abroad after alarm at the number of Germans flying to the Balearics.

Britain — Spain’s largest source of tourists — is increasing curbs on foreign travel. Most UK travel companies expect it will re-employ last year’s traffic-light system, which designated destinations “green” or “red” depending on infection rates.

And Spanish authorities face domestic criticism for seeking to welcome EU tourists while imposing internal travel restrictions on Spanish residents.

“The main thing is that the sector has to get going again and it has to be sustainable,” said Zoreda. “If we need more restrictions now to do that, OK, but what we are calling for is for vaccinations to be accelerated.”

Meanwhile the Spanish and Greek governments have made contact with the UK in an attempt to agree bilateral travel deals if an EU-wide vaccination document scheme is not in place in time.

“We need to do everything we can to save the summer season,” said Llull. “If I was offered just half of the business we had in 2019, I would say: ‘Where do I sign?’”