Wall Street traders are hunting for the source of distressed stock sales on Friday that helped cause a sell-off in which $33bn was knocked off the value of Chinese technology companies and US media groups like ViacomCBS.

The share sales, which amounted to almost $19bn, have proven a mystery, with rumours spreading rapidly that a hedge fund or family office had blown up and had moved to wind down billions of dollars worth of its positions. The trades have captivated Wall Street in what is shaping up to be another volatile year, with big shifts wrong footing respected funds.

The email blasts from Goldman Sachs about the fire sale started well before the trading day had begun, with $6.6bn worth of stock in Baidu, Tencent Music and Vipshop on the block. The Wall Street investment bank told counterparties that the sales were prompted by a “forced deleveraging,” a signal that a fund may have been caught offsides and hit with a margin call, according to people with knowledge of the matter. Goldman upsized the deals several times, they said.

Money managers assumed the selling was concentrated in US-listed Chinese technology groups ahead of a new measure introduced by the Securities and Exchange Commission under President Trump that could see them delisted from US exchanges.

But when the big blocks of stock kept coming, with the share sales no longer limited to Chinese groups, speculation became rampant on Wall Street. Some fund managers have taken the fire sales to mean that a major hedge fund or family office was in trouble.

Throughout the day equity sales traders at Goldman and its midtown-rival Morgan Stanley hammered the phones as they tried to move billions of dollars of stock. Shares in US companies such as Discovery as well as online retailers Shopify and Farfetch were put on the block, wiping billions of dollars off valuations.

The share sales were executed in five blocks as Goldman kicked off trading with $6.6bn worth of stock, followed by another $2.3bn in the afternoon and $1.7bn worth of ViacomCBS shares.

Morgan Stanley sold $4bn worth of shares earlier in the day, followed by another $4bn batch in the afternoon. The bank initially allowed investors to choose their allocations of individual stocks, but later moved to an “all-or-nothing” offering where traders would buy an entire basket of securities, two sources familiar with the process said.

Nowhere was the pain more acute than in shares of ViacomCBS, as more than $11bn was wiped off the valuation of the owner of MTV and Nickelodeon on Friday alone.

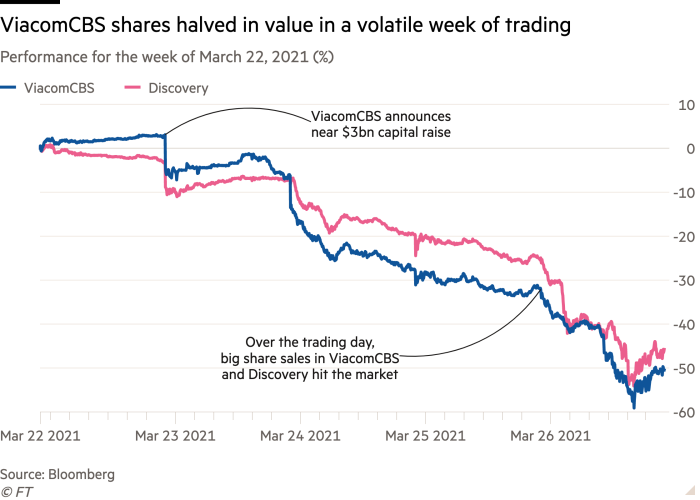

By the end of the week, the company’s shares had halved in value. While news reports pointed to analyst downgrades from investment banks like Wells Fargo and Moffett Nathanson, traders believe the catalyst was something else.

On Monday, shares of the company closed at an all-time high and the cable television group tapped Morgan Stanley and JPMorgan Chase to raise nearly $3bn to plough into its business.

From the moment the press release hit the wire, ViacomCBS stock began to drop. Shares closed 9 per cent lower on Tuesday before falling a further 23 per cent on Wednesday. The declines were eye-popping for a share sale.

“I don’t think anyone saw it trading like this,” one banker briefed on the deal said, who added that it was “probably too big” of a capital raise in the end.

One source said they were told the declines that began in ViacomCBS following its capital raise began to hit a family office hard, forcing it to unravel its positions, while a second said Morgan Stanley confirmed at least some of the trades were from the same seller.

But the sheer size of the sales have prompted questions as to whether more than one fund or family office was caught up in the trade.

It follows an unusual and somewhat unexplained three-months of trading in ViacomCBS and Discovery stock. Shares of the companies had rallied 170 and 148 per cent, respectively, between the start of the year and Monday’s close. They were the top two performing stocks in the S&P 500, up more than twice as much as the next-best performing stock.

Morgan Stanley, Goldman Sachs and ViacomCBS declined to comment.