- Silver edged higher on Monday and built on last week’s bounce from the $25.90 support zone.

- The set-up seems tilted in favour of bullish traders and supports prospects for additional gains.

- A sustained break below 100-period SMA on the 4-hourly chart will negate the positive outlook.

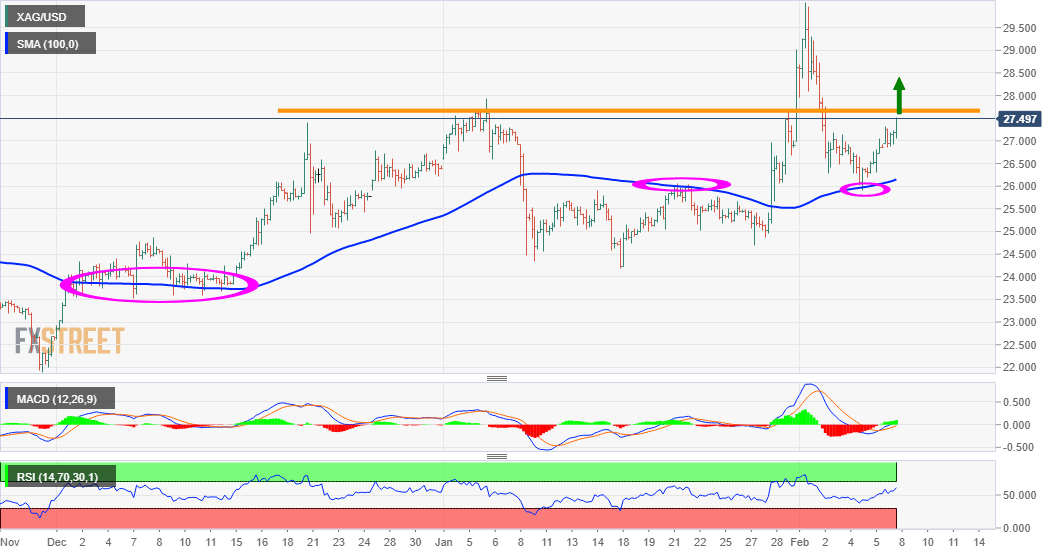

Silver gained positive traction for the second consecutive session on Monday and built on the last week’s rebound from sub-$26.00 levels, or support marked by 100-period SMA on the 4-hourly chart. The commodity climbed back above the $27.00 mark and was last seen trading just below the $27.50-60 supply zone.

Meanwhile, technical indicators on the daily chart maintained their bullish bias and have again started moving into the positive territory on the 4-hourly chart. The set-up favours bullish traders and supports prospects for an eventual breakthrough the mentioned barrier, though stronger USD might cap gains.

That said, a sustained move beyond will set the stage for additional gains and lift the XAG/USD back towards the $28.00 mark. Some follow-through buying should pave the way for an extension of the momentum. The commodity might then aim to surpass the $28.20-30 intermediate resistance and reclaim the $29.00 mark.

On the flip side, the daily swing lows, around the $26.85 region, now seems to protect the immediate downside. This is followed by support near the $26.35 level ahead of the 100-period SMA on the 4-hourly chart, currently around the $26.10 zone. Failure to defend the mentioned support levels might turn the XAG/USD vulnerable.

The commodity might then accelerate the fall further below last week’s swing lows, around the $25.90 region, towards testing the next relevant support near the key $25.00 psychological mark.