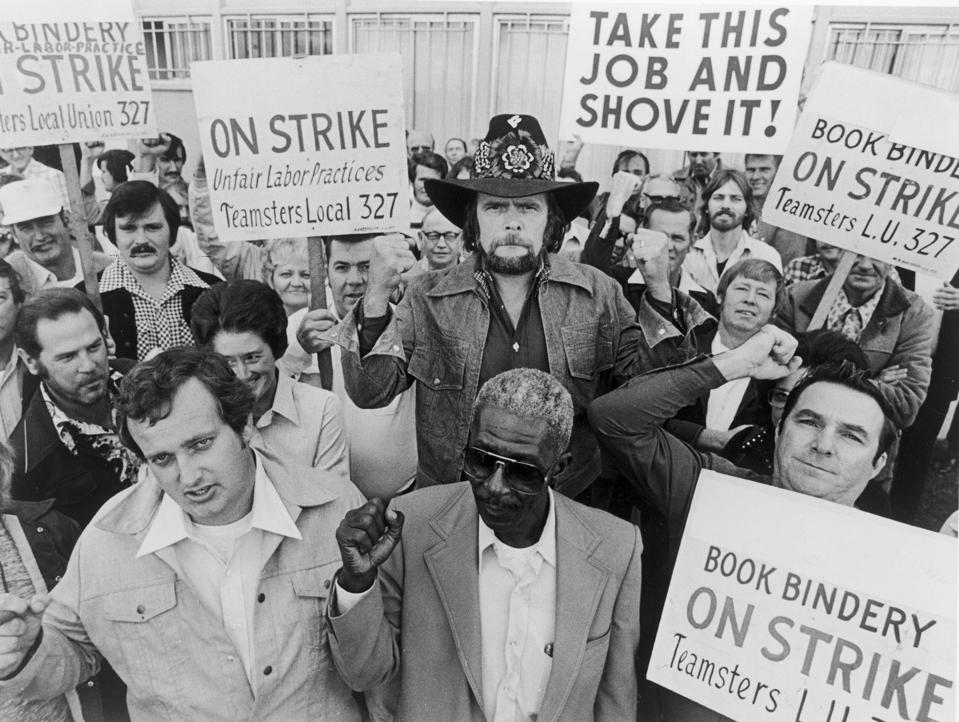

UNDATED FILE PHOTO: Country singer and songwriter Johnny Paycheck (C) holds a teamsters union sign … [+]

Getty Images

Do you have enough money to tell your boss, as singer Johnny Paycheck would say, “Take this Job and Shove It?”

Fidelity money management company advice model says a worker who begins saving 15 percent of their salary at age 25 will have ten times their annual salary in their 60s and be on track to retire. You would also be in a good position to aggressively bargain for better pay and working conditions at your current job. But, 42 years of continuous saving 15 percent of one’s paycheck is exceedingly rare. The Plan Sponsor Council of America reported retirement plan savings rates hit a high of 12.9 percent in 2019 before the pandemic recession and not only is this celebratory rate short of what is needed, only half of Americans have a retirement plan and a willing employer.

But everywhere and often people want to know their number, the amount of money they need in order to walk away from their jobs. In polite terms it is called a replacement rate target, in non polite terms it is called another term, “Take this Job and Shove it” number.

Do I have enough money to walk away from work or tell the boss what I want to stay ?

Fidelity’s number is 10 times final salary at age 67; Aon Consulting Group’s model says 11.1. The thing is American older workers are not even close. Christian Weller, David Madland, and Keith Miller at the Center for American Progress argued that these firms might be too pessimistic but found even the most optimistic studies (for example Karen E. Smith and colleagues at the Urban Institute show four out of every 10 GEN X workers will likely lower their standard of living in retirement.

In 2018 my The New School co-authors (Siavash Radpour, Tony Webb and I) study turned over every stone to get an accurate measure of how much of final pay people have. About 5% of people at the very top of the income distribution had 5 or more times their average pay. Most at the top didn’t even have 10 times their salary. The bottom 95% didn’t even come close. Almost no one can meet the standards of these consultants.

So Mike Papadopoulos, Tony Webb, and I swerved in doing a 2019 study and lowered the definition of “need” to see how many people in the U.S. in 2019 between the ages of 62-70 had retirement wealth if they and their spouse quit work immediately and didn’t have enough money to live on 200% of the federal poverty standard.

MORE FOR YOU

This target isn’t about replacing income to meet the lifestyle you had before retirement but to meet a downsized more modest standard – perhaps a small apartment, enough food, and the ability to celebrate a friend’s birthday at an Applebee’s a few times a year. Even at that lower target a large segment, 61% of working married men, and 86% of working single women aged 62-70 would not have enough to meet those modest standards. If they waited to retire to age 70, 37% of married men would not be in a household with either $32,920 or more per year for a couple and 61% of single women would not have $24,280 per year to live on alone.

By the way, no experts use the official federal poverty standard as an absolute standard because having enough income to be just above poverty income is just above starvation. The official poverty level is based on a calculation tied to the cheapest cost of 2000 calories a day multiplied by three to cover basic shelter and clothing. The poverty level of income is close to a number meant to sustain life for a short period of time. In 2019 the official federal poverty level was $12,140 for a single individual and $16,460 for a couple.

Don’t Blame Yourself If You Don’t Have Enough

William Sharpe, Nobel prize winner in Economics, once said retirement planning was the nastiest most difficult calculations can do. I have long argued expecting people to do their own planning without supportive institutions to save, invest, and withdraw income wisely is ridiculous.