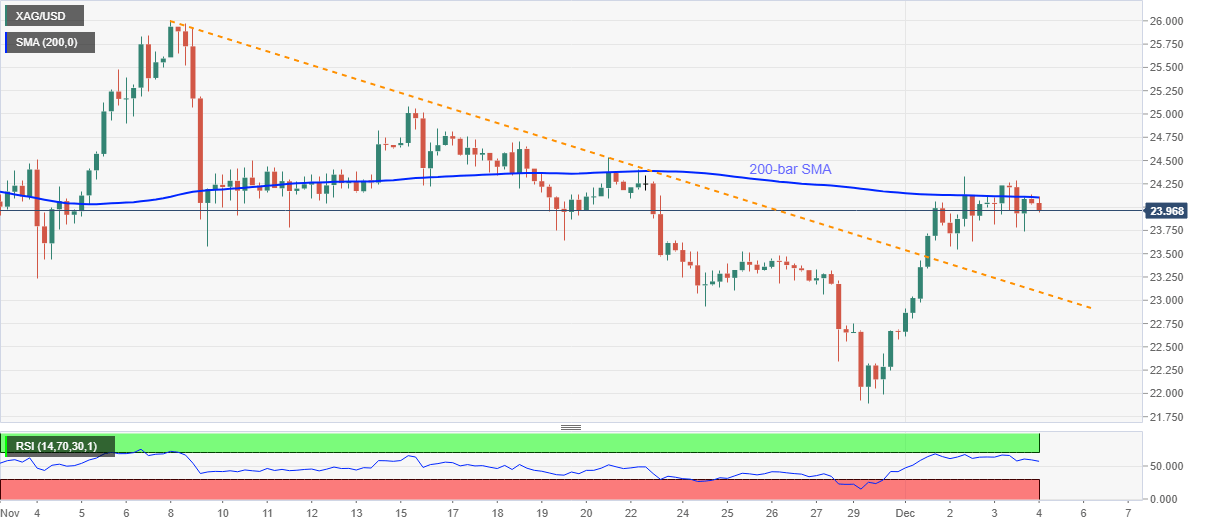

- Silver prints mild losses, battles 200-bar SMA amid receding RSI conditions.

- Sustained break of one-month-old falling trend line keeps buyers hopeful unless breaking the support line.

Silver drops to $23.96, down 0.68% intraday, during the early Friday. The white metal failed to cross 200-bar SMA the previous day while keeping Tuesday’s upside break of a falling trend line from November 06.

Considering the receding RSI conditions and repeated failures to rise past- 200-bar SMA, silver sellers currently eye the previous resistance line, at $23.09 now, during the further downside.

However, any extra weakness below $23.09 will have to break the $23.00 threshold while eyeing November’s bottom near $21.90.

Alternatively, an upside clearance of 200-bar SMA, currently around $24.10, needs validation from the recent high near $24.30 before targeting the mid-November high near $25.10.

Although expected uptick in the RSI can reach the overbought territory around $25.10, which in turn can probe the silver bulls, a further rise beyond the same will not hesitate to challenge the previous month’s high near $26.00.

Silver four-hour chart

Trend: Pullback expected