Partial retirement – the new normal?

getty

People are living longer but they are not increasing the accumulated wealth needed to support a longer life of retirement. On the contrary, the swing from defined benefit to defined contribution pension plans has increased the population of those reaching retirement age without adequate provision.

One result has been a growth in what can be called “partial retirement,” which involves continued employment past the usual retirement age but at a reduced scale at reduced income. A retirement plan to accommodate them should notch at the age when partial retirement becomes full retirement, at which point retirement payments should jump to a higher level.

The mechanics of such a plan depend on the finances of the retiree. A large segment of them are homeowners with minimal financial assets, and I will use this group as my example. The hypothetical retiree is 62, has financial assets of $150,000 and a debt-free house worth $500,000. His plan is to work half time for 8-12 more years, then retire full time. Hence, he needs a retirement payment for 8-12 years to offset his switch to half-time employment, and a larger retirement payment thereafter to offset his switch to full retirement.

- This can be accomplished by artfully combining annuities with a HECM reverse mortgage credit line. The procedure is as follows:

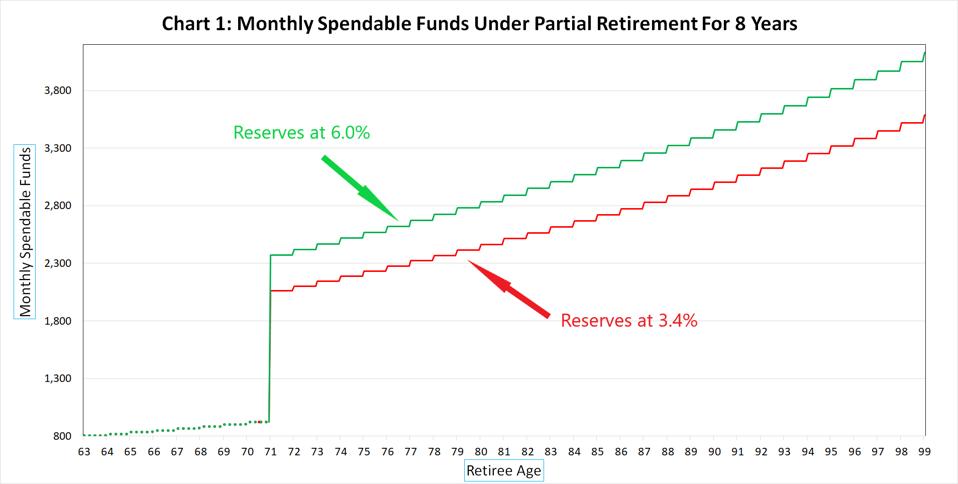

- The retiree’s financial assets are used to purchase a deferred annuity on which the payments don’t begin until the end of the period of partial retirement, which I will assume is 8 years.

- During the 8-year period, the retiree would draw funds monthly against a HECM reverse mortgage credit line.

- During that period, the unused part of the credit line would grow at the HECM interest rate plus insurance premium, currently about 3.4%, accruing a reserve.

- The reserve would be invested in a saving account or a similar facility.

- At the end of the partial retirement date, the accrued savings would be used to purchase an immediate annuity beginning at the same time as the deferred annuity. This results in a jump in spendable funds starting at the beginning of year 9.

- If the HECM rate increases during the partial retirement period, the accrued reserve, and the jump in spendable funds, will be larger.

- All monthly spendable funds include a 2% per year inflation premium.

- I call the retirement plan organized in this way the “partial retirement plan (PRP)

Chart 1 maps the spendable funds available to the retiree, with and without an increase in the HECM rate. Consistent with the retiree’s plan to transition to full retirement after 8 years, even without an increase in the HECM rate, the payment that begins in year 9 is more than twice as much as the final draw from the credit line.

MORE FOR YOU

Non-employment income plan for partial retirement

www.mtgprofessor.com

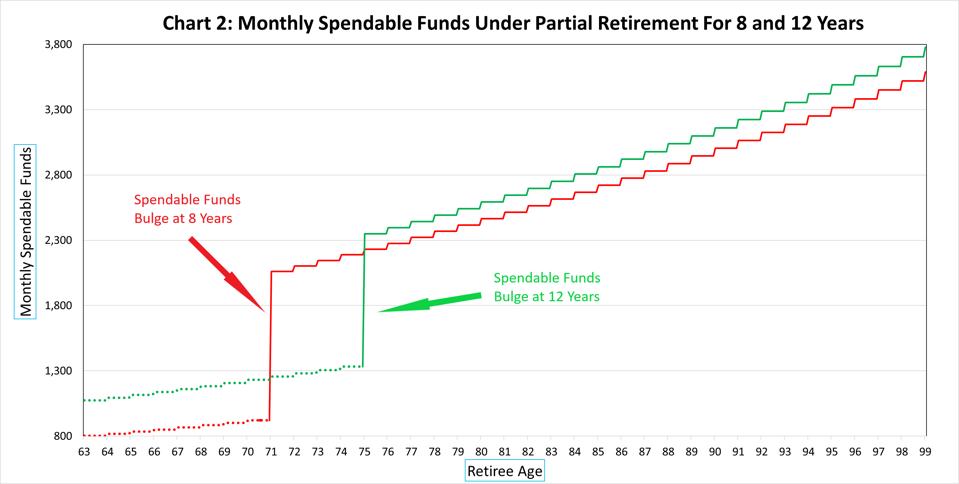

If the partial retirement lasts 12 years instead of 8, larger reserve accruals will generate a larger immediate annuity, and higher spendable funds beginning in the 13th year. This is illustrated in Chart 2 which uses a HECM credit line rate of 3.4% for both cases.

Spendable funds can be tailored based on years of partial retirement

www.mtgprofessor.com

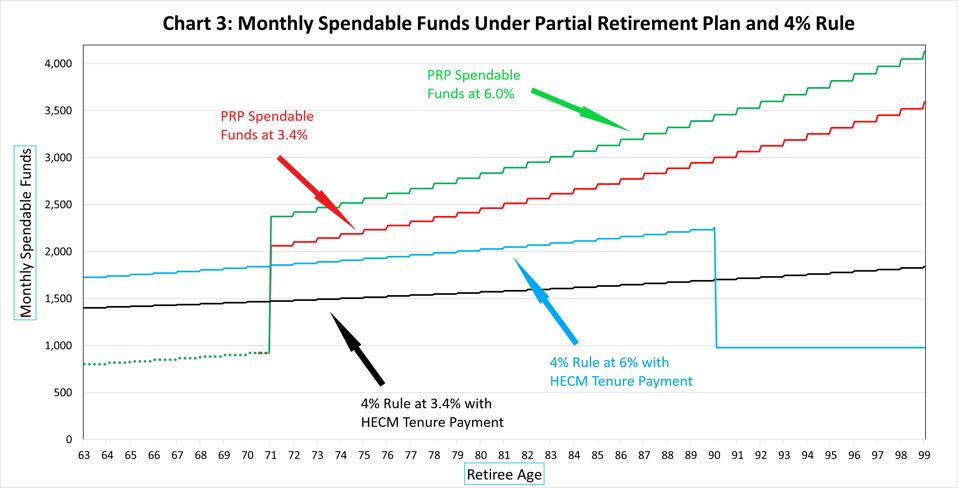

The closest available alternative to the PRP is the so-called 4% rule for drawing on financial assets, which calls for payments equal to 4% of financial assets. To increase comparability with PRP, I add a HECM tenure payment based on the retiree’s home value. The tenure payment provides a fixed monthly stipend for as long as the retiree resides in his house. In addition, I reset the withdrawal rate from 4% to the rates of return used by both PRP and 4% rule.

The two approaches are compared in Chart 3 using rates of 3.4% and 6%. (Note that under the 4% rule, these are withdrawal rates as well as rates of return on assets). The 4% rule provides more spendable funds than PRP during the period of partial retirement, but significantly less thereafter. At a 6% rate on the 4% rule, financial assets are depleted and payments thereafter consist of the tenure payment.

Partial Retirement Plan vs “4% Rule”

www.mtgprofessor.com

The technology used in this article was developed by my colleague Allan Redstone.