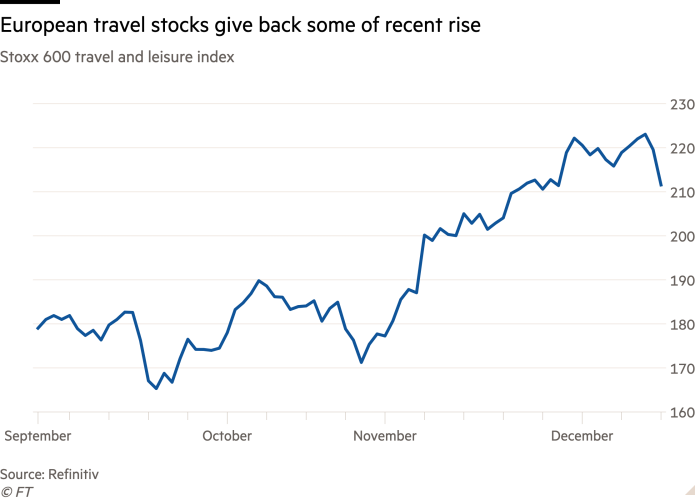

Travel companies led a retreat in European equities after a new strain of coronavirus sweeping through parts of the UK forced the government to launch new social restrictions and triggered new curbs on travelling.

The continent-wide Stoxx 600 fell 1.8 per cent with London’s FTSE 100 off 1 per cent. British Airways parent IAG dropped around 10 per cent in volatile trading, with cruise-ship operator Carnival, jet engine maker Rolls-Royce, and tour operator Tui all notching up similar declines.

On Saturday, Boris Johnson, UK prime minister, unveiled tough new restrictions designed to contain a new strain of coronavirus that Westminster warned was 70 per cent more transmissible. At least 10 European countries banned travel from the UK on Sunday and France halted freight transport via the English Channel Tunnel.

“European airlines, amid a very bleak last quarter of the year, had been hoping for travel to pick up during the holiday season and initial booking data seemed to confirm this hope which would have provided some additional cash flow,” analysts at Bernstein said. “However, with more lockdowns coming into force day by day and now the potential proliferation of a UK travel ban . . . there is a very real risk that instead of relief the Christmas period will not aid airlines’ cash balances.”

Shares in banks, which are considered sensitive to economic fluctuations, also took a hit. Société Générale and Lloyds were both down 5 per cent, with Barclays and ABN Amro down 4 per cent.

US S&P 500 futures were down 0.51 per cent in early trading.

Investors shifted into assets considered to be shelters during times of weakening sentiment, pushing the dollar and the price of US government debt higher. An index tracking the dollar against a basket of six peer currencies was recently up 0.4 per cent, with the euro down 0.7 per cent.

The 10-year Treasury yield, which moves inversely to its price, fell 0.04 percentage points to 0.91 per cent. Germany’s equivalent Bund yield fell by the same margin to minus 0.614 per cent.

The pound dropped 1.8 per cent in early London dealings to $1.3272, leaving it on track for the biggest -day tumble since the market turmoil in March. It was down 1 per cent against the euro at €1.09.

Lee Hardman, currency analyst at MUFG, said: “The negative developments clearly have increased downside risks for the UK economy and the pound, and will dampen the scope for any gains on the back of a Brexit trade deal before year end.”

He added: “The failure to contain the less contagious Covid strains does not give us much hope that the new strain will not spread across the world creating similar disruption as in the UK.”

The pound was also pressured by dimming optimism over whether the UK will forge a broad trade pact with the EU before the Brexit transition deadline ends on December 31, investors said.

“The disruption to supply chains from the travel ban will merely provide a flavour of what might ensue if the UK fails to agree a deal with the EU and facilitate its provisional application from 1 January,” said Chris Scicluna of Daiwa Capital Markets.

“We do, however, maintain our baseline expectation that the UK will relax its position on fish to allow an eleventh-hour deal to be reached.”

Over the weekend, a deadlock on fishing rights in Britain’s waters continued to stall negotiations about a Brexit trade deal, with officials weighing whether a phone call between Mr Johnson and Ursula von der Leyen, president of the European Commission, might help clear the impasse.

In commodities markets, Brent crude, the international oil benchmark, shed 3.2 per cent to $50.59 a barrel on concerns over global demand. The price of oil has rallied in recent months as progress towards a vaccine brightened the outlook, after collapsing earlier this year following the initial coronavirus outbreak.

An agreement by US lawmakers on a nearly $900bn economic stimulus package that includes more relief for small businesses and direct payments to American families suffering in the coronavirus pandemic failed to brighten market sentiment. Traders had already priced-in Washington stimulus in recent weeks, analysts said.

Additional reporting by Philip Georgiadis.