Global equities markets rose on Monday, with German stocks reaching a new record peak, after US president Donald Trump belatedly agreed to sign a bill to inject $900bn of stimulus into the world’s largest economy.

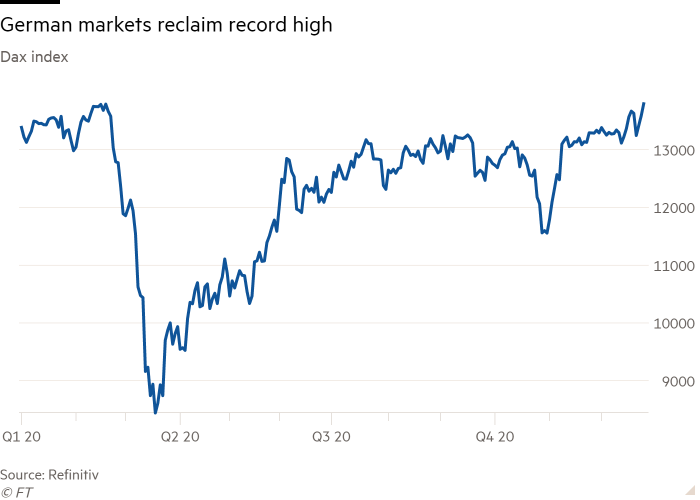

Germany’s Dax climbed 1.5 per cent, leaving it above the record high it recorded in February, before the pandemic triggered a sharp slide in global stock markets. The index has soared by more than two-thirds since its March low. German markets were closed on Christmas Eve, so Monday also provided the first chance for investors there to react to the Brexit trade deal agreed between the EU and UK last week.

Other European markets also gained on Monday, with the continent-wide Stoxx 600 up 0.7 per cent and France’s CAC 40 advancing by 1.1 per cent. Futures tracking Wall Street’s S&P 500 index rose 0.7 per cent. UK markets were closed for a bank holiday.

Mr Trump had shocked many lawmakers last week when he rejected the $2.3tn legislation, which in addition to the stimulus measures also included funding to keep the government open through the end of next September and avoid a shutdown that was set to start after midnight on Monday.

Steven Mnuchin, US Treasury secretary, had negotiated the bill with lawmakers, but Mr Trump initially refused to sign it into law. The president demanded that Congress increase the direct payment cheques sent to Americans from $600 to $2,000 per individual. Mr Trump said late on Sunday he still planned to make a push for that increase.

Despite the delay, Goldman Sachs economists said the stimulus measures were about $200bn bigger than they had forecast and account for about 4 per cent of US economic output. The Wall Street bank now expects the US economy to grow at an annualised pace of 5 per cent in the first quarter of next year, up from its previous forecast of 3 per cent.

“The new path implies meaningfully higher levels of output in all four quarters and lifts 2021 annual growth to 5.8 per cent,” Goldman said.

Sterling slipped 0.3 per cent against the dollar on Monday to $1.3502, leaving the pound further away from the 2020 high of $1.3624 that was hit on December 17.

Investors said the Brexit trade deal cleared one of the major points of uncertainty hanging over the currency but that significant work still needed to be done given it did not cover major industries, such as financial services.

“Despite this being one of the hardest possible Brexit outcomes, it allows for both parties to establish a co-operative platform and possibly allow for improvements eventually,” said Christian Keller, head of economist research at Barclays.

Mr Keller added, however, that the UK bank remained “cautious for the month ahead as acrimonious negotiations have likely resulted in deep diplomatic scars on both sides of the channel”.