Ensign has approved a 5% hike in its quarterly dividend to $0.0525 per share from $0.05. Notably, the healthcare services provider has been paying dividends since 2002 and this marks the eighteenth consecutive year of a dividend increase. Shares of Ensign closed 2.4% higher on Friday.

Ensign (ENSG) said that the new quarterly dividend will be paid by Jan. 31, 2021, to shareholders of record as of Dec. 31, 2020. Its annual dividend of $0.21 per share now reflects a dividend yield of 0.3%.

The company’s CEO Barry Port said that the dividend hike “reflects our strong market position and continued commitment to return value to our shareholders.” He added, “We look forward to continued growth and are optimistic about our long-term prospects.” (See ENSG stock analysis on TipRanks)

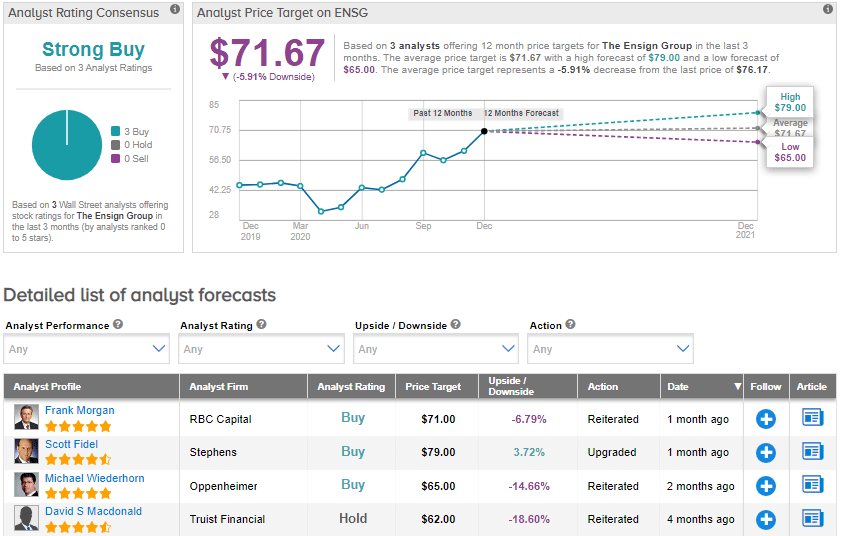

On Nov. 11, Stephens analyst Scott Fidel upgraded the stock to Buy from Hold and lifted the price target to $79 (3.7% upside potential) from $61. The analyst said that Ensign has shown “excellent business execution” during the pandemic. Further, he expects a recovery in Senior Nursing Facility occupancy as the COVID-19 vaccine will be initially distributed to high-risk nursing home patients.

Meanwhile, the Street firmly shares Fidel’s bullish outlook on the stock. The Strong Buy analyst consensus is based on 3 unanimous Buys. With shares up a stellar 67.9% year-to-date, the average price target now stands at $71.67 and implies downside potential of about 5.9% to current levels.

Related News:

Franklin Resources Hikes Dividend By 4%; Street Sees 12% Downside

Waste Management Announces 5.5% Dividend Hike, New Share Repurchase PlanAdvanced Energy Introduces Quarterly Dividend Plan; Shares Rise