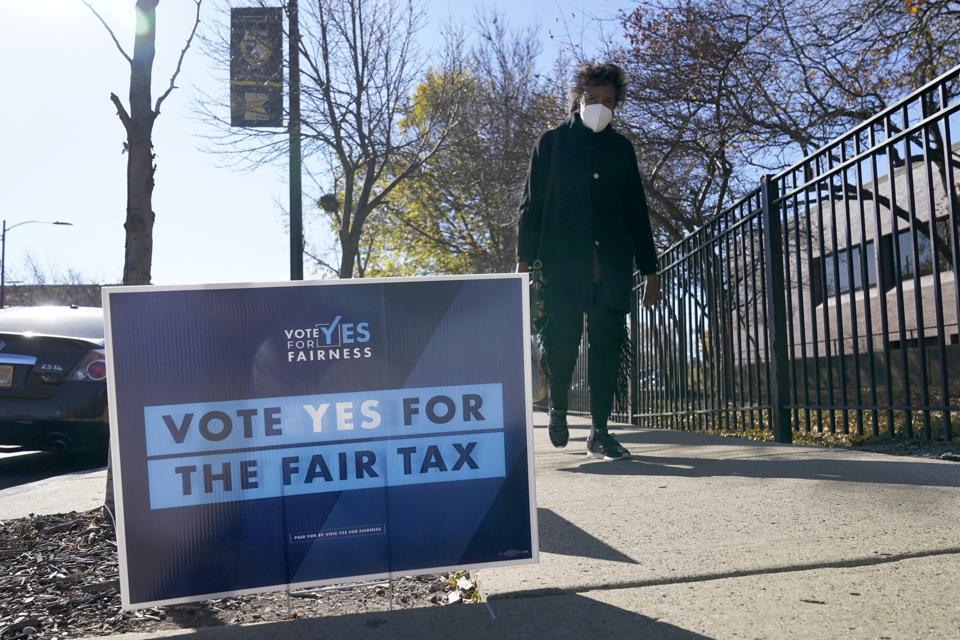

A woman walks past a pro Fair Tax yard sign near a polling place on Election Day, Tuesday, Nov. 3, … [+]

ASSOCIATED PRESS

The outcome was stunning: despite months of ads telling voters that a “yes” vote would ensure that the wealthiest 3% of Illinoisans would “pay their fair share” and the rest of the state would see a tax cut, voters rejected the ‘Fair Tax’ amendment to the state’s constitution, which would have stricken from the constitution the requirement that the state’s income tax be levied as a flat percentage of income across all income levels. With 98% of the vote counted, the Chicago Tribune this morning reported that “no” votes exceeded “yes” votes by a margin of 55% to 45%.

(Thankfully, this margin also rendered moot the provision that an amendment must receive either 60% of the vote among those voting on the item or 50% “yes” votes among all voters who cast a ballot at all, because explaining this requirement is a headache in itself.)

What were the arguments that prevailed against such a powerful headwind as the promises of “free money”? Opponents such as the Illinois Policy Institute warned voters that passing this amendment could lead to the removal of the exemption of retirement income (pensions, 401(k)s, etc.), armed with the comment of Illinois State Treasurer Michael Frerichs in June that a graduated income tax would make it politically easier to begin to tax retirees. (Of course, Gov. Pritzker and other supporters rejected this and instead claimed that rejecting the amendment would make a tax on retirement income more likely, because the state would have to find other revenue sources.)

Austin Berg, vice president at the Illinois Policy Institute, made another pitch against the amendment (for instance, here at the Chicago Tribune as well as at various web forums): it would allow the legislature to raise tax rates more easily by dividing up taxpayers, and raising taxes on one tax bracket at a time, ultimately raising everyone’s tax burden but without the political pushback of an all-at-once hike.

It’s a persuasive argument, but I doubt it won the day.

Instead, I suspect that the ultimate reason for voters’ rejection of an amendment that promised a free lunch, is that years and years of fiscal mismanagement, without any genuine reform, meant the tax’s supporters had no credibility with the voters. The Chicago Tribune reminded its readers repeatedly of the state’s failed promises and indifference to reform — everything from the failure to reform pensions, to failures to reform property taxes, rejection of redistricting reform, rejection of consolidation of local governments. In a mid-September editorial, the Tribune listed one abandoned promise after the next made by Illinois’ elected officials, from the pledge that tolling would be removed from Illinois’ tollways, to numerous pledges that “just one more” tax hike would fix the state’s finances, over and over again.

And, of course, regular readers will recall that just last week, I learned that Pritzker’s promise to boost the state’s pension funding by asset transfers, likewise quietly failed. And, yes, over and over again, I say that pension funding isn’t just an isolated issue removed from the rest of state governance, but that you can’t build a properly-fiscally-managed state, and gain the trust of state residents in the process, without proper pension funding. And refusal to reform pensions, treating the future pension accruals as sacrosanct even as other state needs are crowded out by the spending that requires, is not lost on voters, either.

What is Illinois’ path forward? Does it even have a path to fill the budget hole it was hoping to fill with the next tax rates?

In a set of tweets this afternoon, Pritzker claimed that the only remaining options are to “immediately make billions of dollars in cuts” or “impose a higher flat tax, which falls disproportionately on working and middle-class families.” He then blamed “the millionaires and billionaires” for opposing it and accused them of “deceiving the public about its purpose.”

“Republicans,” he claims, “swore their allegiance to the wealthiest interests in the state and threw middle class families under the bus.”

Of course, the Republican Party in Illinois is in disarray: the state chose Biden, 55% – 43%; Democratic Senator Dick Durbin won his race with an 11 point margin over his Republican challenger; Democrats hold 12 of 18 House seats; and Democrats hold supermajorities in both the state House and state Senate. Clearly there was sizeable crossover among those voting against the amendment.

And, what’s more, at the same time, “purple” state Arizona has approved a new tax rate that would have more-or-less matched what Illinois proposed. It’s probably not a coincidence that Arizona also made the news two years ago when its voters approved pension reform of the sort that Illinois’ elected officials tell us is wholly off the table, unacceptable, not deserving of any consideration despite the state’s financial woes. It’s the difference between a state where voters trust politicians, and one where they don’t.

What it boils down to is that the amendment’s failure was a vote of no confidence in Pritzker and in all of Illinois’ elected officials. Pritzker’s easy blaming of Republicans and millionaires and billionaires, rather than recognizing that Illinoisans made the only rational choice in a state with such a legacy of mismanagement and without any willingness for reform, certainly indicates that the state has a long way to go.

As always, you’re invited to comment at JaneTheActuary.com!