DraftKings (DKNG) has been one of 2020’s success stories. Although the online sports betting (OSB) player has had to contend with the coronavirus’ disruption of sports schedules, OSB is a secular trend that is expected to grow significantly over the next few years as more states get wise to the commercial opportunity and hop on board.

DraftKings is at the forefront of this new paradigm and set to be one of the main beneficiaries, says Rosenblatt analyst Bernie McTernan.

Following recent meetings with DraftKings management, the key takeaway for McTernan is that “DKNG’s data is their moat.”

“Scale and transaction volume drives this competitive advantage, leading to better economic decision-making, and a better customer experience leading to greater share gains,” the 5-star analyst said.

McTernan argues that because of DraftKings’ large transaction volumes, the company has in depth knowledge of their customer base and can leverage the data to “inform accretive levels of customer acquisition through projecting and then maximizing customer lifetime values.”

For example, through the company’s daily fantasy sports (DFS) customer database the company is adept at targeting the right audience.

The conversion rate of this customer base to OSB stands at 30-40%, while 50% turn to iGaming.

This “cross sell opportunity” is important, says McTernan, because it helps drive “higher customer lifetime value.”

Additionally, the data can be used to increase engagement on the platform “through tactics like strategic push notifications or cross selling other sports and verticals.”

As another example of how the company is adept at increasing engagement, McTernan points to New Jersey iGaming revenue which hasn’t decreased from the levels seen during the sports hiatus. This is despite the return of the sports calendar in its current condensed form.

“Said another way,” McTernan summarized, “They are experiencing growing engagement, not crowding out.”

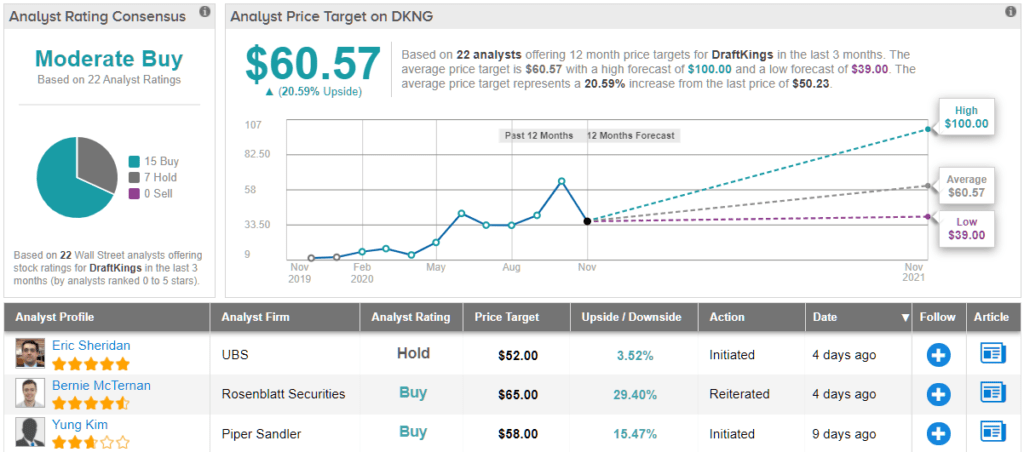

To this end, McTernan reiterated a Buy rating on DKNG shares along with a $65 price target. Investors could be locking in 29% of gains, should the analyst’s call play out over the coming months. (To watch McTernan’s track record, click here)

Looking at the consensus breakdown, the majority of analysts are bullish on DKNG’s prospects, too; 15 Buys and 7 Holds add up to a Moderate Buy consensus rating. The $60.57 average price target suggests upside of 20.5% in the year ahead. (See DraftKings stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.