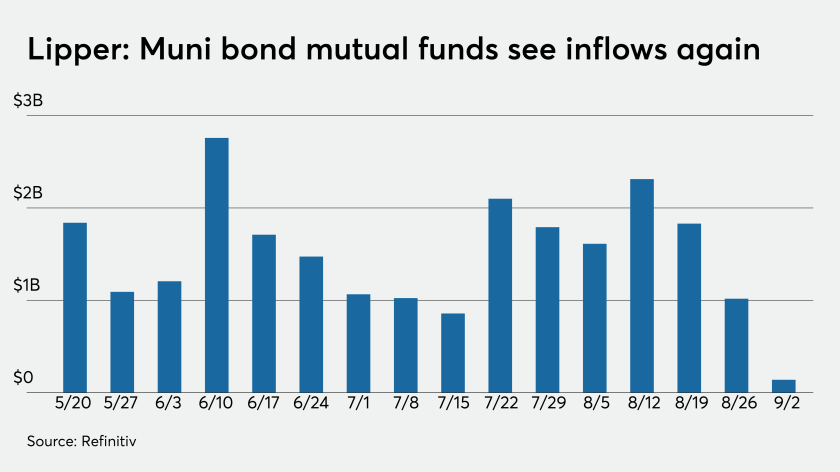

Inflows into municipal bond mutual funds slowed to the lowest level since last July, with

Refinitiv Lipper data showing investors put $139.364 million into the funds in the latest reporting week.

Muni funds have been on a winning streak since May 13, with most week’s seeing over $1 billion of cash flowing into the funds.

“This shows the market is at an inflection point,” said John Hallacy, founder of John Hallacy Consulting LLC.

Municipals were unchanged on Thursday, with yields remaining steady along most of the AAA GO scale.

Action was fairly quiet in the primary too after big offerings from Florida, California and New York hit the market and ahead of Friday’s employment report for August.

Buyers saw deals from Memphis and Connecticut and California issuers price on Thursday, the last big sales ahead of the long holiday weekend.

Refinitiv Lipper reports small inflow

In the week ended Sept. 3, weekly reporting tax-exempt mutual funds saw $139.364 million of inflows, after inflows of $1.017 billion in the previous week.

It was the 17th week in a row of positive results, but the lowest gain since July 15, when the funds saw an inflow of $857.321 million.

Exchange-traded muni funds reported outflows of $457.679 million, after outflows of $19.633 million in the previous week. Ex-ETFs, muni funds saw inflows of $597.043 million after inflows of $1.037 billion in the prior week.

The four-week moving average remained positive at $1.325 billion, after being in the green at $1.693 billion in the previous week.

Long-term muni bond funds had outflows of $238.420 million in the latest week after inflows of $65.842 million in the previous week. Intermediate-term funds had inflows of $101.882 million after inflows of $205.493 million in the prior week.

National funds had inflows of $156.953 million after inflows of $951.416 million while high-yield muni funds reported outflows of $145.115 million in the latest week, after outflows of $15.485 million the previous week.

Primary market

Raymond James & Associates priced Memphis, Tenn.’s $309.13 million of bonds for its Memphis Light, Gas and Water Division, consisting of Series 2020A electric system revenue bonds, Series 2020 gas system revenue bonds, Series 2020 water system revenue bonds and Series 2020B taxable electric system revenue refunding bonds.

The Series 2020A bonds (Aa2/A+/NAF/NAF) were priced to yield from 0.28% with a 4% coupon in 2021 to 2.15% with a 3% coupon in 2042; a 2045 maturity was priced as 4s to yield 2.04% and a 2050 maturity was priced as 4s to yield 2.14%.

The Series 2020 gas system bonds (Aa1/AA-/NAF/NAF) were priced to yield from 0.23% with a 4% coupon in 2021 to 2.08% with a 3% coupon in 2042; a 2045 maturity was prices as 4s to yield 1.97% and a 2050 maturity was priced as 4s to yield 2.07%.

The Series 2020 water system bonds (Aa1/AAA/NAF/NAF) were priced to yield from 0.20% with a 4% coupon in 2021 to 1.97% with a 3% coupon in 2040; a 2045 maturity was priced as 3s to yield 2.16% and a 2050 maturity was priced as 4s to yield 2.02%.

The Series 2020B taxables (Aa2/AA/NAF/NAF) were priced at par to yield from 0.53% in 2021 to 2.05% in 2034. This series was insured by Assured Guaranty Municipal Corp.

BofA Securities priced and repriced the Connecticut Health and Educational Facilities Authority’s (A3/A/NR/NR) $125 million of Series K revenue bonds for Sacred Heart University.

The bonds were repriced as 5s to yield from 0.41% in 2021 to 2.22% in 2040. A 2045 maturity was priced as 4s to yield 2.66%. The bonds had been tentatively priced as 5s to yield from 0.55% in 2021 to 2.27% in 2040. A 2045 maturity was priced to yield 2.76% with a 4% coupon.

Wells Fargo Securities priced and repriced the California Infrastructure and Economic Development Bank’s (A2/NR/NR/NR) $123.345 million of refunding revenue bonds for the Los Angeles County Museum of Natural History Foundation.

The bonds were repriced as a 2050 split maturity to yield 2.57% with a 4% coupon and to yield 2.95% with a 3% coupon. The bonds had been tentatively priced as a 2050 split maturity to yield 2.67% with a 4% coupon and at par to yield 3%.

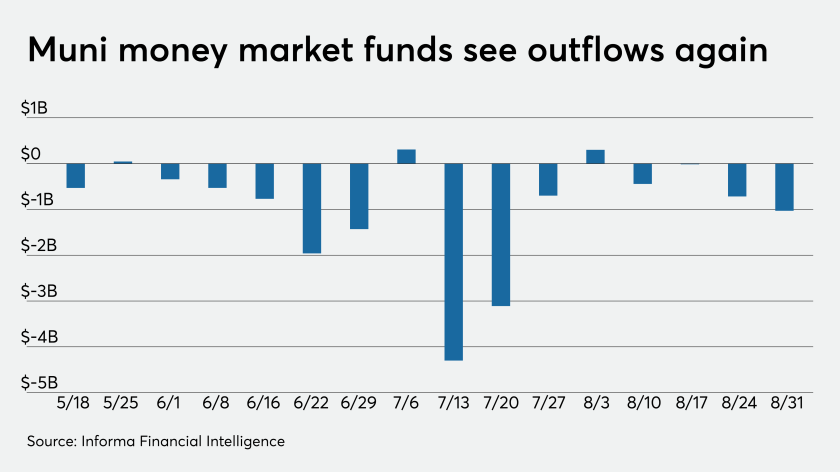

Money market muni funds fall $1B

Tax-exempt municipal money market fund assets fell $1.03 billion, bringing total net assets to $120.07 billion in the week ended Aug. 31, according to the Money Fund Report, a publication of Informa Financial Intelligence.

The average seven-day simple yield for the 187 tax-free and municipal money-market funds fell to 0.01% from 0.02% in the previous week.

Taxable money-fund assets decreased $31.25 billion in the week ended Sept. 1, bringing total net assets to $4.330 trillion.

The average, seven-day simple yield for the 775 taxable reporting funds dipped to 0.02% from 0.03% in the prior week.

Overall, the combined total net assets of the 962 reporting money funds fell $32.28 billion in the week ended Sept. 1.

Secondary market

Continued underperformance, positive flows and attractive percentages made for a sluggish market, yet there was still an improving underlying tone, according to a New York manager of institutional trading.

“Munis are underperforming but still attractive,” he said Thursday afternoon. “There is some supply overhang from the last week and a half mostly from competitive deals, but that has helped us underperform.”

“There were positive flows of a billion this week and Treasuries are at 1.34% from 1.50%,” he added.

“The market is unchanged today and I think it’s gotten a little better underlying tone the last two days.”

He said the improvement stems from municipals holding steady in the backdrop of Treasuries remaining positive.

“As Treasuries move and we don’t, the percentage of Treasuries gets a lot more attractive,” he explained. “On the week we have gotten a lot more attractive and people are starting to realize that.”

The trader said some of the left over balances from a week ago are slowly starting to move and that is helping create a better underlying tone ahead of the Labor Day holiday.

“With a lot of municipal guys working from home remotely, ahead of the holiday i think after a long six months everyone’s looking forward to taking Monday off and then coming back to hopefully resume brisk market activity,” he added.

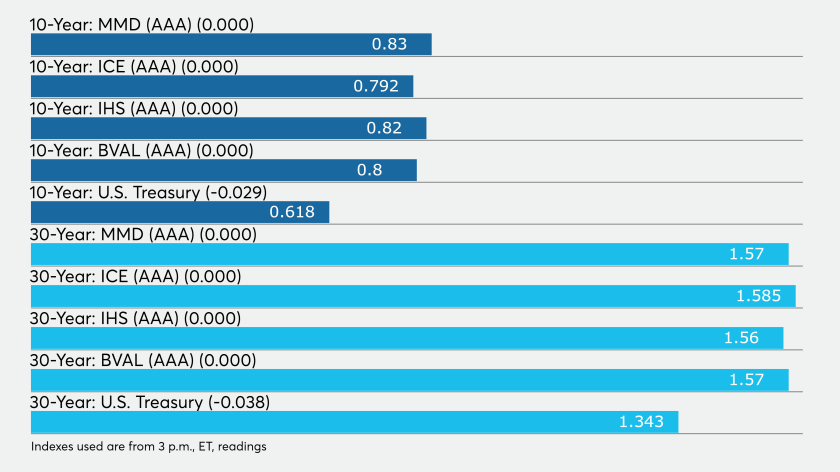

High-grade municipals were unchanged across the curve, according to the final readings on Refinitiv MMD’s AAA benchmark scale Thursday.

Yields were steady in 2021 and 2022 at 0.15% and 0.16%, respectively. The yield on the 10-year muni was flat at 0.83% while the 30-year yield remained at 1.57%.

The 10-year muni-to-Treasury ratio was calculated at 133.4% while the 30-year muni-to-Treasury ratio stood at 116.9%, according to MMD.

“Municipal bonds are little changed today as markets focus on cleaning up new issues before the Labor Day holiday,” ICE Data Services said. “Trade volumes have quieted down from yesterday’s more active pace.”

The ICE AAA municipal yield curve showed the 2021 maturity unchanged at 0.140% and the 2022 maturity steady at 0.157%. The 10-year maturity was flat at 0.792% and the 30-year was steady at 1.585%.

ICE reported the 10-year muni-to-Treasury ratio stood at 134% while the 30-year ratio was at 116%.

The IHS Markit municipal analytics AAA curve showed the 2021 maturity yielding 0.15% and the 2022 maturity at 0.17% while the 10-year muni rose one basis point to 0.82% and the 30-year gained one basis point to 1.56%.

The BVAL AAA curve showed the yield on the 2021 maturity steady at 0.13%, the 2022 maturity flat at 0.15% while the 10-year muni was unchanged at 0.80% and the 30-year remained at 1.57%.

Treasuries were stronger as stock prices traded sharply lower.

The three-month Treasury note was yielding 0.114%, the 10-year Treasury was yielding 0.618% and the 30-year Treasury was yielding 1.343%.

The Dow fell 3.00%, the S&P 500 decreased 3.80% and the Nasdaq lost 5.10%.