Trading in onshore bonds of China Evergrande, the world’s most indebted developer, was halted after reports it was seeking government help to stave off a cash crunch caused the price of its shares and debt to tumble.

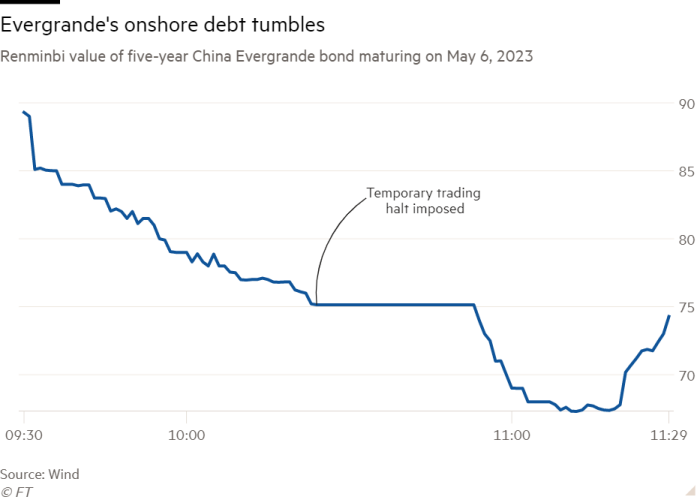

Shanghai’s stock exchange suspended trading in Evergrande bonds for half an hour on Friday morning, citing “abnormal fluctuations”, after prices plunged from just under Rmb90 ($13.19) to as low as Rmb67.20, compared to their par value of Rmb100.

Evergrande’s shares and debt prices dropped after a letter, purportedly from the company, circulated on Chinese social media on Thursday requesting support for a previously planned reorganisation from the provincial government in Guangdong, where Evergrande is based.

The company, which has over $120bn of debt, said in a filing to Hong Kong’s stock exchange late on Thursday that the documents were “fabricated and pure defamation” and that it had reported the matter to China’s security authorities.

Evergrande also asked its employees to post on social media platform WeChat a statement saying the letter was fake, according to several people working at the company. Evergrande did not immediately respond to a request for comment on the matter.

The company’s Hong Kong-traded shares fell more than 8 per cent in volatile trading on Friday, adding to a 5.6 per cent drop on Thursday.

Evergrande’s offshore debt, which trades at a discount, also dropped. A bond maturing in June fell by 6 per cent to 91 cents on the dollar. Longer-dated bonds also dropped, with those maturing in 2025 falling to 77 cents, driving yields up to 15.7 per cent.

In the purported letter dated August 24, Evergrande asked the Guangdong government to approve a plan to float its subsidiary Hengda Real Estate on Shenzhen’s stock exchange through a merger with an already listed company.

Evergrande reportedly added that a failure to complete the reorganisation would pose “systemic risks”, without specifying what those were.

The company has raised about Rmb130bn ($19bn) by selling shares in Hengda and needs to repay investors if it is not listed by the end of January. As of June, Evergrande had Rmb142.5bn in cash and cash equivalents.

Rating agency S&P on Friday downgraded Evergrande’s credit outlook to negative. “Evergrande’s short-term debt has continued to surge, partly due to its active acquisition of property projects,” it said. “We had previously expected the company to address its short-term debt, especially given the tough economic climate.”

S&P also said that it believes Evergrande will have to repay a portion of its investments in Hengda. However, it added that the risk of a liquidity crunch was “still low for now”.

Analysts have long been concerned that any issues at Evergrande could ripple through China’s financial system.

“Evergrande is a significant source of systemic risk,” said Nigel Stevenson, an analyst at GMT Research. “There are huge debts in the listed parent company that will ultimately need to be refinanced.”

Following the coronavirus pandemic, investors have sharpened their focus on China’s heavily indebted property developers, which have huge volumes of outstanding debt held by foreign entities.

Evergrande this month slashed the price of its properties in China by 30 per cent. The company has said the discounts were a “normal sales strategy” for September and October, which are a peak time for home sales in the country.