Though a new Labor Department proposal could hinder the use of ESG factors in retirement plans, the world’s largest money manager isn’t stepping back from sustainable investing.

In fact, BlackRock is upping its commitment.

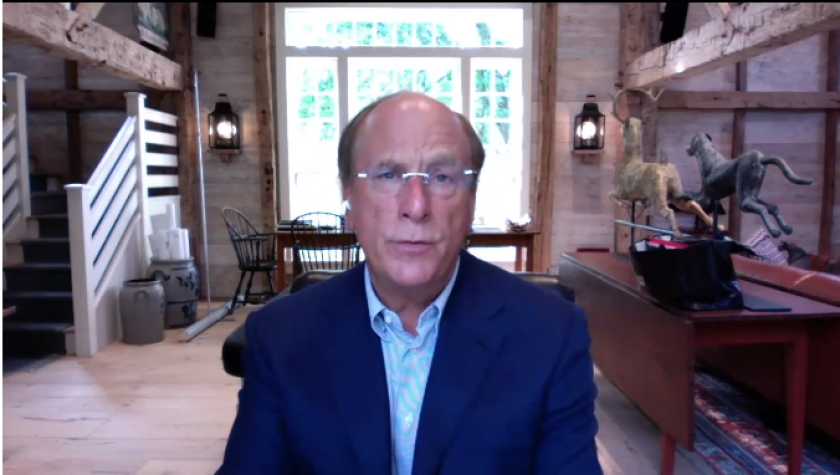

By the end of this year, 100% of its portfolios will integrate ESG metrics, up from 70% at the end of April, CEO Larry Fink said. The asset manager will also produce data and analytics that underscore the investment value of taking into account climate change, according to Fink, who pointed to threats posed by natural disasters.

“As we sit here today, we have raging fires. We have a hurricane. We have five tropical storms in the Atlantic. We have had record heat throughout the world,” he said. “We are seeing more and more examples of how climate change is becoming investment risk.”

Fink’s statements, made at the digital 2020 Morningstar Investment Conference, come after the public comment period ended July 30 for the Labor Department’s proposed regulation.

Under the department’s proposal, fiduciaries who use ESG funds in retirement plans will have a compliance burden to confirm they only considered pecuniary factors when selecting funds for retirement plans.

A vast majority of commenters opposed the proposal.

The department’s proposed regulation comes amid surging interest in ESG among investors. ESG funds reported net inflows of $71.1 billion in April and June, according to UBS Global Wealth Management.

To produce research on the investment case for taking into account climate risk, BlackRock is working with Sustainalytics, which was purchased by Morningstar earlier this year.

Fink pointed to the responsibility money managers have towards client assets, particularly with regard to educating investors as to what climate risk can mean for long-term investment returns.

“Our job is to educate. Our job is to persuade,” Fink said.

Although BlackRock is upping its commitment to sustainable investing, it says it will not exclude non-sustainable products or indices. Fink acknowledged that move has drawn criticism from environmentalists. Still, clients are taking to ESG investments, he said, noting that Blackrock had seen record inflows into sustainable products in the first six months of the year.

Fink also emphasized that social factors are increasingly important.

When asked by a moderator if Fink would send out letters to companies regarding diversity — similar to the one he sent to executives regarding climate change — the chief executive said he wasn’t currently in a position to do so.

“Right now we have to prove that we can do it right,” Fink said. “When I get this right, maybe that’s the time that I could ask other companies to do it well, too.”

Fink said BlackRock isn’t moving fast enough to improve its own diversity numbers, and he’s set a deadline to pick up the pace.

Earlier this year, Fink committed to increasing the firm’s Black workforce by 30% and doubling its Black senior leadership by 2024. As of June, 3% of senior leaders and 5% of BlackRock’s workforce in the U.S. are Black.