A 16-year-old New Jersey Supreme Court case has reemerged to play a central role in Republican efforts to try and halt New Jersey Gov. Phil Murphy’s $9.9 billion borrowing plan.

A lawsuit filed by the New Jersey Republican State Committee last week argued that the debt legislation Murphy signed violates the state constitution and conflicts with the state Supreme Court’s 2004 opinion in the Lance v. McGreevey case over the use of bonding for sustaining operating costs.

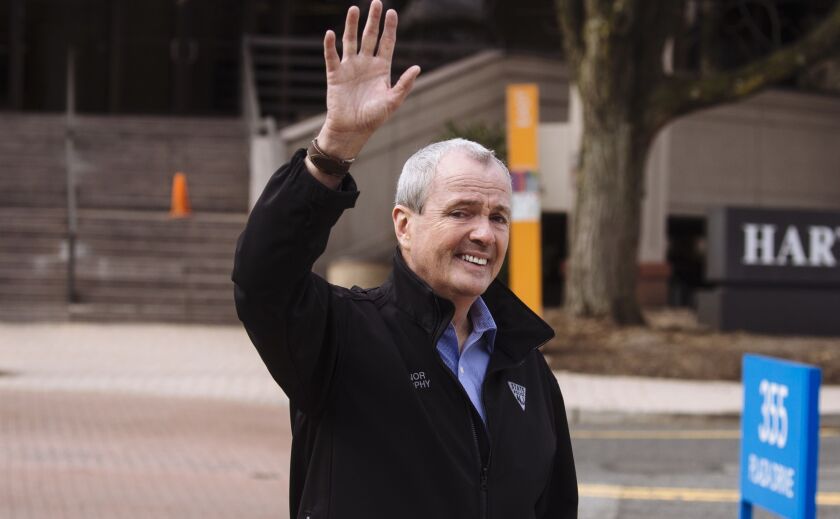

Bloomberg News

While New Jersey’s highest court ultimately did not shut down a $2 billion bond issuance that then Gov. Jim McGreevey already executed during the middle of a fiscal year, the 4-1 decision also outlined that bond proceeds should not be counted as “revenue” in future fiscal years.

The borrowing proposal that cleared the Democratic-controlled legislature on July 16 enables the Murphy administration to borrow up to $9.9 billion either through the issuance of general obligation bonds or short-term debt through the Federal Reserve’s Municipal Liquidity Facility program.

Michael Testa Jr., a Republican state senator who is attorney for the plaintiffs, said the New Jersey COVID-19 Emergency Bond Act violates the appropriations clause of the state constitution and the Lance decision.

“The holding in the Lance – McGreevey case is very clear that borrowed money cannot be used for operating expenses,” Testa said. “We believe this is unconstitutional borrowing.”

New Jersey Republicans filed their initial suit in Mercer County Superior Court after the borrowing measure became law on July 16, arguing that GO debt cannot be issued without voter approval under the state’s constitution. The State Supreme Court fast-tracked the case with a direct certification the next day and has scheduled oral arguments for Aug. 5.

New Jersey Assistant Attorney General Jean Reilly will be leading the Murphy administration’s case, which will argue that the state constitution provides exceptions for GO borrowing to sustain operating costs without voter authorization during a major emergency.

Reilly won a 2015 case before the New Jersey Supreme Court that enabled former Gov. Chris Christie’s administration to cut $1.57 billion of pension funding.

The New Jersey Office of the Attorney General declined to comment.

Testa said he is pleased the State Supreme Court is fast-tracking the case because of important fiscal decisions the Murphy administration is looking to make while grappling with a massive revenue hole.

The approved bonding legislation enables the state to borrow up to $2.7 billion by the end of the extended 2020 fiscal year on Sept. 30, and $7.2 billion for the shortened 2021 budget cycle from Oct. 1 through June 30. Murphy is slated to release an updated 2021 budget by Aug. 25.

“The Supreme Court understands the gravity of the lawsuit,” Testa said.

Steven Malagna, a senior fellow at the conservative-leaning Manhattan Institute for Policy Research, called New Jersey high court one of the “most activist” in the nation, which he said was underscored when it allowed another state borrowing to proceed without voter approval following the McGreevy case.

In that instance, he said, the court allowed New Jersey to skirt voter approval of $2.5 billion in school construction bonds by issuing the debt through the New Jersey Economic Development Authority instead of directly from the state.

“The court basically voided all the state’s debt limitations,” Malagna said. “It was a shell game.”

Malagna noted that the court rulings prompted a 2008 referendum that voters overwhelmingly approved tightening New Jersey’s borrowing restrictions by requiring voter approval of any state-backed debt sold through a conduit issuer.

He said that this referendum might weigh heavily on the State Supreme Court when deciding whether to allow Murphy to sell GO debt this year without voters weighing in.

“This is the first significant test since the 2008 referendum,” Malagna said. “Maybe that referendum sent a message to the court about giving Trenton free reign with borrowing.”

The Murphy administration is pursuing borrowing options as it grapples with economic shockwaves caused by COVID-19 stemming from lengthy closure of non-essential businesses after the virus’s outbreak began in March.

State Treasurer Elizabeth Maher Muoio projected in May that New Jersey faces an estimated $10 billion revenue drop through June 2021 from Murphy’s previous budget proposal unveiled on Feb. 25.

Marc Pfeiffer, assistant director of Rutgers University’s Bloustein Local Government Research Center, said the court will be closely examining whether the COVID-19 pandemic suffices as an emergency exception to issue GO debt for revenue purposes.

He said the court includes justices who will be weighing in for the first time on a borrowing decision, which puts the case very much up for grabs.

“The court will be looking at this from a fresh viewpoint,” Pfeiffer said. “There are people on the court who have never heard issues about state borrowing.”

Pfeiffer said the Fed’s lending, which would not hinge on the Supreme Court decision, may be a better option for the state to pursue. He suggested holding off on any borrowing strategies until July revenue numbers are released to reflect the delayed July 15 tax-filing deadline.

The State Supreme Court is led by Chief Justice Stuart Rabner, who was nominated in 2007 by then Gov. Jon Corzine.

The only current justice who participated in McGreevey v. Lance is Jaynee LaVecchia, who dissented and said at the time she was not prepared to say if that type of borrowing should be allowed in the future. Barry Albin, who has been on the court since 2002, did not participate in that case.

New Jersey had $44.4 billion of outstanding bonded debt as of June 30, 2019, according to the state’s latest annual debt report.

Fitch Ratings downgraded New Jersey’s GO debt to A-minus from A in April citing the state’s low reserve levels. The Garden State is rated A3 by Moody’s Investors Service, A-minus by S&P Global Ratings and A by Kroll Bond Rating Agency.