Europe’s biggest banks are set to unveil another huge round of provisions for loan losses, as they take stock of the damage wrought by Covid-19 around the globe.

The largest UK, Swiss and eurozone lenders are expected to provision at least €23bn for the second quarter as they report earnings in coming days, according to analysts at Citigroup. That is on top of the €25bn of charges the same group took against potential defaults in the first three months of the year.

When added to the $61bn already reserved by the five largest US banks over the first six months, the combined figure from the biggest western lenders could reach $117bn. That would be the highest net addition to reserves since the first half of 2009, in the aftermath of the collapse of Lehman Brothers, according to Citi.

Few economists are projecting rapid “V-shaped” recoveries and more pain is expected when government support schemes wind down in the autumn. Oliver Wyman, the consulting firm, forecasts as much as €800bn of loan losses for European banks over the next three years if there is a second wave of infections.

“It’s going to be another difficult one — several banks have flagged this could be the worst quarter of the year,” said Jon Peace, an analyst at Credit Suisse. He noted that under new accounting rules, banks are required to “front-load” their provisions for likely losses, but added that at the end of the first quarter they were working off assumptions for GDP growth and employment “that were not as bleak as today”.

UBS, the first of the major European financial institutions to report last week, posted a 43 per cent surge in earnings at its investment banking arm, but also took another $272m of loan-loss charges. That brought its total for the first half to $540m — 16 times the same period in 2019.

“The first quarter was about whether you are resilient and, for some, able to survive,” Sergio Ermotti, chief executive of UBS, told the FT. “The second quarter will be about whether you can demonstrate adaptation. We have already entered the ‘lessons learned’ phase of coronavirus.”

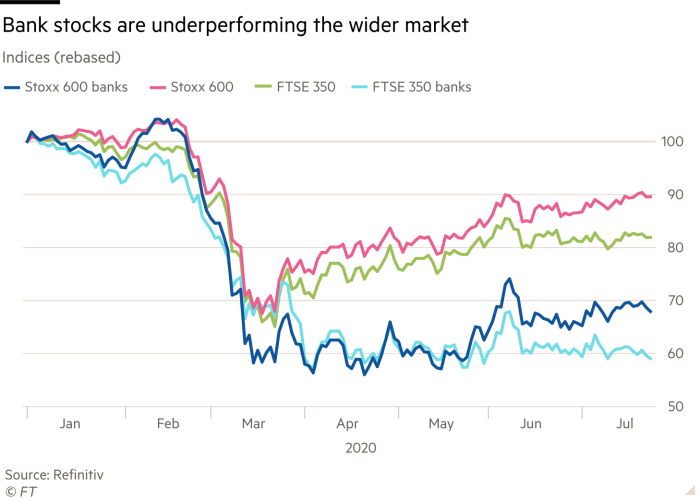

The already beleaguered European banking sector, still dogged by problems carried over from the financial crisis of 2008-09, has been punished in the stock market. Shares in European banks have dropped 31 per cent so far this year, on average, compared with a 10 per cent fall in the benchmark Stoxx 600 index.

On average, the banks are trading at less than 40 per cent of the book value of their net assets. Barclays (€22bn), Deutsche Bank (€17bn) and Italy’s UniCredit (€20bn) have a combined market capitalisation less than Zoom, the $74bn (€64bn) videoconferencing company that has prospered during the pandemic.

“It is a universal consensus that given the headwinds, investing in banks is as stupid an activity as investing in oil majors,” said Richard Buxton, head of UK Alpha strategy at Jupiter Asset Management. “It is unlikely that anything revelatory emerges from this reporting season to change that.”

“The economic downturn clearly means a big pick-up in bad debts,” he added. However, “I am extremely confident that whatever the damage to [profit and loss accounts] from the crisis, it does not mean they need to raise additional equity capital.”

In the first quarter there was a wide disparity between banks’ accounting approaches to potential loan losses — a discrepancy described as “extraordinary” by Magdalena Stoklosa, head of European financials research at Morgan Stanley.

An outlier so far is Deutsche, which provisioned just €500m in the first quarter, compared with £2.1bn at Barclays and $3bn at HSBC. The German bank has already said that loan-loss provisions would rise to €800m in the second quarter, the highest level in a decade.

For European lenders that have significant investment banking arms, a surge in trading revenues should cushion the blow. US banks reported an average 69 per cent increase in revenues from trading stocks, bonds and other assets, benefiting from market volatility and a slew of emergency fundraisings from big companies.

Most of those gains came from fixed income, where revenues more than doubled at JPMorgan, Goldman Sachs and Morgan Stanley.

While European banks on the whole have smaller debt-trading businesses, Barclays, Deutsche, Credit Suisse and BNP Paribas are positioned to profit the most. On average, analysts expect them to post trading revenues up between 40 to 50 per cent.

The spoils will not be spread evenly, according to Berenberg’s Eoin Mullany. While Barclays and UBS have increased their share of global revenues in the past year, “by contrast, the loss of European banks’ market share came almost exclusively from Deutsche and Société Générale,” he said.

Investors are also awaiting the results of the European Central Bank’s Covid vulnerability exercise on Tuesday, and an associated decision on whether banks can resume the payment of dividends. European, Swiss and UK regulators banned payouts at the start of the crisis in mid-March to force banks to conserve capital and lending capacity.

Stuart Graham, founder of Autonomous Research, said that few investors were expecting the ECB to allow banks to return to normal payouts later this year, saying that January 2021 “is a more realistic date.”

However, clarity from the regulator will mean fund managers “know the rules of the game once again”, he added. “It could attract back those investors for whom the sector had been rendered borderline uninvestable because of the zeroing of dividends.”

Additional reporting by Martin Arnold in Frankfurt