Silver prices continue to push the $18 mark and could head higher still, shining the spotlight on silver penny stocks with major upside potential.

Although silver failed to settle above $18.50 this week, the white metal is finding support at $17.50 and is expected to remain elevated in the coming months. According to CIBC analysts, silver will average around $18 an ounce this year and $19 in 2021, while Degussa Goldhandel is suggesting silver price could go as high as $22 in 2020.

Investor interest in silver is already heating up. Last year, investor demand climbed 12% to 186.1 million ounces, its highest jump since 2015, and silver exchange-traded funds (ETFs) boosted their holdings by 13% to 728.9 million ounces, the most significant annual growth since 2010.

If you don’t have any silver in your portfolio, don’t worry, there are plenty of shiny silver penny stocks to choose from that could offer plenty of upside. The following small-cap silver stocks, which are all under $5, are working in Mexico, the most prolific silver mining regions in the world.

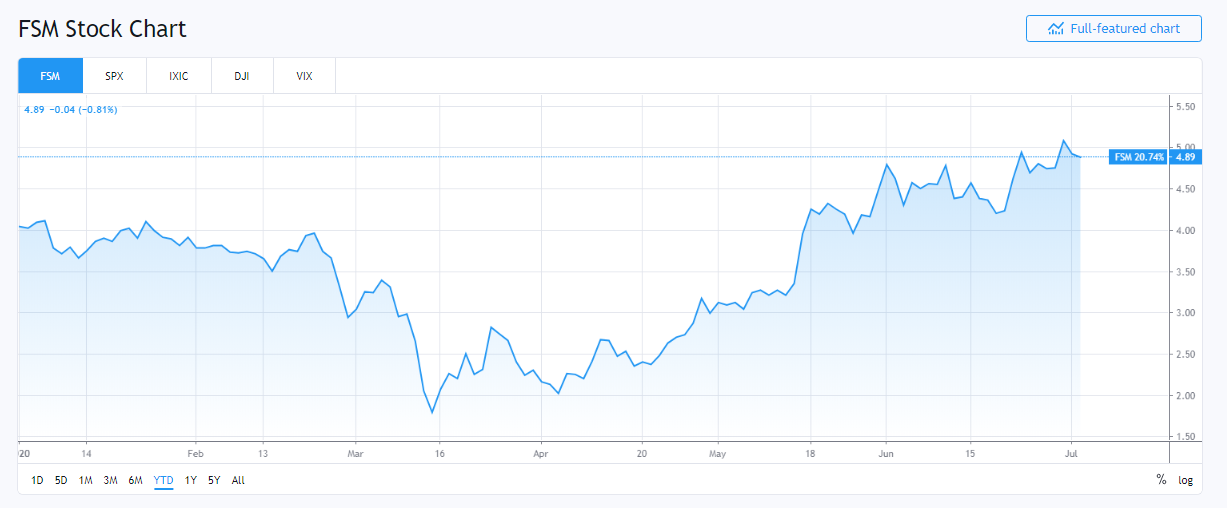

Shiny Silver Penny Stocks: Fortuna Silver Mines (TSX:FVI) (NYSE:FSM)

First on the list of shiny silver penny stocks to buy is Fortuna Silver Mines, a precious metals mining company operating two low-cost underground mines in Peru and Mexico and developing a fully permitted gold project in Argentina.

Despite posting a loss in its Q1 2020 results due to pandemic-related shutdowns, the company still ended the quarter with $88.5 million cash and cash equivalents. Fortuna Silver resumed production at its San Jose mine on May 26 at a capacity of 3,000 tonnes per day, and both analysts and investors have their eye on the company.

PI Financial upgraded its rating to “BUY” on May 31 and offered Fortuna Silver Mines a 12-month price target of $6.80, while BMO Capital Partners gave the company an “Outperform” rating and a $7.50 price target.

At the same time, a number of institutional investors and hedge fund managers have been increasing their positions in the company. Cambridge Investment Research Advisors Inc. boosted its stake in Fortuna Silver Mines by 29.1% during Q4 2019 and now owns 22,485 shares of the company’s stock after acquiring an additional 5,075 shares in the last quarter. Credit Suisse AG boosted its stake in Fortuna Silver Mines by 5.0% during Q4, while Profund Advisors LLC boosted its stake in Fortuna by 19.1%.

On Friday, FSM stock was down 0.81% to $4.89, but the stock is still up over 20% since the beginning of the year.

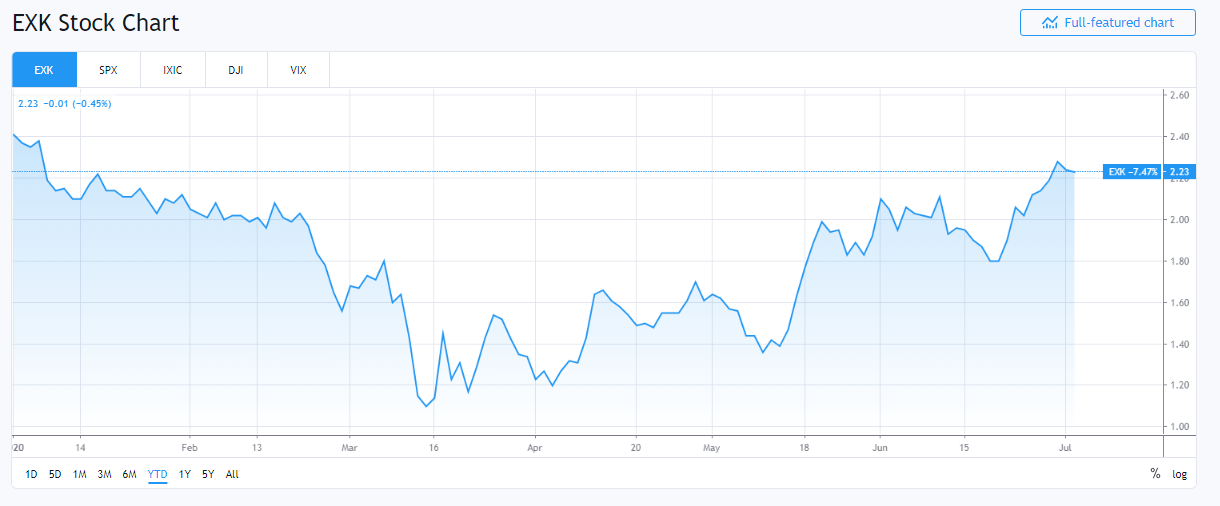

Shiny Silver Penny Stocks: Endeavour Silver Corp. (TSX:EDR) (NYSE:EXK)

Next on the list of shiny silver penny stocks to buy is Endeavour Silver Corp., a mid-tier precious metals mining company that owns and operates three high-grade, underground, silver-gold mines in Mexico. The company is also advancing the Terronera Mine project towards a development decision and exploring its portfolio of exploration and development projects in Chile and Mexico with the goal of becoming a premier senior silver producer.

>> Top Low Float Stocks Under $5 This Week

Like Fortuna, Endeavour Silver experienced a minor setback earlier in the year due to forced shutdowns at Mexico mines, but the company has since restarted operations and is ready to capitalize on rising gold prices.

On June 2, Endeavour announced that exploration drilling through Q1 intersected new high-grade gold-silver mineralization in the Santa Cruz vein on the El Curso property at the Guanacevi mine in Mexico, with 12 of 18 holes hitting high grades over minable widths.

“Last year at Guanacevi, we were successful in outlining new resources on the El Curso property, and we commenced mining there in late Q3 2019,” said Endeavour Silver director and CEO Brandford Cooke. “This year, we continue to discover new resources in the Santa Cruz vein on El Curso which should add to our mine life at Guanacevi.”

On Thursday, EXK stock was down 0.45% at $2.23 and is down 7.46% since the beginning of the year, but analysts see the stock going higher. HC Wainwright has offered the company a “BUY” rating and a 12-month price target of $3, which suggests a potential upside of 34.52% from its current price.

Endeavour Silver Corp. has a market cap of $320.75 million, with 143,838,000 shares issued.

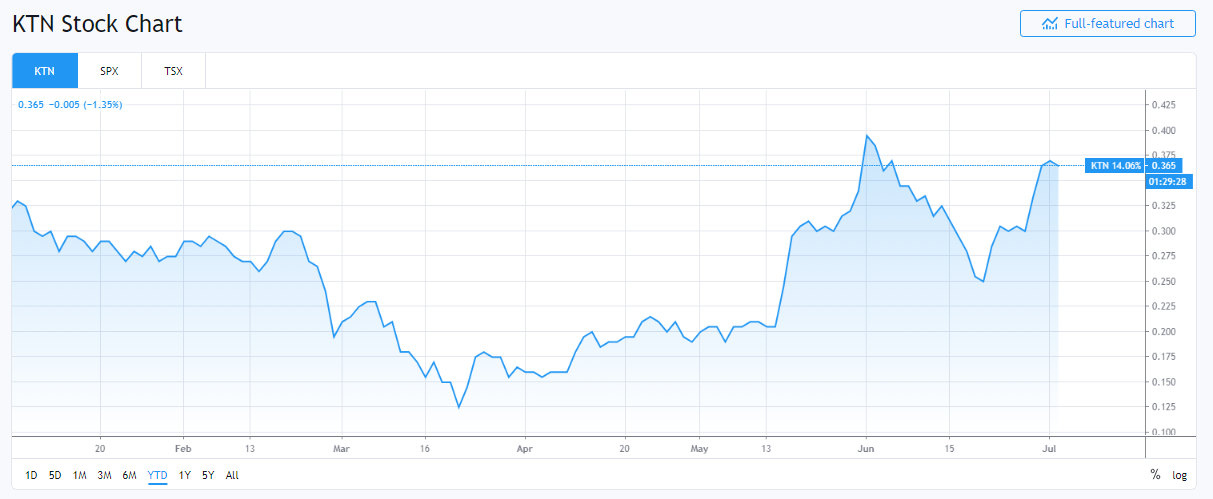

Shiny Silver Penny Stocks: Kootenay Silver Inc. (TSXV:KTN)

Last, but definitely not least on the list of shiny silver penny stocks to buy is Kootenay Silver, a silver exploration company actively engaged in the discovery and development of mineral projects in Mexico and in British Columbia, Canada.

Like its Mexico-based peers, Kootenay Silver was forced to temporarily suspend operations and has returned with a bang.

Since reopening, the company has released promising assay results from its Copalito silver-gold project, which included 22 meters averaging 106 grams per ton (g/t) silver including 244 g/t silver and 1.09 g/t gold over 3.0 meters including 286 g/t silver over 1.0 meters and 360 g/t silver and 0.1 g/t gold over 1.0 meters within 250 g/t silver and 0.247 g/t gold over 5.0 meters.

A week later, the company announced assay results from an additional four holes at the Columba, which included 2,010 g/t silver over 1.0 meter within 762 g/t silver over 2.8 meters and 865 g/t over 2 meters within 317 g/t over 6 meters.

Apart from its ongoing drilling success, Kootenay Silver has also attracted a number of big-name investors, including gold market guru Eric Sprott, who fully subscribed to the company’s $5 million private placement in August 2019.

KTN stock was down 1.35% on Friday at C$0.36 and is up nearly 10% since the beginning of 2020. An analyst at Fundamental Research has given the company a “BUY” rating and a 12-month price target of C$0.57, while Mackie has offered a “Speculative BUY” rating and expects the stock to C$0.55.

Takeaway

The silver market is on fire right now, and silver prices are expected to stay elevated as more demand comes into the market. The silver supply squeeze, due to depleting reserves and temporary shutdowns, paired with the growing demand, is creating a winning combo for silver, and now is absolutely the perfect time to get in.

If you don’t already own silver, these three silver penny stocks are a great place to start. If you want to check out other potential winners, here are a few other silver stocks that have caught our eye.

Are there any silver penny stocks on your radar lately? Let us know in the comments!

Featured Image: Depositphotos ©TunedIn61