Municipal prices were little changed on the day, with action focusing on new-issue supply as the big Massachusetts deal became even bigger. The issue was upsized from the original amount of $670.51 million to nearly a billion.

There were some notable trades in the secondary. Berkeley Heights, California 2s of 2021, traded at 0.38%-0.37%. Collin County, Texas, community college taxable paper, 0.64% coupon with a par coupon traded at par after selling on June 22 at the same level. Taxable issuance has emerged as a new force in the municipal market once again.

Columbus, Ohio, GOs, 5s of 2023, traded at 0.32%-0.30%.

Meanwhile, Fairfax County, Virginia GOs, 5s in the 10-year, traded sub-1.00% at 0.97%-0.96%, adhering to the AAA remaining below 1.00%.

In coronavirus news, Texas announced it paused its reopening as Arizona mandated the use of face masks while more states are expected to make adjustments.

“The announcement helped bring stocks to mixed on the day,” said Peter Franks, senior analyst at Refinitiv MMD. “And then the FDIC announced, ‘they are loosening the restrictions from the Volcker Rule, allowing banks to more easily make large investments into venture capital.’ The news boosted bank stocks pushing the DJIA above the flat line … investors cheered the good bank news but grapple with possible COVID-19 induced pauses or shutdowns.”

ICE Data Services said that munis were little changed on the day in moderate volume.

“Yields on the ICE muni curve are about ½ basis point lower in the front end and ½ to one basis point higher in the back end,” ICE said in a Thursday market comment. “The week’s new issues are finalizing and freeing to trade.”

In the week ended June 24, tax-exempt mutual funds saw $1.474 billion of inflows, according to data released by Refinitiv Lipper Thursday. It was the seventh week in a row that investors put cash into the bond funds.

Primary market

BofA Securities priced, repriced and restructured Massachusetts’ (Aa1/AA/AA+/NR) $945.615 million of tax-exempt general obligation and GO refunding bonds for institutions after a one-day retail order period. The issue was upsized from the original amount of $670.51 million.

The Series 2020B GO refunding bonds were repriced to yield from 0.38% with a 5% coupon in 2024 to 1.40% with a 5% coupon in 2034.

The Series 2020D GOs were repriced to yield from 0.65% with a 5% coupon in 2026 to 1.72% with a 5% coupon in 2041; a 2045 term bond was repriced to yield 1.86% with a 5% coupon and a 2048 split term bond was priced to yield 1.89% with a 5% coupon and 2.31% with a 3% coupon.

The Series 2020B GO refunding bonds were tentatively priced to yield from 0.38% with a 5% coupon in 2024 to 1.46% with a 5% coupon in 2031. The Series 2020D GOs were tentatively priced to yield from 0.65% with a 5% coupon in 2026 to 1.75% with a 5% coupon in 2041; a 2045 term bond was priced to yield 1.88% with a 5% coupon and a 2048 term was priced to yield 1.91% with a 5% coupon.

On Wednesday, the Series 2020B GO refunding bonds were priced for retail to yield from 0.38% with a 5% coupon in 2024 to 1.13% with a 4% coupon in 2031.

The Series 2020D GOs were priced for retail to yield from 0.65% with a 5% coupon in 2026 to 2.09% with a 3% coupon in 2039; a 2048 term bond was priced to yield 1.86% with a 5% coupon.

Barclays received the official award on the Massachusetts Development Finance Agency’s $103.48 million of tax-exempt revenue refunding bonds for the university.

The deal was priced to yield from 0.39% with a 5% coupon in 2022 to 1.13% with a 5% coupon in 2028 and from 1.31% with a 5% coupon in 2030 to 1.67% with a 5% coupon in 2036.

JPMorgan Securities priced Utah County, Utah’s (Aa1/AA+/NR/NR) $350 million of hospital revenue bonds for IHC Health Services.

The $200 million of Series A bonds were priced to yield 2% with a 5% coupon and 2.22% with a 4% coupon in a split 2043 maturity and 2.13% with a 5% coupon and 2.67% coupon in a split 2050 maturity.

The $150 million of Series 2020B-1 bonds were priced to yield 0.69% with a 5% coupon in 2060 with a mandatory tender in 2024 and Series 2020B-2 bonds were priced to yield 0.93% with a 5% coupon in 2060 with a mandatory tender in 2026.

Piper Sandler priced the Cypress-Fairbanks Independent School District, Texas’ (Aaa/AAA/NR/NR) $263.945 million of unlimited tax school building and refunding bonds. The deal is backed by the Permanent School Fund guarantee program.

The bonds were priced to yield from 0.32% with a 5% coupon in 2023 to 2.03% with a 3% coupon in 2041; a 2045 term bond was priced to yield 2.16% with a 3% coupon.

JPMorgan received the official award on Wisconsin’s (Aa1/AA/NR/AA+) $297.795 deal, which consisted of $163.955 million of taxable Series 3 GO refunding bonds and $133.84 million of Series 1 tax-exempt forward delivery GO refunding bonds.

RBC Capital Markets received the written award on the Alaska Municipal Bond Bank’s (A1/A+/NR/NR) $98.31 million of GO refunding bonds. The deal was priced to yield from 0.54% with a 5% coupon in 2020 to 2.20% with a 4% coupon in 2033, 2.33% with a 4% coupon in 2035, 2.41% with a 4% coupon in 2037 2.45% with a 4% coupon in 2038 and 2.49% with a 4% coupon in 2039.

In the competitive arena, Fort Lauderdale, Fla. (AA2/AAA/NR/NR) sold $167.32 million of taxable special obligation revenue refunding bonds.

BofA Securities won the deal with a true interest cost of 1.5518%. The deal was priced at par to yield from 0.40% in 2021 to 1.95% in 2032.

PFM Financial Advisors was the financial advisor; Greenberg Traurig was the bond counsel.

Money market muni funds fall $1.96B

Tax-exempt municipal money market fund assets fell $1.96 billion, bringing total net assets to $131.22 billion in the week ended June 22, according to the Money Fund Report, a publication of Informa Financial Intelligence.

The average seven-day simple yield for the 187 tax-free and municipal money-market funds was unchanged at 0.03%.

Taxable money-fund assets increased $2.12 billion in the week ended June 23, bringing total net assets to $4.492 trillion.

The average, seven-day simple yield for the 793 taxable reporting funds was steady at 0.07%.

Overall, the combined total net assets of the 980 reporting money funds rose $159.34 million to $4.623 trillion in the week ended June 23.

Secondary market

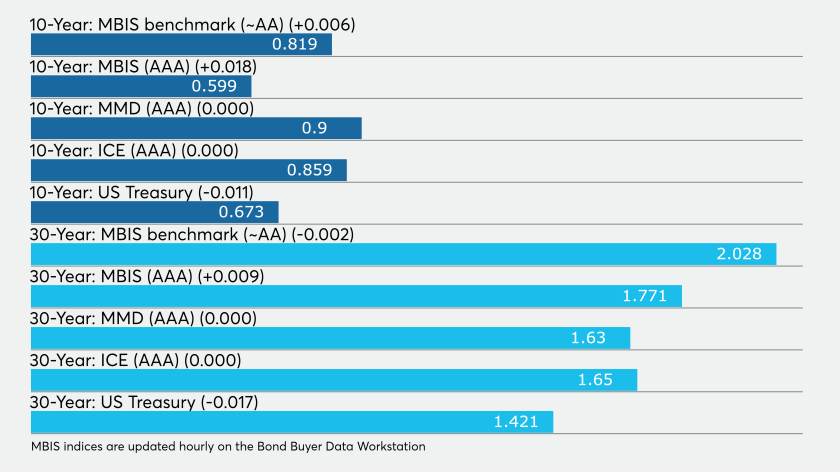

On MMD’s AAA benchmark scale, yields were unchanged. Yields on the 2021 and 2023 maturities were steady at 0.25% and 0.27%, respectively. The yield on the 10-year GO muni was flat at 0.90% while the 30-year yield was steady at 1.63%.

The 10-year muni-to-Treasury ratio was calculated at 133.1% while the 30-year muni-to-Treasury ratio stood at 114.8%, according to MMD.

ICE Data Services said that munis were little changed on the day in moderate volume.

“Yields on the ICE muni curve are about ½ basis point lower in the front end and ½ to one basis point higher in the back end,” ICE said in a Thursday market comment. “The week’s new issues are finalizing and freeing to trade.”

The ICE AAA municipal yield curve showed yields were little unchanged, with the 2021 and 2022 maturities at 0.230% and 0.241%, respectively. Out longer, the 10-year maturity was steady at 0.859% while the 30-year was flat at 1.650%.

ICE reported the 10-year muni-to-Treasury ratio stood at 136% while the 30-year ratio was at 114%.

The IHS Markit municipal analytics AAA curve showed the 2021 maturity yielding 0.24% and the 2022 maturity at 0.27% while the 10-year muni was at 0.91% and the 30-year stood at 1.66%.

The BVAL AAA municipal yield curve showed yields were unchanged, with the 2021 and 2022 maturities at 0.190% and 0.24%, respectively. Out longer, the 10-year maturity was steady at 0.84% while the 30-year was flat at 1.65%.

Munis were little changed on the MBIS benchmark and AAA scales.

Treasuries were stronger as stocks traded lower.

The three-month Treasury note was yielding 0.145%, the 10-year Treasury was yielding 0.673% and the 30-year Treasury was yielding 1.421%.

The Dow rose 0.07%, the S&P 500 increased 0.12% and the Nasdaq gained 0.10%.

Lynne Funk contributed to this report.