Europe’s economic recovery from the coronavirus pandemic is well under way, according to sentiment indicators, high-frequency measures and hard data — but activity remains far below normal levels, suggesting that the recovery from recession will be a struggle.

The continent’s workers and consumers began to return to work, shopping and dining out from last month onwards, generating an initial post-lockdown rebound.

But high-frequency data indicators such as footfall and consumer spending suggest that the economic improvement is patchy and limited by social-distancing measures.

The figures are more up to date than official economic indicators, although they are also experimental and the extent to which they reflect the subsequent trends documented in official data is variable.

Real-time data “have spurred hopes of a quick economic rebound . . . but this expectation is overly optimistic”, said Madhavi Bokil, vice-president of credit rating agency Moody’s. “The recovery is more likely to be a long and bumpy slog rather than a quick rebound.”

Shopping and entertainment

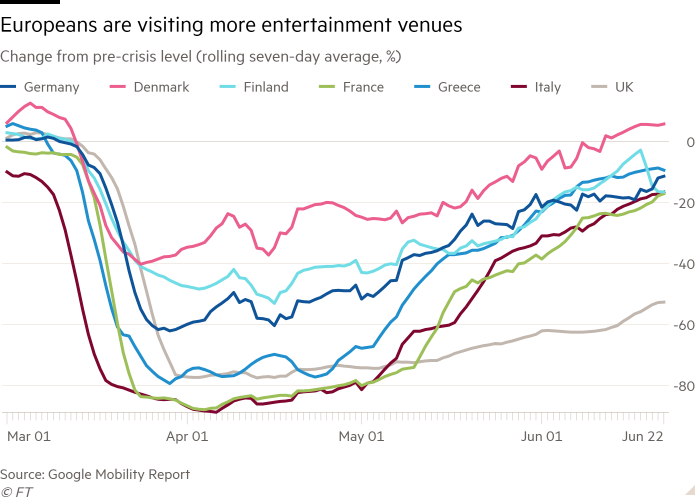

As some parts of the entertainment sector reopen, footfall at venues and restaurants — a proxy for consumer spending — has generally improved across major European economies, according to Google Mobility data. However, it remains below pre-virus levels in most countries.

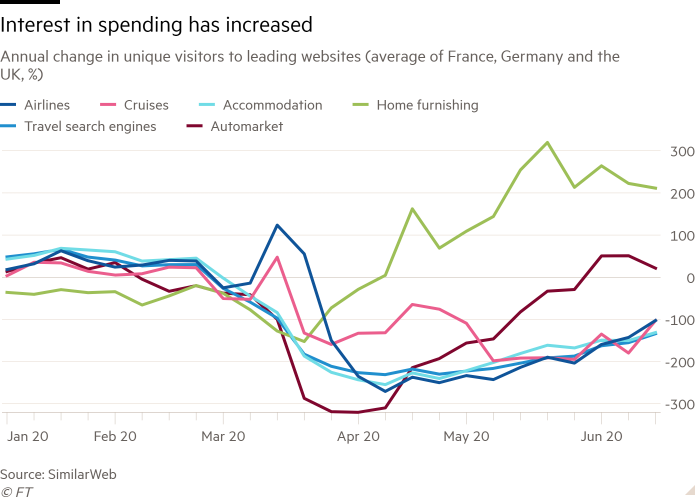

Visits to home furnishings and motor websites are running above last year’s levels across France, Germany and the UK, suggesting that consumers have become more interested in spending again.

Restaurant bookings are increasing fast in Germany, according to data from booking services provider Open Table. Figures for other major European economies such as France, Spain and Italy were not available.

All major European shopping centres are still seeing footfall levels which are well under the norm, according to Financial Times analysis of Google Maps data. Some are still down 30 per cent or more compared with the long-term average.

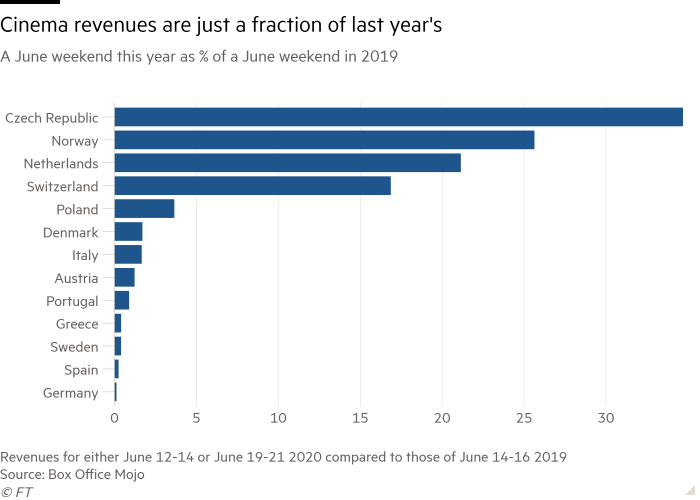

Cinemas are only just starting to reopen across Europe and, in some cases, are only operating outdoors or with limited capacity. As a result, ticket revenues are just a fraction of last year’s, according to website Box Office Mojo.

On Monday, the European Commission’s latest economic sentiment indicators for the eurozone are expected to show sharp improvements in June, mirroring gains in business sentiment indicators which were published last week.

The strong rebound recorded in survey-based data “provides further evidence that the recovery is a little quicker than we had anticipated”, said Jessica Hinds, European economist at Capital Economics. However, “the level of activity remains very depressed compared to the start of the year”.

A large chunk of the continent’s economy remains restricted and international travel and trade are still in a deep downturn.

“We see a sharp initial rebound in consumption to be followed by a much slower recovery, as households will prefer to keep precautionary savings, due to uncertainty and income risks,” said Nicola Nobile, economist at Oxford Economics.

Peter Vanden Houte, chief economist at ING, warned that waning government aid and rising job cuts would begin to weigh on the rebound in the coming months, while social-distancing measures only allow a partial return of service sector activity.

Industry and jobs

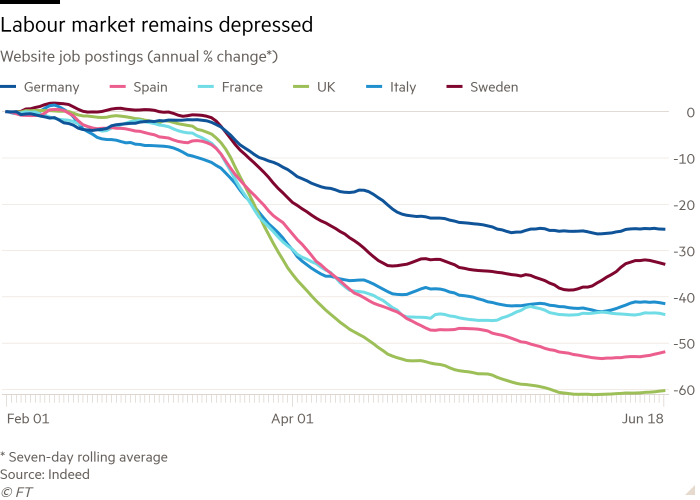

A rebound in vacancies will be the first clear sign of recovery in the labour market. But although the number of recruitment opportunities has stopped decreasing across major European economies, it has not yet begun to show any uptick, according to data from the job site Indeed.

In the week to June 19, job postings on the site were down 25 per cent in Germany compared with the same period last year, more than 40 per cent in France and Italy, and 52 per cent in Spain.

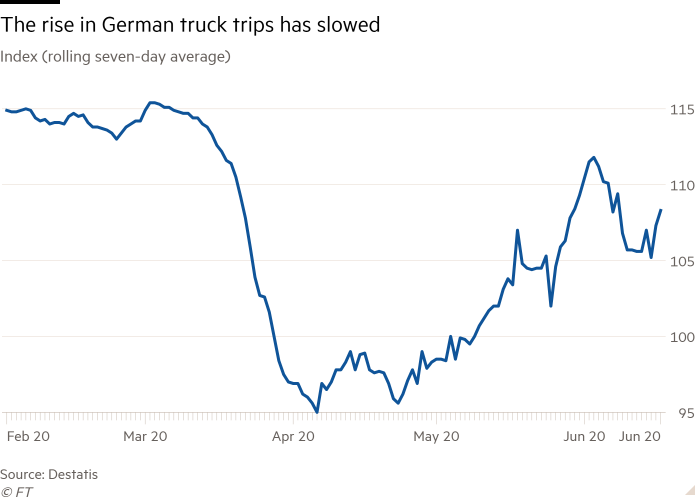

Separate data on German truck toll mileage, which tracks truck journeys and is considered a proxy for industrial production, has weakened in June, after a steady rise in May, according to the German Office for National Statistics, suggesting that the country’s manufacturing sector may face fresh struggles.

What matters most for jobs and business survival is the extent to which businesses are making enough money to survive and pay for staff, particularly as government support starts to dwindle.

Last week Christine Lagarde warned that jobs in the hospitality sector “will go first”.

Consumption “will be held back in the coming quarters by the remaining social-distancing rules, lingering contagion fears and heightened domestic economic uncertainty driven in particular by widespread job fears,” said Katharina Utermöhl, senior economist at Allianz Research.

She forecast that eurozone output would not recover to pre-virus levels before the end of 2023: “A swift return to business as usual is clearly not on the table.”

Travel

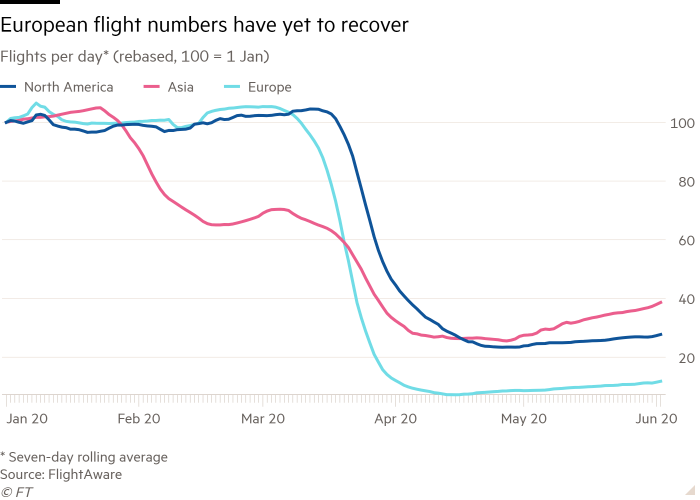

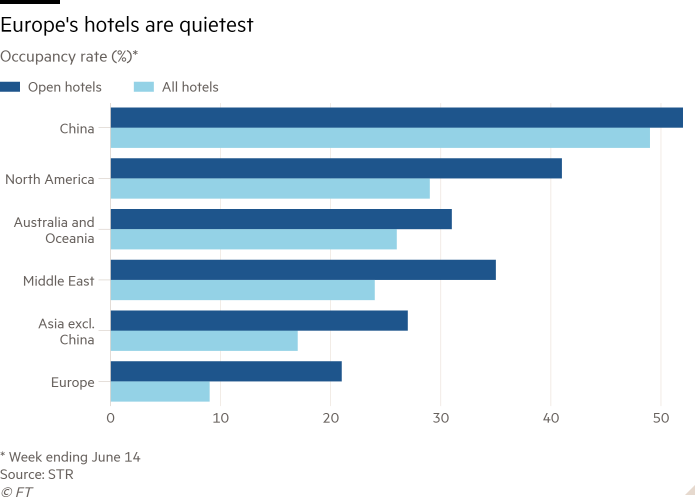

Europe’s international travel industry has yet to show much sign of recovery. Flight numbers and hotel occupancy rates are still a fraction of pre-pandemic levels.

In the first week of June, European flight numbers were up 36 per cent compared with the same period in the previous month, but they were 91 per cent down compared with the same time last year, according to FlightAware, a global aviation data services company.

Across Europe, only one in 10 hotel bedrooms was occupied in mid-June, according to consultancy STR — the worst of all major regions.

Visits to accommodation and travel websites, a measure of future demand, have increased across France, Germany and the UK, but remained depressed compared with last year’s levels, according to data from the web tracker company Similar Web.

“While further loosening of restrictions is progressively under way across the continent, some restrictions, especially in tourism-related sectors, will most likely remain throughout the coming months and continue to drag on activity,” said Ludovico Sapio, economist at Barclays.