Wealth Losses In the Pandemic Hurt All Households

Getty

Households lost $6.5 trillion early in the pandemic. Most of this decline came from sharply lower stock prices and thus especially hurt the wealthiest American households. Yet even less wealthy ones saw a substantial drop in their wealth and those wealth losses are more likely to linger. After all, those with the least wealth are most likely to need extra money right now and thus most likely to use whatever limited savings they have to pay their bills.

Total household wealth fell by 5.6% from the end of 2019 to March 2020. This meant that households had $6.5 trillion less to cover an emergency or invest in their own future within a short period of time.

Most of this loss stemmed from sharply lower stock prices at the start of the global coronavirus pandemic. Since stock holdings are highly skewed towards the wealthiest Americans, the wealth losses in early 2020 also fell largely on those with a lot of money. The wealthiest one percent of households owned 54% of all stocks and mutual fund shares at the end of 2019. In comparison, the bottom half of all households owned only 0.8% of all stocks and mutual fund shares. Not surprisingly, the total wealth for the top one percent dropped by 10.2% in the first three months of this year, well above the average decline of 5.6% across all households.

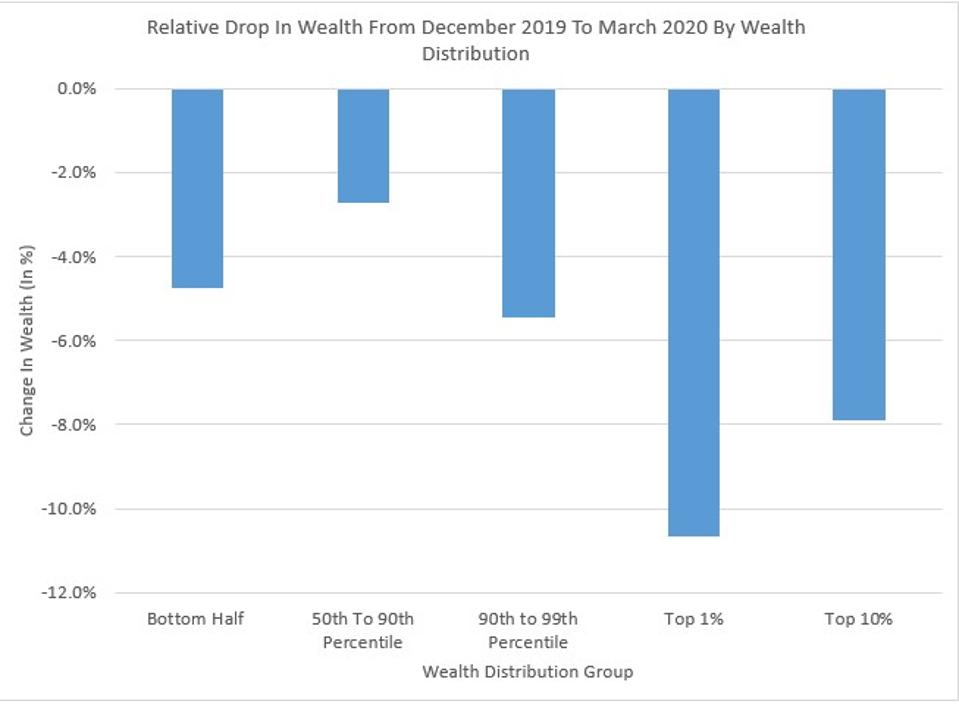

The fact that the wealth losses were heavily concentrated among the wealthiest does not mean that other households were spared. Average wealth per household, for example, fell by 4.7% for those in the bottom half of the wealth distribution (see figure below). This is well above the 2.7% decline in wealth for households between the median and 90th percentile (see figure below). Importantly, low-income households little to lose to begin with. Their average wealth was $24,536 in December 2019. Economic security quickly moved even further out of reach for many American families as the pandemic went under way.

All Household Groups Saw Wealth Declines

Calculations Based on Federal Reserve. Distributional Financial Accounts and Survey of Consumer Finances

The decline in household wealth at the bottom of the distribution followed from a number of factors. While households with little wealth do not own a lot of stocks outright or in mutual fund investments, the stock market still impacted their savings. Many of these households have some savings in retirement accounts, while others have earned a pension on their current or past jobs. But both retirement savings accounts such as 401(k)s and IRAs as well as defined benefit (DB) pension plans took a bath when the market crashed. Since so-called pension entitlements – the sum of money held in retirement accounts and DB pensions – accounted for 45.5% of all assets at the bottom of the wealth distribution at the end of 2019, wealth there dropped, too.

The stock market regained many of those losses, but this recovery will likely not come soon and quickly enough for those with little other assets. Many households with retirement accounts and retirement benefits will be near retirement. And many of those nearing retirement with little money saved for retirement had worked longer in recent years to make up for low savings. But these are also the same workers – many are African-American, Latina or Asian women —, who now experience the largest job losses and highest unemployment rates. Many will deplete whatever meager savings they have to make ends meet as the deep recession continues to linger.

The recession will then worsen wealth inequality over time. Those who are most likely to economically suffer from the crisis are also the ones who have the least wealth. Yet they are the ones who need the money the most and who will use their savings or go deeper into debt to pay their bills. In comparison, those with more wealth tend to see lower unemployment rates and fewer job losses and thus less of a need to use their savings right now. On the contrary, many wealthier households will have sufficient additional savings and income to invest more money in the stock market with prices still below their previous peaks. Wealth inequality after all sharply rose in the wake of the Great Recession with those in the top 10% recovering all of their losses much faster than those in the bottom half.

American families need to heavily rely on their own wealth in times of crises because of poor or nonexistent social insurance benefits. Yet the Great Recession and the current one illustrate the failure of this system of self-reliance. Those who are most vulnerable in a recession, women, those without a college degree, African-Americans and Latinx families, are also the ones who have the fewest savings. Their economic pain will linger for years if not decades unless Congress steps up and expands much needed benefits such as more widespread and higher unemployment insurance benefits.