Computing giant Hewlett Packard Inc. (HPQ), which focuses on PCs and printers, said it has secured a 364-day revolving credit facility, with aggregate lending commitments of $1 billion.

Loans under the senior, unsecured revolving credit facility will be used for general corporate purposes, the company said in a SEC filing. JPMorgan Chase Bank, N.A. will act as the administrative agent on the credit line.

Last week, HP reported lower-than-expected revenues with sales sales declining about 11%, while also pulling its financial guidance for the year due to the uncertain business impact of the coronavirus pandemic. The computing giant, which in March already experienced a significant slowdown in some of its products, including printers, as offices closed and trade shows were cancelled, said it expected a larger hit to the print business in the third quarter.

Shares in HP have dropped some 27% so far this year and were trading at $15.14 as of Friday’s close.

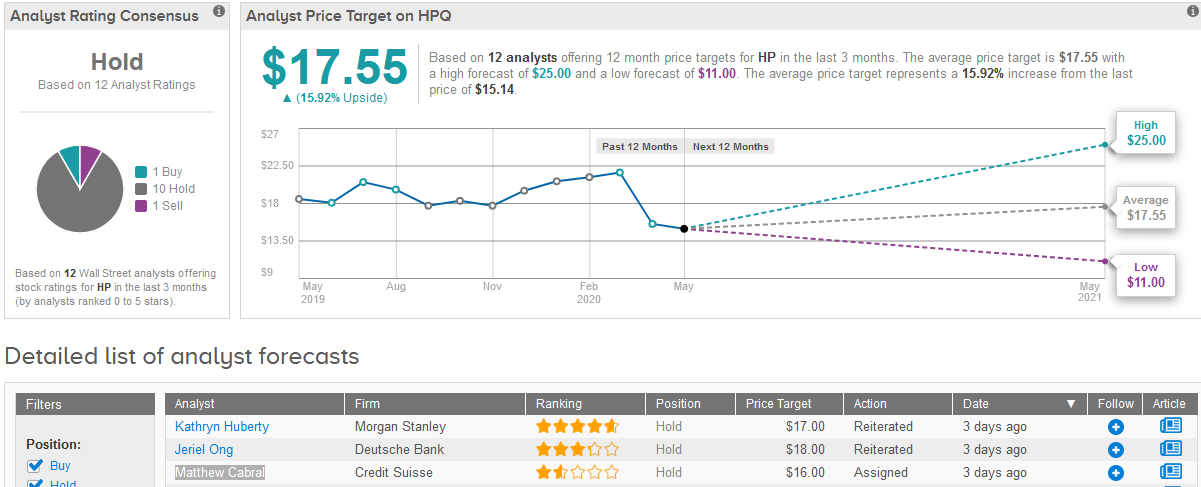

Following last week’s earnings results, Credit Suisse analyst Matthew Cabral cut the stock’s price target to $16 from $17 and maintained a Hold rating.

“We expect the full run-rate of demand weakness to further weigh on F3Q (CSe -25% y/y for Supplies) which, in turn, drags down profitability,” Cabral wrote in a note to investors. “With print under significant pressure near-term and lingering WFH magnifying the secular headwinds coupled with risk of a pull-forward from 2H in PCs, we remain neutral awaiting greater line-of-sight on a return to steady-state EPS/FCF.”

All in all, the Street is currently taking a cautious approach to HP. The Hold consensus rating breaks down into 10 Holds, 1 Sell and 1 Buy. The average price target comes in at $17.55 and implies potential upside of 16%. (See HP’s stock analysis on TipRanks).

Related News:

Logitech Shares Lifted In Pre-Market On Share Buyback Plan, 10% Dividend Boost

Apple Snaps Up AI Startup Inductiv, As Analysts Boost PTs On Store Reopenings

KKR Invests $1.5 Billion in Reliance’s Jio Platforms In Biggest Deal In Asia