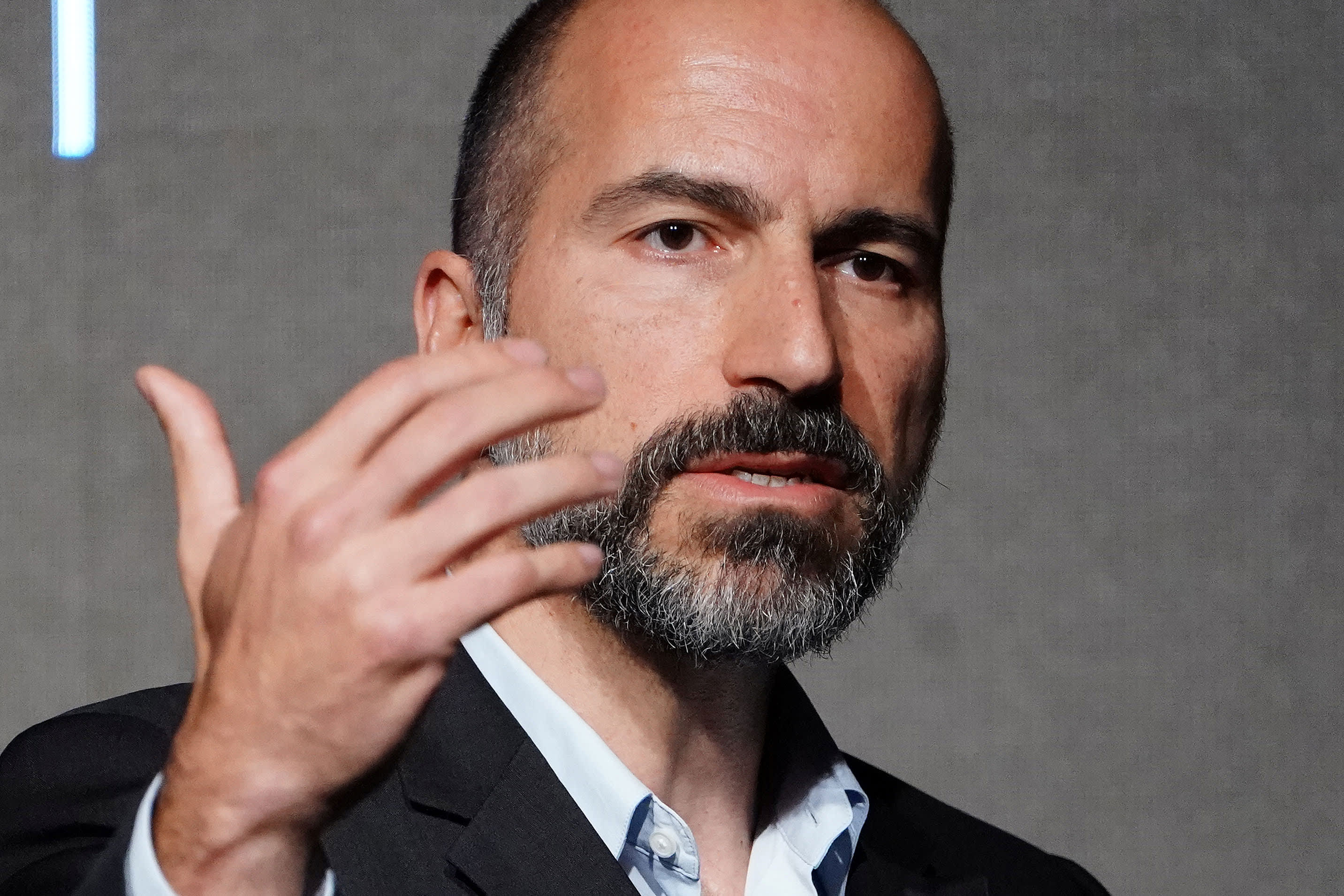

Dara Khosrowshahi, CEO, Uber

Carlo Allegri | Reuters

Here are the biggest calls on Wall Street on Friday.

Atlantic Equities initiated Uber as ‘neutral’

Atlantic Equities said Uber’s path to profitability is clearer.

“Given the benefits of scale, we prefer Uber, with its market-leading ridehailing position augmented by the fast growing Eats business and freight brokerage opportunity. We forecast ’18-22 27%/34% gross bookings/adj gross profit CAGRs, driven by high-teens ridehailing growth, rapid Eats/freight expansion and eventual easing in promotional intensity. Our YE19 PT implies 0.9x FY20 gross bookings, similar to the historical average multiple of Amazon’s ecommerce business.”

Atlantic Equities initiated Lyft as ‘underweight’

Atlantic Equities said it is more “skeptical” about Lyft‘s route to profitability.

“Underweight Lyft, $50 YE19 PT: While having recently delivered impressive share gains, we are more skeptical on Lyft’s route to profitability. We forecast ’18-22 28%/49% gross bookings/adj gross profit CAGRs with our PT implying 0.85x FY20 gross bookings. “

Bernstein upgraded Walmart to ‘outperform’ from ‘market-perform’

Bernstein said it thinks Walmart could show an “outsized” investment return over the next few years.

“We see three changes in WMT to justify our move in rating: 1) Expense harvesting is a core tactic of WMT which is finally being allowed to return into vogue with a change in leadership that we find positive (even if all segment CEOs change). 2) Strategy is solid as WMT is the only full-scale challenger to AMZN with sizable investments on Price & Convenience (grocery) and Price & Assortment (general merchandise) which may combine in mini-fulfillment pick-up points that we expect to see next year. 3) The tipping point is nigh where comp growth (better in eventual slowdown, maybe Q4) and cost control (aided by better pick-up) should flip WMT back to sustainable expense leverage. “

Bernstein downgraded Target to ‘market-perform’ from ‘outperform’

Bernstein downgraded the stock and said it thinks it is “less wise” that Target is stressing growth over cost containment.

“We have been a long-time bull on TGT. Usually on any unjustly deep pullback, we say buy more. We also have a history as essentially the only long on this in the dark days. However, after some reflection on the stock’s strong performance, the investor day message, and more recent chats with TGT leadership, our view has evolved. We think TGT’s continued emphasis on growth over cost containment (even as a message for internal consumption to keep optimism high) is a stance that we think is less wise at this point. We believe: 1) TGT has not tactically emphasized expense control to the degree we think is warranted as we near peak everything, 2) TGT’s strategic positioning is somewhere between Price & Convenience and Service & Assortment which makes them unique (not just like WMT), but less protected from disruption in our view, 3) TGT may be at the earnings stalemate point where cost pressures (i.e. wage rate, online margins) are overwhelming cost offsets (i.e. labor savings, supply chain). “

Jefferies upgraded Tilray to ‘hold’ from ‘underperform’

Jefferies upgraded the stock on valuation.

“While we remain cautious on Tilray‘s outlook, this now appears to be much better appreciated by the market, with the valuation now at more palatable levels (CY20 cons. EV/Sales at 13x vs. c.22x as at early March). Given this shift, we upgrade to Hold. PT lowered c7% to $57. “

Barclays upgraded Bristol-Myers Squibb to ‘overweight’ from ‘equal-weight’

Barclays said it has “increased confidence” in the closing of the deal with Celgene.

“We are upgrading shares of BMY to Overweight and raising our price target to $55 (from $53) on increased confidence in the proposed Celgene acquisition closing later this year on the back of last month’s favorable shareholder vote. Recognizing the apparent risks that come with the proposed deal (i.e., Revlimid erosion/IP risks; clinical and commercial risks from late-stage pipeline assets), we think the combined company is attractive near and longer term as it provides Bristol with the much-needed optionality—with what we’d characterize as a very strong and fairly de-risked pipeline from Celgene—and a dramatically differentiated growth profile looking to 2020/2021 (see Figure 1 for our pro forma assumptions; Barclays PF model/recent slide analysis HERE, 3/22/19). We wouldn’t be surprised to see the multiple expand by several turns as further de-risking catalysts play out over the course of the year (like data/regulatory submissions from JCAR017 and bb2121), but our bullish outlook is rooted in the successful launch trajectories of these late-stage assets, so we note that our outlook could be impacted if the assets ultimately underwhelm. “

MKM Partners downgraded Electronic Arts to ‘neutral’ from ‘buy’

MKM downgraded EA and said it doesn’t see enough “upside” to continue rating the game maker as a buy.

“We no longer see sufficient upside to justify a Buy rating. Looking at FY20, even though our EPS estimate is rising to $4.36 from $4.02, our outlook is below consensus of $4.51 and, management, in our view, is unlikely to issue initial guidance beyond $4.10-$4.20. Furthermore, we are less enthusiastic about the incremental drivers in FY20 than we were two to three months ago. Most notably, the initial success of Apex Legends in 4QFY19 likely created a head fake where early, upward revisions of FY20 Street forecasts may have been too much, too soon as player engagement has meaningfully declined in the last 10 weeks. Furthermore, in looking at other key FY20 drivers, our current view is less enthusiastic than three months ago as: (1) Anthem proved disappointing relative to forecasts and its impact should be minor; (2) Star Wars Jedi: Fallen Order appears to have no recurrent revenue spending potential; and (3) we project mobile will decline double digits. As a result of our higher FY20E EPS, our fair value estimate is now $100 (19x our FY20E EPS plus cash), up from our prior price target of $92. Based on our concerns and with just 6% upside potential from the current price level, we cannot justify a Buy rating and are therefore downgrading EA shares to Neutral. “

Deutsche Bank upgraded TripAdvisor to ‘buy’ from ‘hold’

Deutsche Bank said it expects TripAdvisor’s restaurant and attractions business to continue to grow.

“We upgrade TripAdvisor shares to Buy as we see a path for confidence in the medi-um term outlook to grow in the Hotel segment as the company (1) can grow CB&T advertising again in 2H19 and 2020 driven largely by mobile, (2) provides more granularity around the media strategy to expand ad units, (3) continues to show upside to Adj EBITDA and (4) introduces investors to new execs running Hotels and Core Experiences. “

Goldman Sachs downgraded Cigna to ‘buy’ from ‘conviction buy’

Goldman Sachs said Cigna has too much “uncertainty” around pharmacy benefit management fundamentals but it is still bullish on the stock.

“CI‘s first full quarter of ownership of Express Scripts exacerbated uncertainty around underlying PBM fundamentals in a year of lower branded drug price inflation and evolving competitive dynamics, reducing our conviction in the near-term path for earnings and the stock. “

RBC upgraded American Express to ‘sector perform’ from ‘underperform’

RBC said the company has a card network model that is “uniquely positioned.”

“We are assuming coverage of American Express with a Sector Perform rating and a $120 price target. We view the company as a very high quality core holding with a distinguished and uniquely positioned card network model that has proven it can generate sustained top of class returns. “