The worst earnings season in nearly three years is about to begin, but stock strategists say the market should be able to look right past declining profits and continue to reach for all-time highs, as long as trade talks between the U.S. and China continue to show progress.

Stocks were higher in the past week, on the prospect that the trade talks would ultimately lead to a deal that could end punitive tariffs and boost earnings growth. The S&P 500 was up more than 1.9% for the week and is just about 1.5% from its closing high of 2,930, reached in September.

Among the first major companies to report are J.P. Morgan Chase and Wells Fargo, both on Friday. In addition to earnings, investors will be watching for minutes from the last Fed meeting Wednesday; CPI inflation data Wednesday and any headlines on trade or the U.K.’s ‘Brexit’ from the European Union.

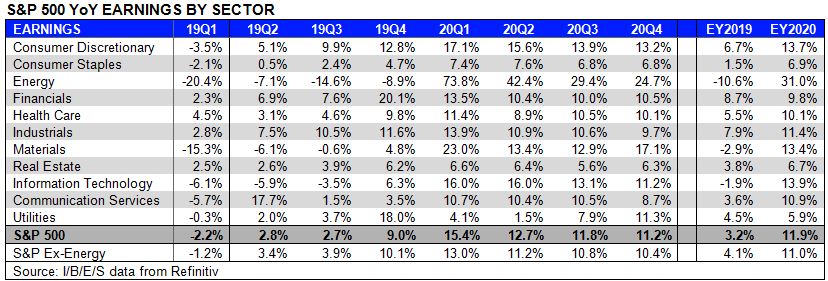

As for earnings, Refinitiv expects a 2.2% decline in first quarter profits for the S&P 500 companies, but those lower results are expected to be the trough. Earnings growth is expected to rebound to 2.8% in the second quarter and by as much as 9% in the fourth quarter. The first quarter decline would be the first negative earnings period since the second quarter of 2016.

“The second, third and fourth quarter will show a rebound.That’s supportive of higher equity prices,” said Ed Keon, chief investment strategist at QMA. “I was thinking I’d like to see a record for the whole year, and it looks like we might do better than that.”

Keon said there are risks, including whether there really is a trade deal with China over the next couple of weeks and whether China’s economy is really bottoming. “Is the success of China’s stimulus gong to to continue and spread to other countries? To me, the picture is much brighter than it was a couple months ago,” he said.

Strategists said any number of factors could be the catalyst to push stocks to records, including earnings season, if companies beat lowered guidance and their outlooks are good. Stocks could also ride higher on a better outlook for the U.S. economy, after a batch of better data including Friday’s March jobs report.

“I think maybe we end up getting to a new high sometime early in the second quarter, and then maybe we do some sideways moving in that ‘sell in May’ period,” said Sam Stovall, chief investment strategist at CFRA. “I think we confirm that 10th anniversary of this bull market by hitting a new all-time high. Then we digest some of those gains and move sideways for a bit and let some of those earnings catch up, and then maybe there’s a yearend advance.”

Also in the week ahead, investors are watching for the minutes from the Fed’s last meeting, released Wednesday afternoon. At that meeting, the Fed released revised forecasts, with no rate hikes now expected in 2019 and a slower growth outlook. The minutes should also show what Fed officials were considering when they decided to end the program to roll down their balance sheet, and bond traders are looking for clues on which type of Treasurys the Fed will hold in its balance sheet.

On the data front, there are CPI consumer inflation data Wednesday and producer price inflation on Thursday. Both of these indexes should be closely watched since wage gains were muted in Friday’s March jobs report, and strategists said they see no sign of inflation on the horizon. The Fed also sees below trend inflation, so any unexpected change would be important.

The U.K.’s effort to leave the European Union will continue to make headlines in the week ahead. The European Union Council meets Wednesday, and will consider the U.K.’s request to extend the Brexit deadline, originally this coming Friday.

“It could go in any number of directions. The thing we’ve been telling people is if it’s a messy, hard Brexit, the big difference between now and three years ago is you’d get a big chunk of that safe haven flow into U.S. dollars,” said Michael Schumacher, director, rate strategy at Wells Fargo. Schumacher said investors would be more inclined to move into the short end of the Treasury curve, rather than into German bunds, which have negative yields.

Monday

10:00 a.m. Factory orders

Tuesday

Earnings: Shaw Communications, PriceSmart, Levi Strauss, WD-40

6:00 a.m. NFIB survey

9:30 a.m. Fed Vice Chair Richard Clarida

10:00 a.m. JOLTS 1:00 p.m. 3-year auction

5:00 p.m. Fed Vice Chair Randal Quarles

Wednesday

Earnings: Delta Airlines, MSC Industrial, Bed Bath and Beyond

8:30 a.m. CPI

10:00 a.m. Wholesale trade

11:50 a.m. Fed’s Quarles

1:00 p.m. 10-year auction

2:00 p.m. Federal budget

2:00 p.m. FOMC minutes

Thursday

Earnings: Fastenal, Apogee, Rite Aid

8:30 a.m. Initial claims

8:30 a.m. PPI 1:00 p.m. 30-year auction

9:30 a.m. Fed’s Clarida

9:35 a.m. New York Fed John Williams

9:40 a.m. Kansas City Fed President James Bullard

2:00 p.m. Minneapolis Fed President Neel Kashkari Twitter Q&A

4:00 p.m. Fed Governor Michelle Bowman

Friday

Earnings: JPMorgan Chase, Wells Fargo, First Republic Bank, Infosys, PNC

8:30 a.m. Import prices

10:00 a.m. Consumer sentiment