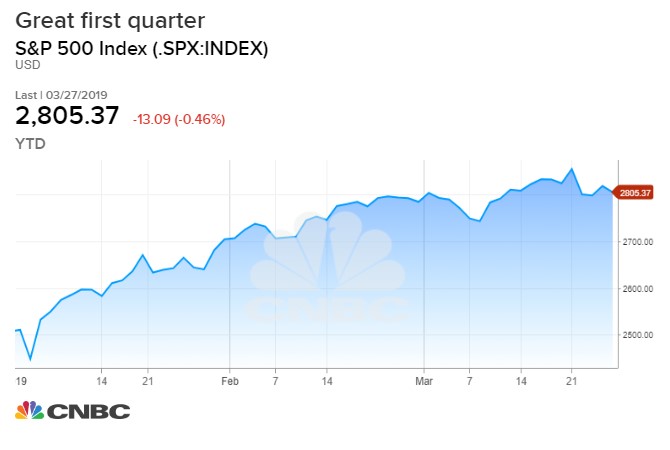

We are ending the first quarter on a note of modest anxiety over lower Treasury yields, but investors should be very happy with their investment portfolios.

It’s not just that the S&P 500, up 11.9 percent, is having its best quarter since 2012. Everything is up, and I mean everything, including stocks and bonds. The S&P Midcap 400 index is up about 12 percent, and the small cap Russell 2000 is up 12.9 percent

The gains are broadly based. Technology stocks are the biggest gainers, up 17 percent, but energy stocks also were strong as oil rallied from $42 at the end of December to nearly $60. Industrial stocks, which were dramatically oversold at the end of the fourth quarter on global growth concerns, snapped back as well, up 15 percent.

Overall, 90 percent of the S&P is up on the quarter even as fears of an inverted yield curve, a reliable recession indicator, have crept up here near the end of the period.

What’s more, bond portfolios have also gained. Exchange-traded funds for high-yield bonds, corporate bonds and Treasurys are all up, not including dividends. The iShares High Yield (HYG) fund is up 6.1 percent; the iShares Corporate (LQD) is up 5.3 percent and the iShares 7-10 Year Treasury (IEF) is up 2.2 percent.

What’s it all mean? Let’s look at a typical ETF portfolio, which has a mix of 60 percent stocks and 40 percent bonds in it, broken down by weighting this way:

- S&P 500 ETF (SPY) 30 percent (stocks)

- Russell 2000 ETF (IWM) 30 percent (stocks)

- iShares High Yield (HYG) 10 percent (bonds)

- iShares Corporate (LQD) 15 percent (bonds)

- iShares 7-10 Year Treasury (IEF) 15 percent (bonds)

With this breakdown, an investor with a $100,000 portfolio on Jan. 1 would have a value of roughly $109,000 as of Wednesday. That’s an overall 9 percent gain, without the dividend appreciation.

Not bad for three months work.