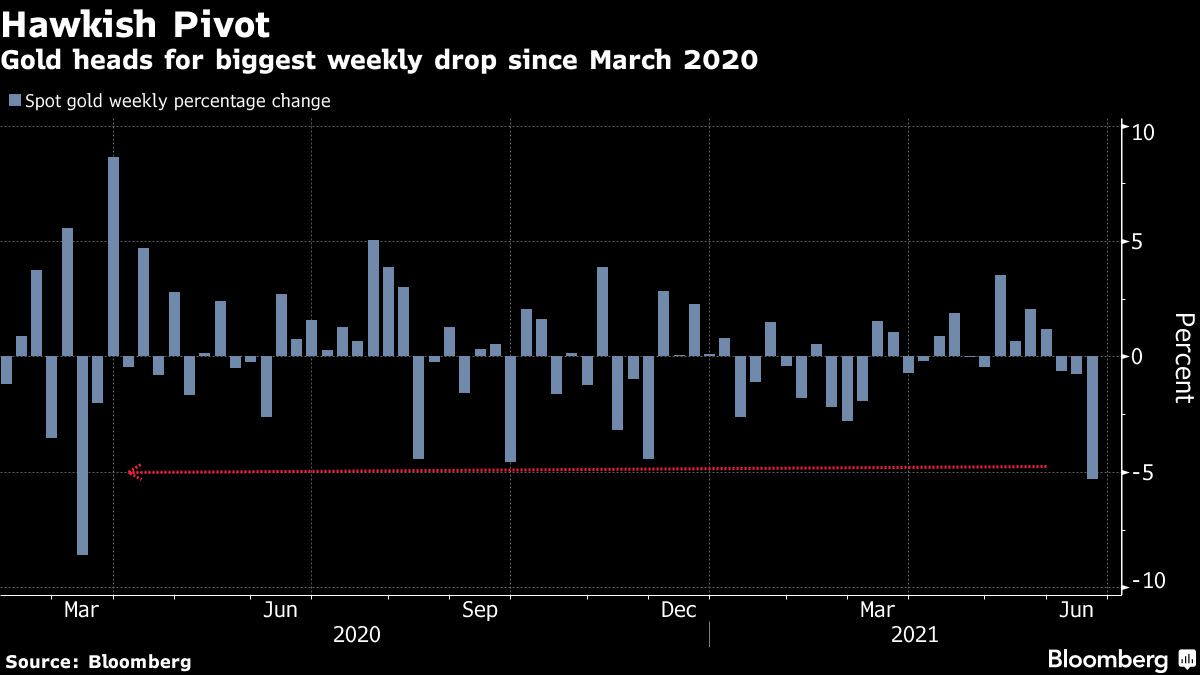

(Bloomberg) — Gold headed for the biggest weekly loss in 15 months as the Federal Reserve’s hawkish tilt sent the dollar surging.

Officials signaled monetary policy tightening could start earlier than expected, with Chair Jerome Powell saying that the central bank would begin a discussion about scaling back bond purchases used to support financial markets and the economy during the pandemic. Still, Powell cautioned that discussions about raising interest rates would be “highly premature.”

Bullion is steadying near the lowest level in six weeks as investors now debate the timing of when the Fed is likely to start trimming its bond purchases. The surprisingly hawkish shift of bringing forward the start of rate hikes puts the central bank on course to formally announce tapering at their September gathering and begin to slow its $120 billion in monthly bond buying in November, according to economists at Barclays Plc.

“The taper tantrum trade is hitting gold the hardest right now and could last a couple more sessions,” said Edward Moya, a senior market analyst at Oanda Corp. “Gold looks like a falling knife but eventually the longer-term prospects will attract buyers. Long-term bets on gold could start to emerge closer to the $1,750 level, but some might wait and see if one last thrust lower eyes the $1,675 level. ”

Spot gold rose 0.6% to $1,784.88 an ounce at 12:35 p.m. in Singapore, after tumbling to $1,767.34 on Thursday, the lowest since May 3. Prices are down 4.9% this week, the most since March 2020. Silver, palladium and platinum all advanced. The Bloomberg Dollar Spot Index slipped 0.1% to pare this week’s gain to 1.6%.

More stories like this are available on bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

©2021 Bloomberg L.P.