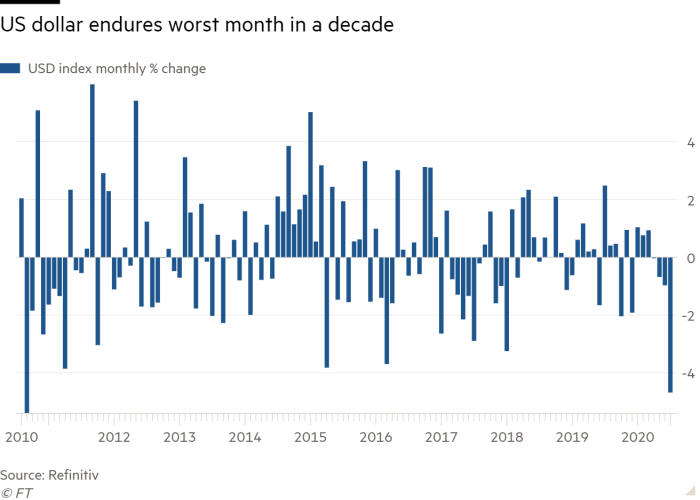

The US dollar has tumbled the most in a decade this month, propelling sterling and the euro higher, on questions over the recovery of the world’s biggest economy and growing political uncertainty.

The greenback weakened 0.2 per cent against a basket of its trading peers by late morning on Friday in Europe. The greenback has shed 4.7 per cent in July, its worst monthly sell-off since September 2010.

Other currencies made gains as the dollar slipped. The euro rose 0.1 per cent against the US currency to $1.1856, its highest level in two years, while the pound gained 0.3 per cent to trade above $1.31. Japan’s yen rose 0.1 per cent to ¥104.6 a dollar, a more than four-month high.

“The dollar sell-off remains relentless,” said Lee Hardman, currency analyst at MUFG.

The dollar’s tumble has intensified this week with traders anxious over the economic recovery in the US, after a historic fall in output this spring, as large swaths of the country contend with serious coronavirus outbreaks.

Early signs of improvement in other portions of the global economy along with US “political considerations” could place further pressure on the buck, said Allison Nathan, a strategist at Goldman Sachs.

Supriya Menon, multi-asset strategist at Pictet Asset Management, added that the narrowing gap between interest rates — and potentially economic growth rates too — in the US and the rest of the world has contributed to the dollar’s declines.

“There are other short-term factors weighing on the dollar. The US election is one. The worsening infection rates are another,” she said.

The yield on US 10-year Treasuries slipped slightly to just below 0.53 per cent, leaving it trading near all-time lows. Analysts at Tradeweb noted that the entire US Treasury yield curve is now close to being below 1 per cent.

Analysts and investors have said the decline in Treasury yields, which signals a rise in prices, has come as a result of a subdued outlook for the economy and expectations for further stimulus from the Federal Reserve.

Futures markets tipped the US benchmark S&P 500 stock index to climb 0.2 per cent when trading begins later on Friday. Futures tracking the tech-heavy Nasdaq 100 index climbed almost 1 per cent after Amazon, Apple and Facebook posted blowout quarterly results after Thursday’s closing bell.

Gold pushed towards $2,000 per troy ounce, adding 1.5 per cent at $1,970. It has risen 11 per cent in July as investors have been faced with negative returns, when adjusted for inflation, on other haven assets such as Treasuries and German and Japanese government debt.

European equities recorded muted gains on Friday with the continent-wide Euro Stoxx 600 rising 0.4 per cent and London’s FTSE 100 flat.

In Asia-Pacific, Japan’s benchmark Topix index fell 2.8 per cent while Australia’s S&P/ASX 200 dropped 2 per cent.

The CSI 300 index of Shanghai and Shenzhen-listed stocks closed 0.8 per cent higher. Hong Kong’s Hang Seng slipped 0.5 per cent.

On Friday, official data showed that Chinese factory activity quickened in July, marking the fifth straight month of expansion. However, analysts cautioned that China’s economic recovery from Covid-19 could soon lose momentum.

“The current rapid pace of recovery is likely to slow in the coming months as the initial boost from reopening businesses fades,” said Julian Evans-Pritchard, senior China economist at Capital Economics.

Oil prices edged higher after a sell-off prompted by fears that demand for crude could be weakening. Brent, the international benchmark, rose 0.5 per cent to $43.14 per barrel, while West Texas Intermediate, the US marker, rose by a similar degree to just above $40.