Municipals outperformed moves in U.S. Treasuries Thursday, playing catch up to taxables’ massive flight-to-safety rally that hit Wednesday, while equities ended in the black.

Municipal triple-A yield curves saw up to 10 basis point bumps on the long end while UST saw yields fall four to eight basis points.

Muni-UST ratios on Thursday were at 72% in five years, 91% in 10 years and 102% in 30, according to Refinitiv MMD’s 3 p.m. read. ICE Data Services had the five at 73%, the 10 at 91% and the 30 at 101% at a 4 p.m. read.

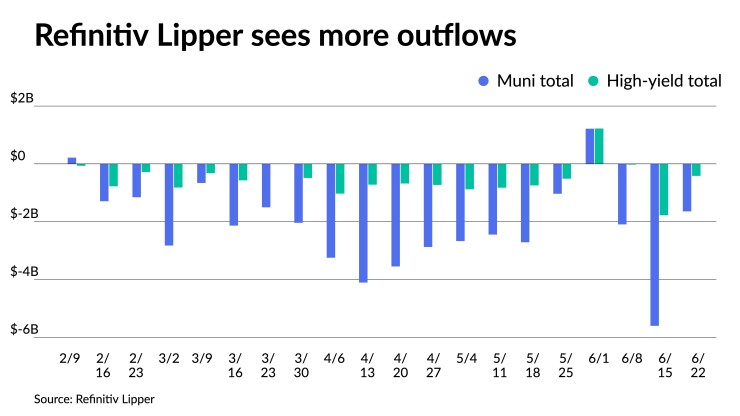

Investors pulled more from municipal bond mutual funds, with Refinitiv Lipper reporting $1.6 billion of outflows, down from the $5.6 billion the week prior and brings the total to $45.7 billion year-to-date.

High-yield saw $415.840 million of outflows after $1.777 billion of outflows the week prior. Exchange-traded funds saw inflows to the tune of $421.720 million.

In the primary Thursday, Citigroup Global Markets priced for Los Angeles, California, $1.572 billion of 2022 tax and revenue anticipation notes, serial 2023, with 4s of 6/2023 at 2.375%, noncall.

Barclays Capital priced for the Fred Hutchinson Cancer Center, Washington, (A2//A+/) is set to price Thursday $300 million of taxable corporate CUSIPs, Series 2022, with 4.966s of 1/2052 at par, make whole call.

Piper Sandler & Co. priced and repriced for the Rockwall Independent School District, Texas, (Aaa/AAA//) $106.555 million of unlimited tax school building bonds, Series 2022A, with 5s of 2/2023 at 1.66% (unch), 5s of 2032 at 3.22% (unch), 5s of 2037 at 3.52% (unch), 5s of 2042 at 3.59% (-5), 5s of 2047 at 3.67% (-8) and 5s of 2052 at 3.72% (-8), callable in 2/15/2031.

In the competitive, Nassau County, New York, sold $254.690 million of general obligations general improvement bonds, 2022 Series A, to Jefferies, with 5s of 4/2024 at 2.11%, 5s of 2027 at 2.50%, 5s of 2032 at 3.13%, 5s of 2037 at 3.52%, 4s of 2042 at 4.26%, 4.125s of 2047 at 4.35% and 4.25s of 2052 at 4.40%, callable in 4/1/2032.

“In what has become a very usual risk-on/risk-off trade,”the market has been drawing support from stronger USTs, said senior vice president at FHN Financial.

One of the catalysts to move municipal yields lower came from the well-received Georgia general obligation bonds.

Oftentimes, Olsan said, “high-grade state GO sales can influence the muni curve as potential buyers assess market direction.”

“Maturities due inside 10 years came flat or though implied AAA spots, while longer 4s were purchased with spreads ranging +36-45/AAA,” she said.

Georgia’s sale in early June 2021 “resulted in a month-end yield curve that was unchanged to slightly firmer in longer maturities,” she said.

When Maryland GOs sold two weeks ago, Olsan noted, “market tone subsequently turned bearish.” This is “similar to results of the state’s last two sales as the major spot levels have sold off 30-40 basis points since June 8,” she said.

Additional high-grade issues priced close to triple-A spots — “both Aaa/AAA Charleston SC Water/Sewers and Aa1/AAA Southern CA Metro Waters priced 10-year maturities spread nominally to the benchmark — a function of a quality (of rating) over quantity (of yield) move,” she noted.

Large muni fund outflows continue to be a problem, though, she noted. The Investment Company Institute $6.2 billion in outflows in the latest week and “potentially pressuring a $100 billion outflow number this year,” she said.

Per ICI’s data, there’s been an aggregate loss of $81.2 billion in muni fund assets year-to-date, which equals nearly three months of issuance, Olsan noted.

“That dynamic faces the final week of the quarter which is setting up to be active with numerous large deals slated to price,” she said.

Secondary trading

Maryland 5s of 2023 at 1.57%-1.56%. Georgia 5s of 2023 at 1.69% and 1.65%. Frederick County, Maryland, 5s of 2024 at 2.06%.

Georgia 5s of 2025 at 2.13%. Prince George’s County, Maryland, 5s of 2027 at 2.13%. Georgia 5s of 2027 at 2.36%-2.35% versus 2.38% Wednesday.

Boston 5s of 2030 at 2.70% versus 2.73% Wednesday. Maryland 5s of 2032 at 2.91%. Maryland 5s of 2034 at 3.06%-2.95% versus 3.19% a week ago.

Maryland 5s of 2037 at 3.16%-3.15%. California 5s of 2042 at 3.56% versus 3.64% Wednesday.

Los Angeles DWP 5s of 2046 at 3.72%-3.70%. New York City 5s of 2047 4.02%-4.01% versus 4.16%-4.11% Wednesday.

Los Angeles DWP 5s of 2051 at 3.78%-3.74%. NYC waters 5s of 2052 at 3.91%-3.86%.

AAA scales

Refinitiv MMD’s scale was bumped six to 10 basis points at the 3 p.m. read: the one-year at 1.63% (-5) and 1.97% (-5) in two years. The five-year at 2.26% (-7), the 10-year at 2.79% (-9) and the 30-year at 3.25% (-10).

The ICE municipal yield curve was bumped four to five basis points: 1.67% (-4) in 2023 and 1.99% (-4) in 2024. The five-year at 2.33% (-5), the 10-year was at 2.77% (-4) and the 30-year yield was at 3.26% (-5) at a 4 p.m. read.

The IHS Markit municipal curve was bumped nine basis points: 1.63% (-9) in 2023 and 1.97% in 2024 (-9). The five-year at 2.24% (-9), the 10-year was at 2.80% (-9) and the 30-year yield was at 3.26% (-9) at 4 p.m.

Bloomberg BVAL was bumped five to eight basis points: 1.67% (-6) in 2023 and 1.96% (-5) in 2024. The five-year at 2.28% (-7), the 10-year at 2.79% (-7) and the 30-year at 3.26% (-8) at a 4 p.m. read.

Treasuries were stronger.

The two-year UST was yielding 3.021% (-4), the three-year was at 3.126% (-7), the five-year at 3.148% (-7), the seven-year 3.159% (-8), the 10-year yielding 3.090% (-7), the 20-year at 3.461% (-4) and the 30-year Treasury was yielding 3.202% (-5) at 4 p.m.

Mutual fund details

In the week ended June 22, Refinitiv Lipper reported $1.644 billion of outflows Thursday, following an outflow of $5.602 billion the previous week.

Exchange-traded muni funds reported inflows of $421.720 million after outflows of $1.002 billion in the previous week. Ex-ETFs, muni funds saw outflows of $2.066 billion after $4.599 billion of outflows in the prior week.

The four-week moving average widened to negative $2.031 billion from negative $1.879 in the previous week.

Long-term muni bond funds had outflows of $1.068 billion in the last week after outflows of $4.986 billion in the previous week. Intermediate-term funds had outflows of $293.205 million after $286.249 million of outflows in the prior week.

National funds had outflows of $1.297 billion after $5.108 billion of outflows the previous week while high-yield muni funds reported $415.840 million of outflows after $1.777 billion of outflows the week prior.