claffra/iStock via Getty Images

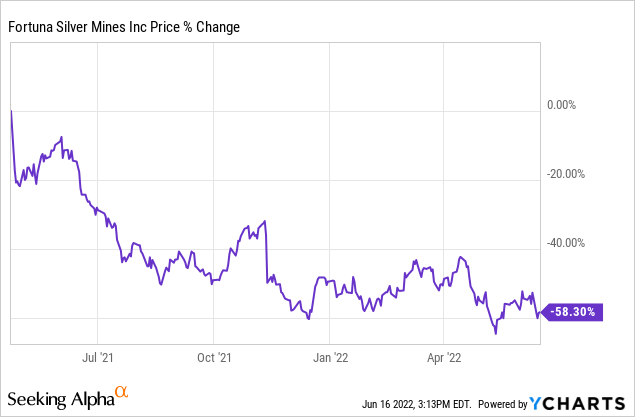

Fortuna Silver (NYSE:FSM) is down 58% since the company announced the acquisition of Roxgold back in April of 2021. Investors immediately sold FSM after the transaction was announced due to displeasure with the price paid and the increased jurisdictional risk (Roxgold’s assets are in West Africa). However, that’s not all that’s contributed to the decline in FSM over the last year. Uncertainty surrounding its San Jose Mine in Mexico and general selling pressure in the sector have greatly added to the losses.

I believe FSM is oversold and in a good position for a substantial reversal over the next 12-18 months-with or without the help of rising gold and silver price. A few things, though, need to happen.

In this article, I will explain.

Mines And Projects

First, I want to give a brief overview of the company’s mines and projects, especially for those investors that might not be familiar with this story.

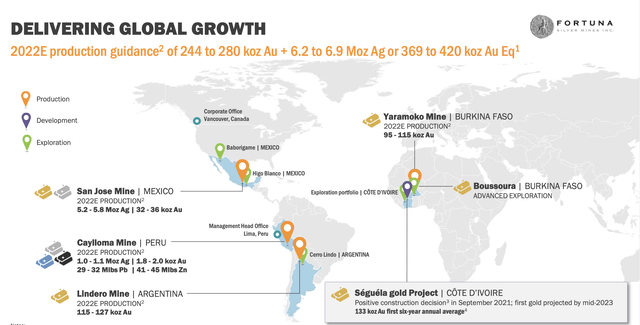

One bullish aspect of FSM is its diversification. The company owns four producing mines in four different countries and is entering a new country with its fifth mine in development. When assets are spread out across many mines and regions, it greatly lowers the operational and jurisdictional risks. What’s also appealing about Fortuna is that it gives investors exposure/leverage to both gold and silver, and there is some base metal production in there as a kicker.

The new Lindero gold mine in Argentina is performing much better after the construction delay and slow ramp-up in 2020 due to Covid-19. 2022 production from the mine is estimated at 115,000-127,000 ounces of gold at an AISC of $900-$1,100 per ounce. Lindero produced ~104,000 ounces last year at an AISC of $1,116 per ounce. The Caylloma mine in Peru is a small-scale polymetallic operation that had only three years of mine life remaining, but a healthy increase in reserves at the end of 2021-thanks to successful exploration-extended the life of mine to six years. San Jose in Mexico is a solid, relatively low-cost silver and gold mine. And rounding out the group is the Yaramoko mine in Burkina Faso, which currently produces ~100,000 ounces of gold and came into the portfolio via the Roxgold merger. One of the main reasons to own FSM is the other former Roxgold asset, known as Séguéla. The Séguéla gold mine in Côte d’Ivoire will be Fortuna’s flagship mine once it’s in production next year. If I had to rank in order of importance, Séguéla is at the top of the list, San Jose and Lindero are tied for second, Yaramoko is fourth, and Caylloma is fifth.

Fortuna Silver

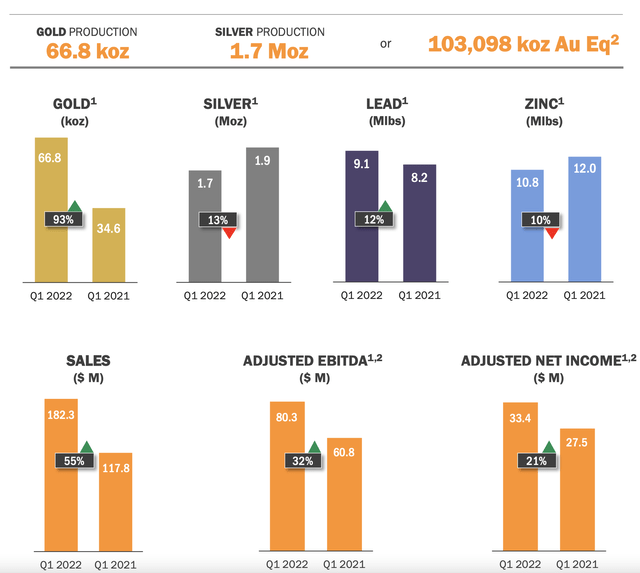

Fortuna announced strong Q1 operational and financial results a few months ago from its producing operations, “with all mines on target to achieve annual guidance for silver and gold.” The increased gold production is because of the inclusion of the Yaramoko mine and the ramp-up at Lindero. Silver output dropped due to sequencing and mining of lower grade stopes at San Jose. The key financial metrics-revenue, EBITDA, net income-all jumped year-over-year thanks to the almost doubling of gold production.

Fortuna Silver

Séguéla – A Major Bullish Catalyst Next Year

As of the end of Q1 2022, construction activities at Séguéla were progressing on time and on budget (with the SAG mill delivery on schedule), and overall construction was 48% complete at the end of March.

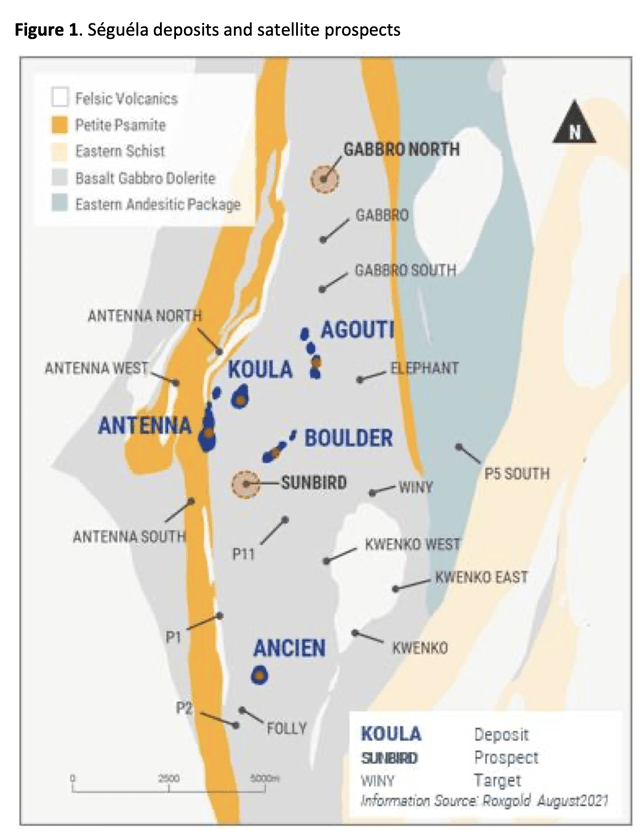

While Séguéla isn’t a large-scale mine, the quality of the deposit sets it apart from other mines/projects in West Africa and Fortuna’s portfolio. There are just over 1 million ounces of near-surface, ultra-high grade (2.8 g/t) reserves at Séguéla, and it will add 133,000 ounces of gold production per year at an AISC of under $800 per ounce during the first six years of production.

That is only a starting point.

Discoveries are being made left and right at the project. Take, for instance, Sunbird, which last year was just a prospect, and now contains 350,000 ounces of open-pit Inferred resources at a grade of 3.16 g/t. Sunbird is close to the plant and main Antenna and Koula pits. The currently-defined deposits are open at depth and along strike, and there are numerous other prospects within a few km of the planned pits.

Fortuna Silver

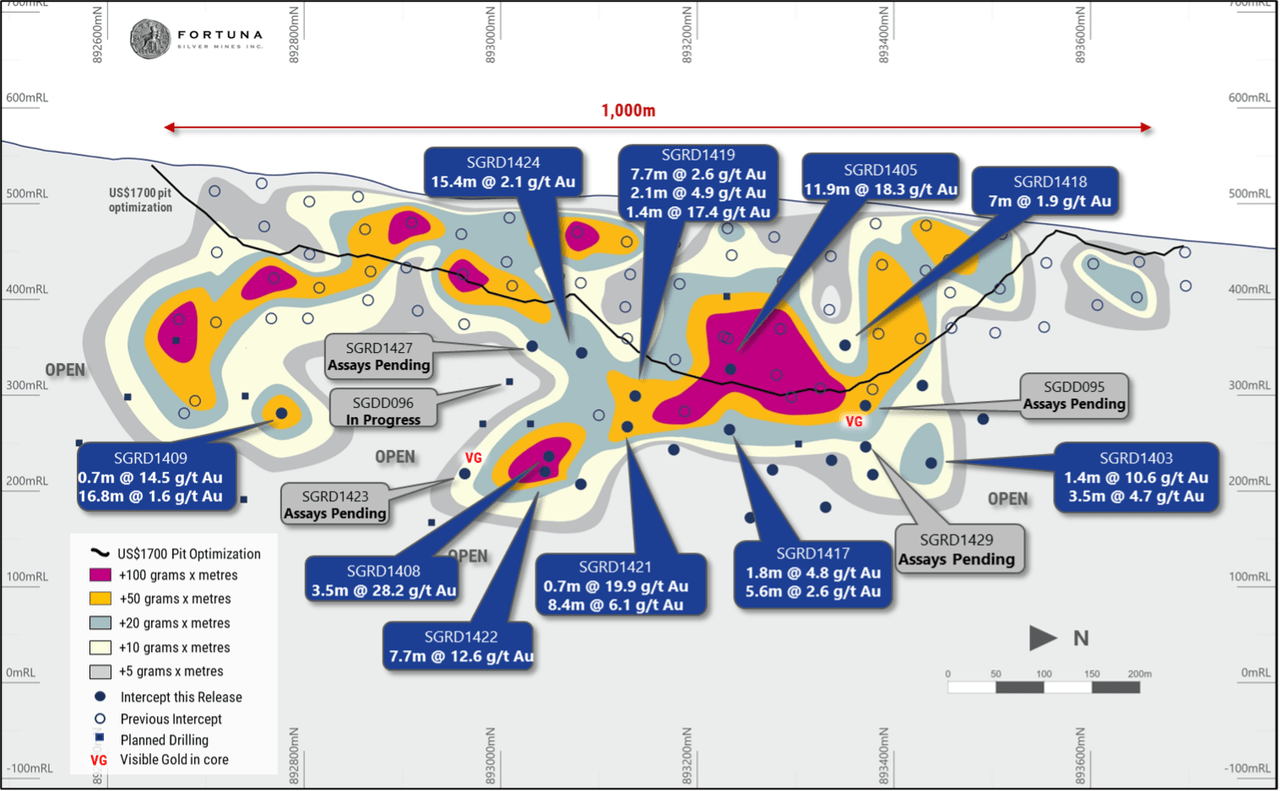

Recent expansion drilling at Sunbird shows the upside potential, as Fortuna intersected high-grade gold 100 meters beyond the current pit shell in what is interpreted as continuation of the core high-grade mineralization. Results included drill hole SGRD1408 which intersected 28.2 g/t gold over an estimated true width of 3.5 meters and drill hole SGRD1422 which hit 12.6 g/t gold over an estimated true width of 7.7 meters. Drill hole SGRD1423, which is a further extension of these other two drill holes, “intersected several points of visible gold a further 100 meters down plunge.” Assays are pending for SGRD1423. Other drill holes such as SGRD1405 (18.3 g/t gold over an estimated true width of 11.9 meters) confirmed the central high-grade core within the Inferred resource pit shell.

Fortuna Silver

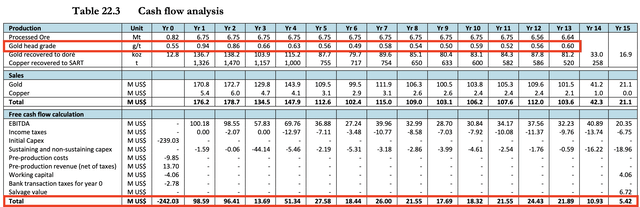

Séguéla is expected to enter production in mid-2023, so a little more than a year before this bullish catalyst will impact the stock. The timing is good, as Lindero is mining well above the reserve grade during the first few years of the mine plan. According to the technical report, Lindero will see a sharp drop in grade and cash flow in year 3. As a side note, the cash flow analysis in the table below only uses a gold price of $1,250. At current gold prices, the cash flow will be far greater than shown. Lindero has been in production for a little over a year and a half, but it had a slow ramp-up, so it’s unclear if 2023 production guidance will reflect the lower grade or if the impact will be felt in 2024. Either way, Séguéla will more than fill the gap, and Lindero will still be generating robust free cash flow at $1,800+ gold.

Fortuna Silver

If Fortuna can deliver on Séguéla and the mine ramps up as planned, FSM will be aggressively re-rated because it’s not close to fully valued in the portfolio. That’s just based on reserves as well.

Between now and then, there are other potential bullish catalysts.

Issues At San Jose That, If Resolved, Will Result In A Further Re-Rating

Issue #1

Last November, FSM crashed by 25%+ as SEMARNAT (Mexico’s environment ministry) didn’t renew the mining license for the San Jose mine.

In December 2021, SEMARNAT reversed that decision and granted a 12 year extension of the EIA, with Fortuna stating: After continued dialogue and technical evaluation, SEMARNAT confirmed operations at the San Jose Mine are conducted in accordance with all environmental obligations under the EIA. Following confirmation of compliance, SEMARNAT reassessed Fortuna’s application and granted the extension on the existing EIA terms.”

However, in early February 2022 (not even two months later), Fortuna disclosed that it was advised that SEMARNAT had made a typographical error in the extension to the term of the environmental impact authorization for the San Jose mine, and the correct term is two years, not twelve.

What’s incredibly odd about this situation, and as Fortuna explained, is the company:

- Explicitly applied for a 12 year extension which SEMARNAT explicitly granted. The term of 12 years is referred to repeatedly in all documentation related to the filing of the application for the extension. No other period of time was contemplated in the documentation or in communication with SEMARNAT.

- Received legal advice that SEMARNAT is not legally able to argue a typographical error in order to amend the term of an EIA that has been extended by the authority, and which extension is consistent both with the application for the extension and the actual EIA Extension document. The document that SEMARNAT issued which evidences the EIA Extension refers to a 12 year extension several times throughout the document in different contexts.

To this day, FSM has failed to get even close to the level it was trading in early November 2021, before the company was informed that the San Jose mining license wouldn’t be renewed.

Fortuna is trying to settle the matter in court to receive the initially granted 12 year extension.

It seems that Fortuna has a strong case, especially after SEMARNAT confirmed that San Jose is abiding by all environmental obligations under the EIA.

As long as the mine isn’t shut down in the short-term, that’s all that matters as it continues to generate cash flow for Fortuna, even though it’s not reflected in the share price. Kicking the can down the road for two years (if that’s how it plays out) and generating cash flow through 2023 is a dramatically better result than what was first feared. Substantial cash can be harvested during that time.

If Fortuna can also resolve the issue with SEMARNAT this year and confirm the 12 year extension, it will take pressure off the stock. Even if the company is successful, they need to work on rebuilding the complex community relations. San Jose is an important economic driver of the local community and has lots of support, but there are many groups that oppose the mine as well. Mining companies and communities should work hand-in-hand for the benefit of all. It’s unrealistic to assume that all minds/opinions can be changed, but Fortuna needs to go above and beyond when it comes to community relationships, environmental responsibilities, and being good stewards of the land they are allowed to mine.

Issue #2

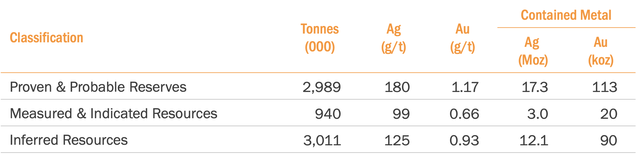

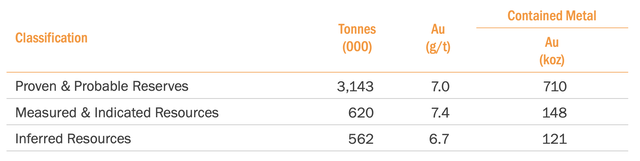

As of the end of 2021, San Jose’s reserves were 17.3 million ounces of silver and 113,000 ounces of gold, a decrease of ~25 percent YoY. Grade dropped as well. As it is now, the mine only has three years of reserves remaining. I believe this has also weighed on shares of FSM.

2021:

Fortuna Silver

2020:

Fortuna Silver

I can’t help but point out the illogicality of the situation. Punishing the stock because of the uncertainty with the length of the mining license extension, yet also using the 3 year reserve life as a reason to re-rate lower.

Like many underground mines, the reserve life is short at San Jose, as it’s cheaper and easier to drill when you are chasing the veins. Often underground mines operate with only 5-7 years of reserves yet continually replenish those ounces.

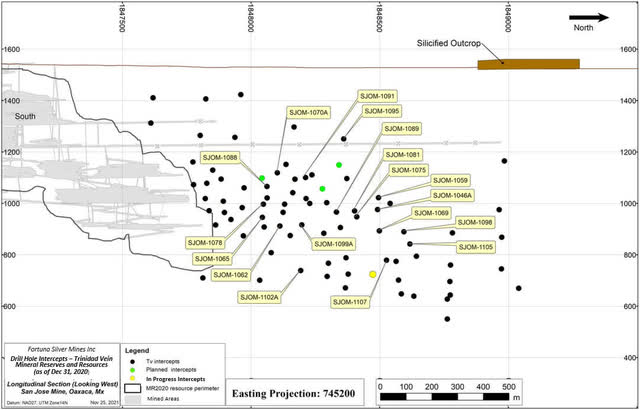

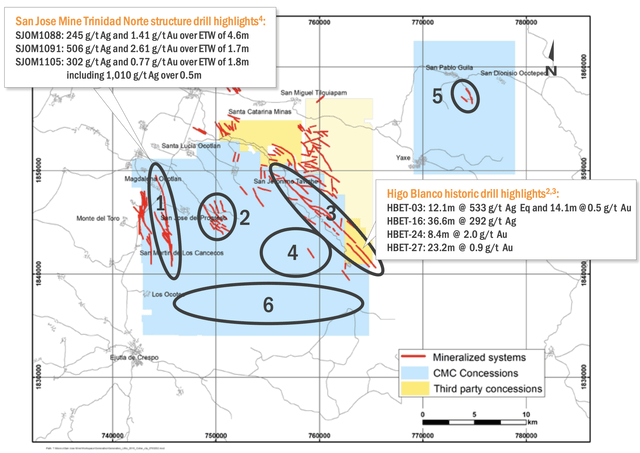

Recent step-out exploration drilling shows the potential to increase the reserves and mine life of San Jose.

If we focus on Trinidad Norte, drilling adjacent to mined-out areas has intersected above-reserve-grade mineralization. The current reserve grade at San Jose is 180 g/t Ag and 1.17 g/t Au. Hole SJOM1088 intersected 245 g/t Ag and 1.41 g/t Au over an estimated true width of 4.6 meters, SJOM1091 hit 506 g/t Ag and 2.61 g/t Au over an estimated true width of 1.7 meters, and SJOM1105 drilled 302 g/t Ag and 0.77 g/t Au over an estimated true width of 1.8 meters including 1,010 g/t Ag over 0.5 meters.

Fortuna Silver

Figure 4: Trinidad Norte long-section looking west showing recent drilling results

That’s just the low-hanging fruit. There are extensive vein systems throughout Fortuna’s land package. I believe that San Jose will be in production for much longer than three years, but I will admit that Fortuna is cutting it too close. They need more breathing room-at least 5-6 years. If they can show mine life extension in the end-of-2022 reserve estimate and at least hold the grade, the stock should command a higher valuation.

Fortuna Silver

Many bearish assumptions are priced into San Jose, which means a reversal in valuation will occur should the outlook be brighter than anticipated. I don’t think Fortuna first needs clarity from SEMARNAT to get that re-rating. If they can deliver on guidance for the mine and add to reserves, that should be enough to alleviate some of the pressure on the stock.

Yaramoko – Disappointing Mine Life Outlook And Reserves

While I’m constructive on the outlook for San Jose, recent developments at Yaramoko are more concerning. Or, maybe I should say, appear much more challenging to overcome.

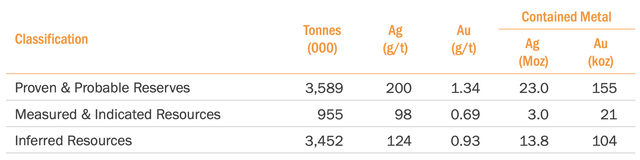

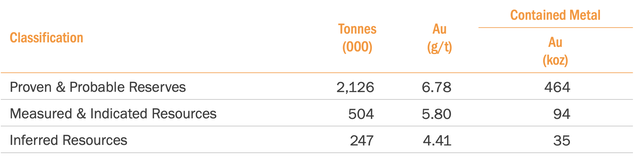

Gold reserves at Yaramoko dropped almost 250,000 ounces from June 2020 to the end of 2021. There are only 464,000 ounces of Au reserves remaining and a paltry amount of M&I and Inferred resources.

2021:

Fortuna Silver

June 2020:

Fortuna Silver

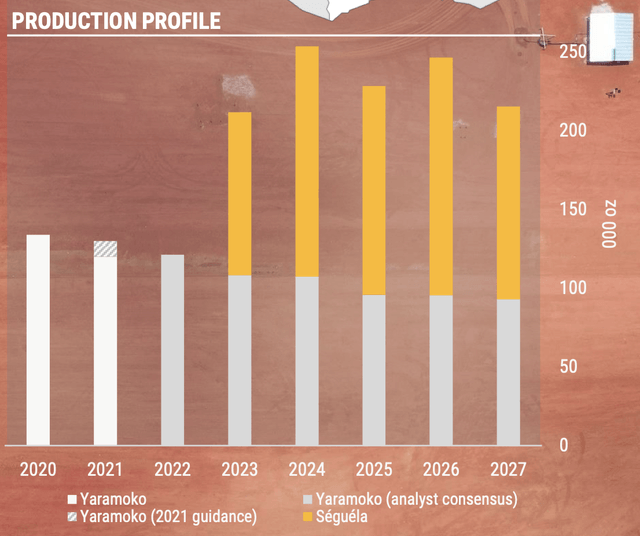

Yaramoko was expected to be a steady 90,000-100,000 ounce mine through 2027. Or at least that’s what was being sold to investors when Fortuna purchased Roxgold.

Fortuna Silver

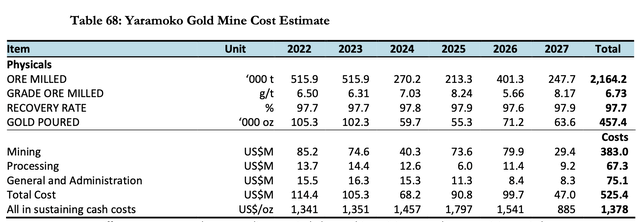

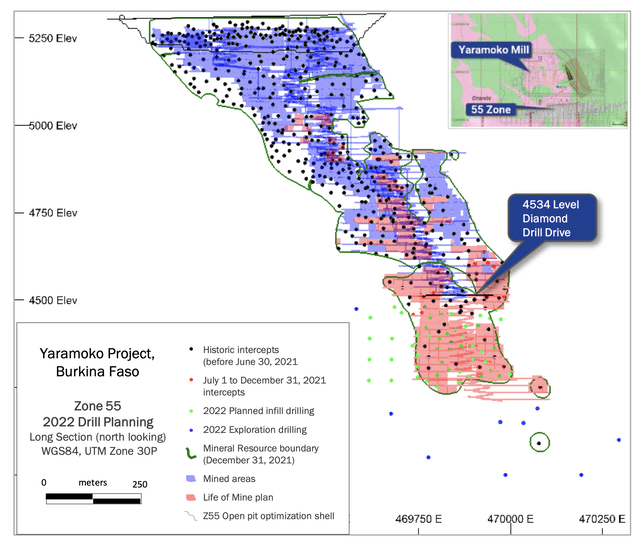

An updated technical study released several months ago paints a much different picture. Now the mine is only expected to produce ~100,000 ounces through 2023, and then production will drop to ~60,000 ounces. This is due to the transition from the underground mine to the 55 Zone open pit, and will require existing infrastructure to be relocated or decommissioned in advance. As the technical report states: “the footprint of 55 Zone open pit is directly where current underground infrastructure of vent fans, refrigeration plant and surface water settlers are located. To reduce the transition time between underground and open pit mining, pit design has been completed to be mined over two stages, with stage 1 commencing in the southwest, which provides the opportunity for decommission and relocation to be completed in parallel with mining.” I question the viability of the mine plan, especially considering the AISC from 2024-2026, and over the LOM for that matter.

Fortuna Silver

There is exploration drilling planned at depth in the 55 Zone this year. Depending on the results, there could be an optimized mine plan.

Fortuna Silver

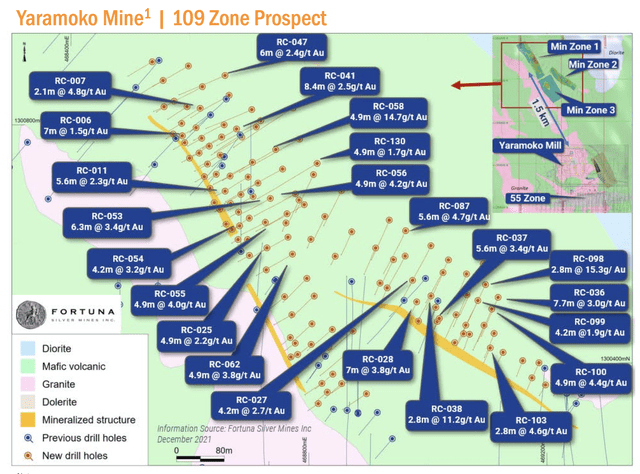

There is also the 109 Zone open-pit prospect that is 1.5 km from the Yaramoko mill. Drill results show high-grade intercepts across the entire length of the mineralized structures.

Fortuna Silver

Yaramoko isn’t central to the story, but I still believe that Fortuna needs to come up with a better mine plan for this operation. What’s occurring with Yaramoko is the main negative of the Fortuna story, but it’s certainly not a bearish enough development to warrant the current low valuation.

Valuation Of FSM

Fortuna has a market cap of US$935 million, which by the way, is almost the price it paid for Roxgold last year. The enterprise value is just over $1 billion when you account for the ~$90 million of net debt.

At current gold prices, the after-tax NPV (5%) of Séguéla is ~US$500 million. That NPV doesn’t include the resources at Sunbird or account for any additional exploration success. If 300,000 ounces of gold are mined at Sunbird that’s another $300 million of cash flow at $1,800 gold and assuming similar AISC to the current mine plan. All of the defined deposits at Séguéla are open at depth and along strike, and there are a host of other high-grade targets on the property. Depending on resource growth in the future, the value of this mine alone could support the company’s EV.

Lindero’s remaining after-tax NPV at $1,800 is about $400-$450 million, based on what’s been mined to-date. So just the current mine plan at Séguéla and Lindero support the market cap of FSM. That means there is little to no value being given to San Jose, Caylloma, Yaramoko, or the exploration upside at all of the company’s assets.

Fortuna doesn’t need to deliver on everything discussed above to see its share price re-rated. However, if over the next ~12 months it gets Séguéla into production and close to budget, adds a few years of reserves at San Jose and receives a 12-year mine extension, and Lindero’s production and costs remain on track, FSM should be one of the best performing gold/silver stocks in the sector. Those aren’t lofty ambitions; they are realistic goals but by no means guarantees.