billnoll/E+ via Getty Images

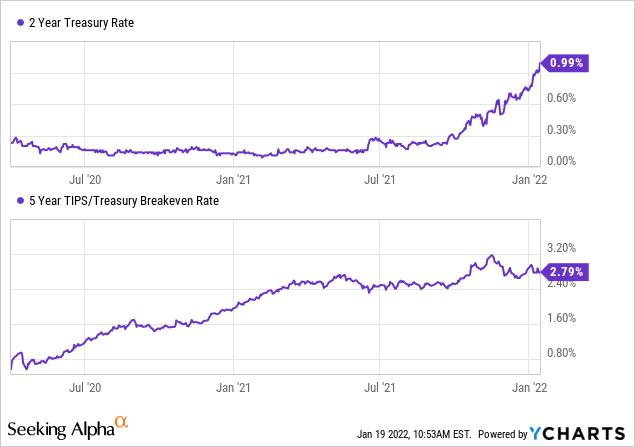

The new year has started with generally lackluster performance across financial markets. Historically, there has been a significant decline in the bond market, pushing many rate-sensitive stocks lower. The most important trend is the spike in short-term interest rates, which implies the Federal Reserve will likely need to pursue even more aggressive interest rate hikes to keep inflation in check. On the one hand, rising short-term rates have caused the inflation expectation rate to stop growing. However, it seems that the “cost” (via interest rates) of controlling inflation is skyrocketing at an accelerating pace. See below:

In my view, these two charts above are the two most important factors impacting virtually all stocks, bonds, and commodities today. Investors who wish to avoid experiencing immense portfolio volatility would be wise to understand the causes of these trends and their importance in determining the market’s future. Overall, long-lasting supply-side constraints push inflation higher via commodity and labor shortages. The only way to stop prices from accelerating too high is to raise interest rates to a sufficient level that total economic demand declines such that it meets reduced supply levels.

Problematically, the extent to which interest rates must rise to stop inflation is growing at a very fast pace. Rising rates have caused the inflation expectation rate to stop rising. Still, such rapid increases in short-term borrowing rates have a habit of killing market liquidity and causing rapid declines in asset prices. The “cost” of stopping inflation is likely rising at such a fast pace because it is becoming apparent that supply shortages are likely to last years due to depressed production capacity in global energy markets and similar constraints.

Notably, “typical” safe havens such as long-term bonds are highly unlikely to prove effective because their correlation to stocks has turned alarmingly positive. The concept of “bonds hedging against stocks” stems from the fact that bonds benefit from the deflation that crashes in the stock market bring. However, this relationship reverses when supply-side issues are persistent, as shown in many historical periods (such as the 1970s-80s and during the inflationary world-wars). The best “safe haven” was generally limited to the precious metals market during such periods. While gold is a decent option, I believe it may experience some downside given the ongoing rise in real interest rates; however, the recent resilience in silver implies it may be the best overall opportunity today. Let’s take a closer look.

Why Stocks Could Crash While Inflation Rises

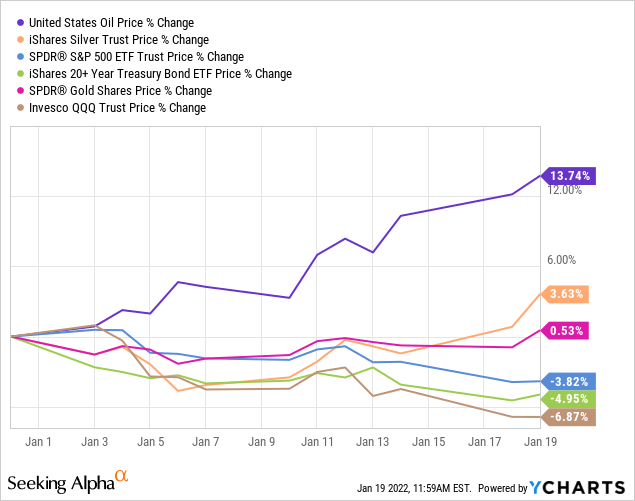

The current market environment is “dark” because there are very few clear trends or historical precedents to lighten investors the path. However, the bulk of the precedents which do exist generally point to much higher silver prices to come. Typically, silver declines with the stock market because industrial demand for silver usually falls with the broader economy. However, the past few weeks have indicated the opposite trend as silver prices have climbed while stocks and bonds have slipped together. Similarly, crude oil has also risen exceptionally despite declines in the equity market. See below:

Overall, it appears that there is a negative correlation between stocks & bonds (financial assets) and commodities (real assets). This trend is in its infancy and has not existed long enough to be established. However, it is notable considering it is uncommon for silver and oil to diverge from stocks. A more typical situation for these same assets can be found during the spring of 2020 volatility period, where stocks and commodities crashed together while long-term bonds climbed on a disinflationary outlook.

Today, we are seeing no significant changes to the inflation outlook while rates are rising at a fast pace, directly depressing bond prices while increasing companies’ interest expense outlooks and limiting banks’ ability to lend (due to yield curve flattening). In my opinion, this will most likely result in a continued decline in bond, and stock prices as earnings and growth expectations for most companies are constricted by a shift away from the “easy money” lending era. To some extent, this means companies may see no changes in operating profits but declines in net profits via higher interest costs. This situation would almost certainly push stocks lower but may not cause actual economic activity to decline as much.

The idea of stocks and bonds crashing without causing a deflationary decline in the economy is historically rare. Still, it has happened during past supply shortages (wars, geopolitical conflicts, etc.). We are effectively in this type of odd environment today where truly non-economic factors (culture, politics, geopolitics, etc.) influence the economy instead of vice versa. Commodities are historically the best asset class to own in such a period.

Why Silver Is The Best Commodity Today

The commodity complex tends to vary from those with high industrial demand and low “safe haven” value (such as oil and copper) to those with lower industrial use and higher safe-haven value (like gold). Silver is somewhere in the middle since it has both industrial and haven value. Typically, I would prefer gold to silver, given a negative outlook for stocks since silver usually declines with stocks. However, I do not believe deflationary forces will transpire even if rising rates cause stocks to crash. Accordingly, I expect industrial silver demand to remain intact, particularly considering silver is crucial for growing “green” infrastructure projects.

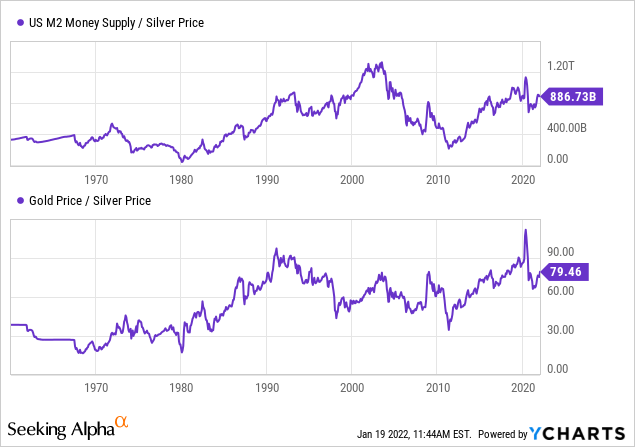

Silver is also very cheap by most historical ratios. The gold-to-silver price is around 80X, which is historically a peak level. Like gold, silver also tends to track the M2 money supply, which has risen tremendously from Q.E. Since 1970, the average M2-to-Silver ratio has been roughly 400-500B while the average gold-to-silver ratio has been around 30-50x. Today, these ratios are at 886 and 79, respectively, implying silver must rise by approximately 70-90% for these ratios to return toward normal levels. See below:

Of course, it may take years for this to occur, and it is possible that these ratios may not normalize any time soon. However, these ratios are at historically strong resistance levels, implying it is unlikely that silver becomes even cheaper compared to gold or the money supply.

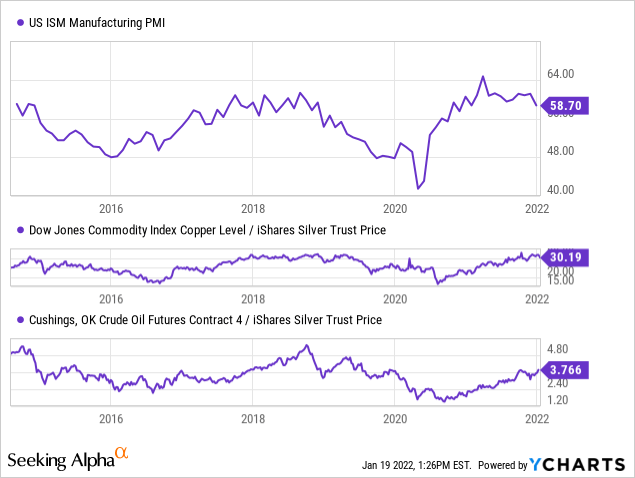

Interestingly, silver is also very cheap compared to industrial commodities like crude oil and copper. The silver-copper and silver-oil ratios are also very similar and tend to fluctuate with manufacturing growth expectations which have cycled over recent years – hitting peaks in 2014, 2018, and 2021 (based on the manufacturing PMI). This relationship can be clearly seen by comparing the PMI and the price ratios:

For the past decade, there has been a minor economic cycle pertaining to manufacturing activity. Following the end of the most severe lockdowns, there was a boom in manufacturing activities from late 2020 to last year. However, based on IHS data (slightly different from the ISM’s), we see a clear declining pattern as factories struggle with high commodities and labor prices. Historically, this means the price ratios of silver-to-oil and silver-to-copper should slide favorably to silver compared to the other industrial goods.

Overall, it is apparent that silver is cheap compared to gold, the overall monetary base, and industrial commodities. While I am bullish on virtually all commodities, I believe silver offers the best protection overall due to its apparent extreme undervaluation compared to peer assets. It is difficult to say precisely “how high” silver could rise, and, indeed, that question may be a bit meaningless since the value of fiat currency is becoming volatile. Based on the metrics above, it seems that silver offers the best overall potential compared to stocks, bonds, and other investable commodities.

SLV Is Seeing Momentum Return

Many investors are unsure about buying “paper silver” products like iShares Silver Trust ETF (SLV) since supply chain issues have some added risks. SLV legally owns physical silver and can hypothetically distribute it to qualified owners. However, I believe these fears are partly boosted by precious metals dealers who make immense profits from huge spreads between silver futures and their selling prices. In the event of a severe economic collapse, it would probably be best to own physical silver that can be traded for goods. However, SLV is the most liquid and low-cost means of gaining direct exposure to silver prices for all practical purposes as it almost always trades directly at its net asset value.

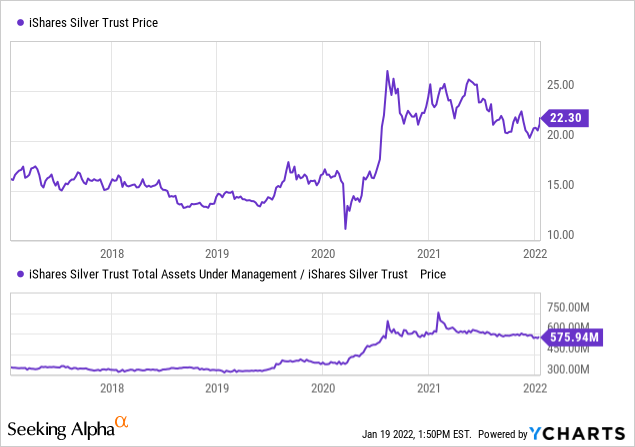

SLV is also the most liquid silver fund having ~12X more assets than its competing silver ETF. Interest in SLV skyrocketed during 2020 as investors rushed into any haven asset they could find, and silver’s price soared. Since then, silver’s performance has been lackluster, staying around the $22-$25 range. Unsurprisingly, the total shares outstanding of SLV (measured as total AUM-to-price) have also been flat, implying there have been no changes in investor interest in SLV since the summer of 2020. See below:

As seen in the recent SLV price data, the ETF spiked from its support level over recent weeks despite the slip in the stock market. To me, this is a strong catalyst signal for a more significant breakout in silver. I’ve been expecting a renewal in silver for roughly six months, but a breakout seems even more likely today, given the confluence of factors that suggest a breakout that did not exist last summer. Most notably, the recent divergence between stocks and commodities suggests a proper long-lasting stagflationary economic environment.

I am as bullish on silver today as I was in March of 2020 and believe it offers the best overall balance between “inflationary upside” and “safe-haven protection.” Of course, this depends on the demand for silver remains strong despite a potentially significant decline in stocks. While recent trends suggest this is likely, it may not persist, so I still believe investors would be wise to hold some dry-powder cash along with assets like SLV. Of course, if silver and other commodities do decline in a disinflationary manner, it would only allow the Fed to pursue further dovish policies that would likely end with even higher commodity prices (as occurred in 2020). As such, I would buy any dips in silver and not consider selling until the metal is at least at $30/oz, though I would not be surprised to see an even more considerable spike.