By Graham Summers, MBA

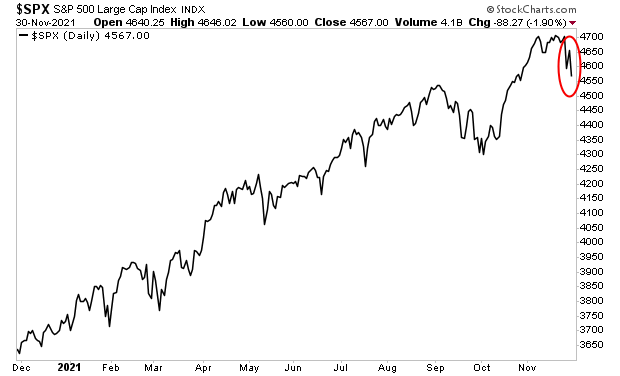

Stocks are bouncing again because investors have been trained by the Fed to “buy the dip” since the March 2020 lows.

So, traders are buying this one.

However, there is a big difference between this recent drop in stocks and the others.

This time around, the Fed has indicated it is NOT going to start easing again. In fact, Fed Chair Jerome Powell made it clear the Fed might very well accelerate its monetary tightening.

Yesterday Fed Chair Jerome Powell told a Senate panel that he no longer believes inflation is “transitory” and that the Fed can consider wrapping up its taper “a few months sooner.”

This means the Fed has shifted gears.

For the last 20 months, the Fed has told the world that its focus was on growth in terms of jobs and employment. Throughout this period, Fed Chair Powell and his Fed colleagues stated that inflation was “transitory’ and didn’t warrant action.

This meant the Fed was willing to risk inflation while trying to create growth.

Not anymore.

The Fed is now focused on inflation, not growth. Which means it will be tightening not easing monetary conditions, most likely faster than most expect.

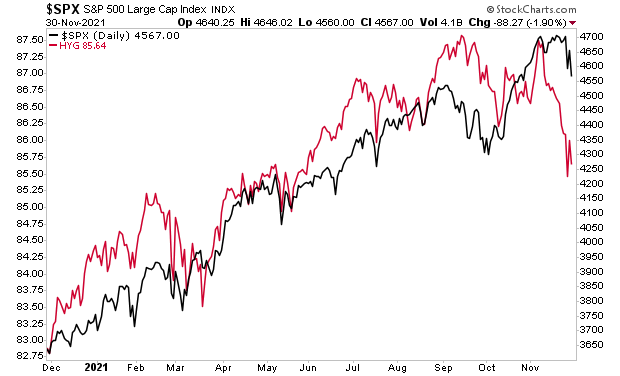

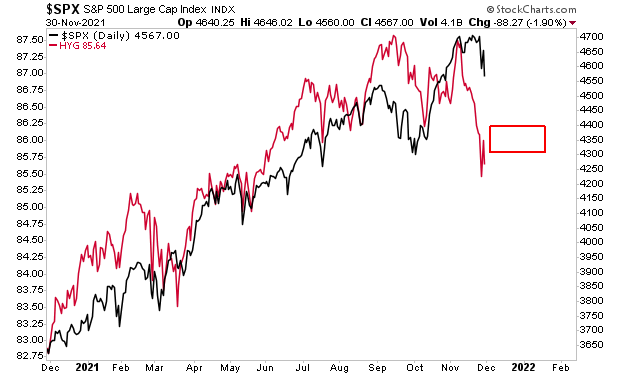

The credit markets have figured this out… take note where high yield credit (red line) is relative to stocks (black line) in the chart below. High yield credit leads stocks. It did so from the March lows. And now it’s doing the same to the downside.

Look, the message here is simple: the correction in stocks is NOT over. It’s NOT time to buy yet. If anything, we can expect stocks to drop to the red box sometime in the coming days.

Put another way, another bloodbath is coming. And when it hits, smart investors will cash in while everyone else gets taken to the cleaners.

For those looking to prepare and profit from this mess, our Stock Market Crash Survival Guide can show you how.

Within its 21 pages we outline which investments will perform best during a market meltdown as well as how to take out “Crash insurance” on your portfolio (these instruments returned TRIPLE digit gains during 2008).

To pick up your copy of this report, FREE, swing by:

phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards,