The world economy rebounded from the historic recession caused by the Covid-19 crisis better than many economists expected in 2021 but faces a harder path ahead in the coming year, forecasters have warned.

Progress will depend on the virulence of the pandemic, the ease with which inflation is tamed and the dispersion of the economic damage across countries and industries, they said, warning of a rising risk of monetary and fiscal policy errors as governments and central banks seek to respond.

“The easy part of this uneven global economic recovery appears over,” said Daan Struyven, senior global economist at Goldman Sachs.

Janet Henry, chief economist of HSBC, said the outcome was unlikely to be a “Goldilocks” scenario — not too hot and not too cold.

Most economists agree that the backdrop in most countries of a strong recovery combined with high inflation will make it difficult to balance supply and demand.

Simon MacAdam, senior global economist at Capital Economics, said that, although headline inflation rates would certainly fall, there was likely to be persistent underlying pressure on prices due to tight labour markets, especially in the US, and “product shortages and high transport costs” in most countries.

Economists at Nomura are confident that monetary authorities will get inflation under control, but it will come at a cost. “By late 2022 we see a very different backdrop, with stagnation a bigger risk than stagflation,” they warned.

The OECD expects global output growth to moderate from 5.6 per cent in 2021 to 4.5 per cent this year, with inflation rising from 3.5 per cent to 4.2 per cent, although the peak will come in the early months of the year.

Economists agree that the key uncertainties about outlook for the coming year stem from what has happened in the past 12 months. A better than expected recovery alongside a shift in the pattern of spending from services towards goods raised prices and showed that consumers’ willingness to purchase was exceeding companies’ ability to supply.

Coronavirus vaccines allowed a rapid relaxation of restrictions and policy stimulus propelled consumer spending, enabling the world to end the year “in a better place than we might have expected a year ago”, Henry said.

What happens in 2022 will depend on three linked forces.

The virus

The severity of the pandemic matters both for the willingness of people and companies to spend and for government restrictions on mobility, which are again tightening across Europe.

“The global economy continues to be whipsawed by the ups and downs of the pandemic,” said Jay H Bryson, chief economist of Wells Fargo. Although households, companies and countries have become much better at adapting to waves of coronavirus, the latest Omicron variant shows that it still has the power to damage consumer and business confidence and economic activity.

Tamara Basic Vasiljev, senior economist at Oxford Economics, noted that Omicron had undermined consumer sentiment globally in the past few weeks. But with sentiment still at relatively high levels and household finances strong, she does not expect the hit in economic activity to be large globally.

“The global economy will manage to navigate the rough waters presented by the Omicron variant,” she said. The big uncertainty is whether there will be further waves to come.

Inflation

The second big uncertainty stems from the imbalance between global supply and demand, which created inflation in 2021.

Economists expect the headline rate to fall — in part because of the statistical effect of last year’s high rates on the annual calculation, and because oil and energy prices are not expected to rise further.

The question is whether the pressure on prices will moderate sufficiently for central banks to avoid taking stiff action to bring inflation down, which could risk stalling the recovery.

“As the year goes on, [supply] shortages should ease and their inflationary effects should subside too, albeit with a lag,” said MacAdam at Capital Economics. However, he is concerned that the US labour market is overheating and the Federal Reserve could err by being too cautious.

“We doubt that the scale of tightening the Fed has signalled will be enough to pull core inflation down to 2 per cent,” he added.

Patchy damage

The third big issue for the global economy in 2022 stems from differences between countries and industries in their ability to recover from the crisis.

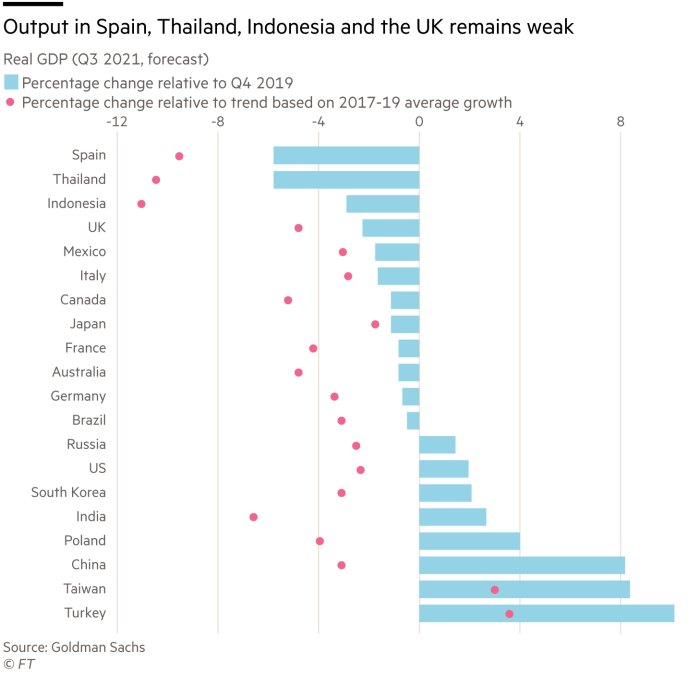

Spain, Thailand and Indonesia have fallen furthest behind their economies’ expected path due to the pandemic, with Turkey, Taiwan and China furthest ahead, according to Goldman Sachs research.

Much of this, Struyven said, was due to the degree to which countries were exposed to sectors that were hit by shifts in demand or benefited from them; for example, manufacturing has experienced very high demand while travel and tourism-dependent locations have suffered great damage.

“The services where spending remains particularly depressed in many economies are generally either associated with high virus risk, such as spectator events and international travel, or connected to office-based work, such as ground transportation or dry cleaners,” Struyven said.

For countries specialising in these services, gains would depend on “more significant medical improvements” to fight the pandemic.

As a result of these fundamental uncertainties, the path of monetary and fiscal policy could result either in further inflationary pressure if too much stimulus is provided, or a dip into stagnation if the recovery receives insufficient support.

According to Henry at HSBC, “things are still very far from normal”.