Equities on Wall Street joined a global decline on Friday as investors dashed out of shares in companies most exposed to the pandemic and sought shelter in havens after the discovery of a new coronavirus variant.

The blue-chip S&P 500 stock index dropped 1.4 per cent in early dealings, with the more tech-focused Nasdaq Composite off 1 per cent. The falls echoed declines across Europe and Asia triggered by a surge in cases in a mutated form of the virus across parts of Africa.

“Things have escalated on the Covid front quite rapidly over the last 12 hours,” said Jim Reid, a strategist at Deutsche Bank. On Thursday, the new variant “was slowly starting to gather increasing attention but overnight it has begun to dominate markets,” he said.

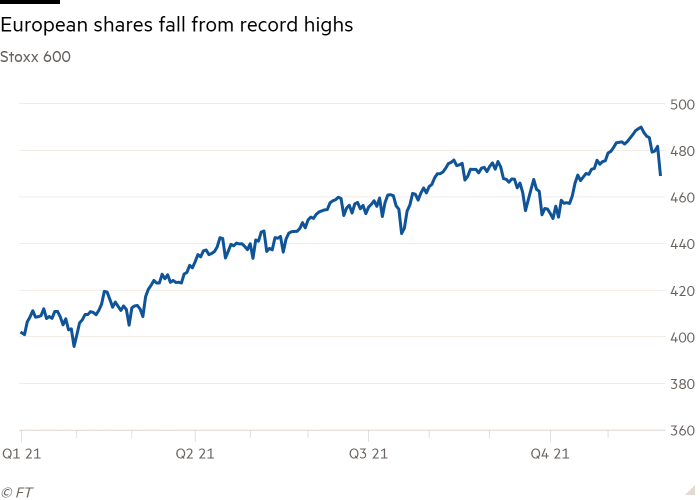

Europe’s Stoxx 600 fell as much as 3.6 per cent, and was down 2.8 per cent in afternoon trading. France’s CAC 40 index and Germany’s Dax were down by 3.9 per cent and 3.1 per cent respectively.

London’s FTSE 100 index dropped 3 per cent. In a sign of the market anxiety, shares in British Airways parent IAG, German carrier Lufthansa and aircraft maker Airbus dropped about 10 per cent.

Pharmaceutical companies rallied in US trading, with Moderna jumping 16 per cent and Pfizer gaining 6 per cent. Lab test provider Quest Diagnostics, meanwhile, gained 4 per cent.

Other pandemic beneficiaries such as food delivery service Deliveroo and meal-kit company HelloFresh were among the slim number of gainers in Europe on Friday, while companies vulnerable to travel curbs such as WHSmith dropped. Oil benchmarks on both sides of the Atlantic fell more than 5 per cent.

The B.1.1.529 Sars-Cov-2 variant, first identified in Botswana, is believed to be behind a surge of Covid cases in southern Africa over the past week and has alarmed global health officials because of its apparent ability to evade vaccines and spread more quickly than the Delta variant.

The EU and UK moved to impose travel restrictions on a group of southern African nations, while Israel has banned travellers from South Africa. The World Health Organization is holding an emergency meeting to discuss the new variant, which has been described as the most concerning strain yet encountered by researchers.

US financial markets were closed for the Thanksgiving holiday on Thursday, and the bond and stock markets are only open for an abridged trading session on Friday. Investors said the shortened US day meant trading volumes were thin in some asset markets, something that exacerbated price fluctuations.

“When you get less liquid markets because of public holidays, you often get more volatility,” said Mike Riddell, a portfolio manager at Allianz Global Investors. “While there’s an obvious catalyst for these moves, I don’t think they would be as big as what we’re seeing without the impact of Thanksgiving.”

Still, the jitters were apparent in a broad array of closely watched market barometers. The Vix index, a measure of expected volatility in Wall Street stocks over the next month, rose 7.6 points on Friday to 26, the biggest increase since early 2021.

Government debt rallied as investors turned to assets traditionally seen as carrying lower risk. The yield on the benchmark US 10-year Treasury note fell 0.12 percentage points to 1.53 per cent on Friday. The yield on its German equivalent declined 0.07 percentage points to minus 0.32 per cent. Japan’s yen, which typically rises during times of rising market angst, climbed more than 1 per cent against dollar.

Meanwhile, oil prices were hit hard with Brent, the international crude marker, down more than 5 per cent at $77.36 a barrel, and US benchmark West Texas Intermediate off 6.4 per cent at $73.41.

The moves marked the steepest daily falls since July and follow this week’s steps by the US, UK, India, South Korea, Japan and China to release strategic oil reserves, adding more supply to the market.

Industrial metals prices were also lower, with copper sliding 2 per cent to $9,558 a tonne and aluminium 2.1 per cent weaker at $2,658. Concerns about the property sector in China also weighed on this market.

Gold bucked the weak market trend, however, rising $18.50, or 1 per cent, to $1,802 a troy ounce as investors looked for safe places to park cash.

“The gold price should remain supported in this environment and the topic of tapering should take a back seat for the time being,” said Alexander Zumpfe, precious metals dealer at German industrial group Heraeus.

In Asia, Hong Kong’s benchmark Hang Seng index shed 2.7 per cent, while Tokyo’s Topix dropped 2 per cent.

Additional reporting by Tommy Stubbington