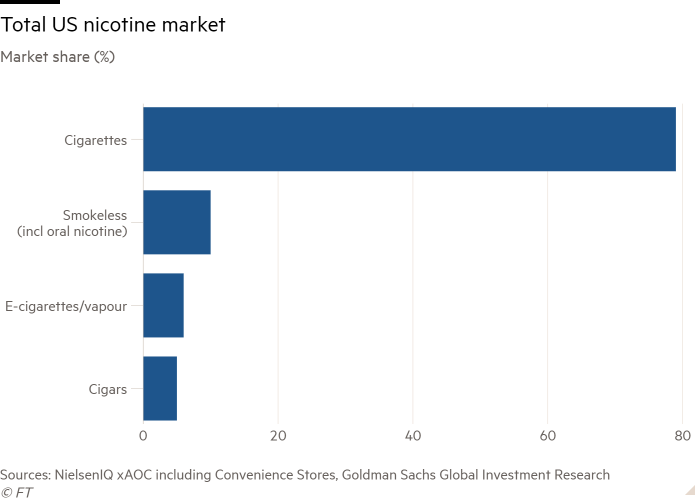

The authorisation of the first e-cigarette by US regulators this week was described by industry experts as a historic moment for the $5bn sector, which has been operating under a cloud since a crackdown on a teen vaping “epidemic” in 2018.

But the US Food and Drug Administration’s choice of product for its first ever green light — an unpopular device shaped like a real cigarette made by a subsidiary of British American Tobacco — puzzled some observers.

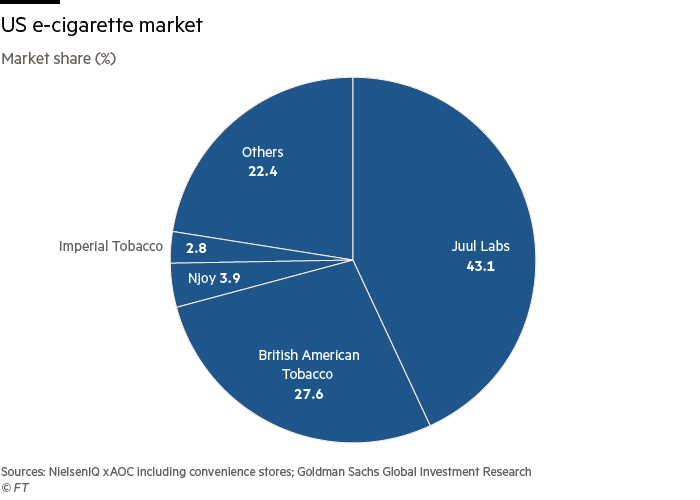

Juul, the market leader with a 43 per cent share, has also filed for authorisation, and has yet to find out whether its products will be authorised too.

Still, by rubber stamping the Vuse Solo e-cigarette and related devices, the agency sent a clear signal that it does not intend to ban vaping outright. Rather, it started to sketch out a new regulatory regime where it will allow products designed to help people quit smoking while clamping down on those aimed at first time vapers who are not addicted to tobacco — especially teenagers.

“It’s a historic moment and an inflection point in the long, drawn out and controversial process of tobacco legislation,” said Cliff Douglas, director of the University of Michigan Tobacco Research Network.

Just as important was the agency’s decision to reject five flavoured tobacco products also made by Reynolds American, the BAT subsidiary that markets the Vuse Solo. In doing so, the FDA expressed its distaste for the kinds of vaping products that had led to an explosion in usage among teens.

It has also declined, so far, to rule on BAT’s much more popular device, the Vuse Alto, and placed strict marketing curbs on the Solo product.

“The FDA is under enormous political pressure and is trying to thread a needle in a way that satisfies its scientific and public health mission in the face of litigation, threats and political hardball,” said Douglas.

He said the denial of flavours by the FDA clearly signalled it would take a conservative approach to any products that were popular among school children and young people.

Last year, US regulators temporarily banned the manufacture, distribution and sale of cartridge-based fruit and mint flavoured e-cigarettes to tackle what they called an “epidemic” of teenage vaping. The FDA required all US e-cigarette manufacturers to submit their products for review or take them off the market.

Even before the FDA formalised its crackdown, the growing regulatory uncertainty had sparked a management shake-up at Juul in 2019 and prompted Philip Morris International to call off talks about a $200bn merger with Altria, which owns a 35 per cent stake in Juul.

Juul has since cut back on marketing spending and stopped selling flavoured pods for its vaporiser device.

The strategic reset has cost the company market share, which has fallen from 64 per cent in May 2018 to 43 per cent last month. Retail sales of Juul products fell 10 per cent to $1.99bn in the 52 weeks to September 25, according to a Goldman Sachs analysis of Nielsen data.

But Juul is confident that by repositioning itself as a responsible industry leader focused on adult smokers it can reduce regulatory risk and build a sustainable business over the long term.

Last month the company released a new Juul2 device in the UK, which includes new technology to prevent the use of counterfeit pods and make its devices less accessible to children.

“Over the past several years, we reset our company because while millions of adult smokers have converted to our products from cigarettes, we will only be trusted to provide alternatives to adult smokers if we continue to combat underage use,” said Joe Murillo, Juul’s chief regulatory officer.

Reynolds has benefited from Juul’s strategic pivot and has continued marketing aggressively over the past year. It also cut the price of its main e-cigarette device to 99 cents, one-tenth of what Juul’s devices typically cost. Retail sales of its e-cigarette products surged 60 per cent to $1.2bn in the year to September 25, according to Goldman analysis.

Analysts said the FDA’s approval of the Vuse Solo product was unlikely to provide Reynolds with much of a competitive advantage because it is such a small part of its e-cigarette sales — about 1.5 per cent.

“The FDA is authorising a tiny, mainstream vapour product in Vuse Solo — a product not even featured on the Vuse brand website,” said Christopher Growe, analyst at Stifel, an investment bank.

He said the FDA’s decision was perhaps more noteworthy for what it had not authorised: Reynolds’ main e-cigarette product Vuse Alto, the much slicker e-cigarette which accounts for the vast majority of the company’s market share.

Reynolds said it was confident in the quality of its application to the FDA for Alto, which was submitted nearly a year after the application for Solo.

But industry and health experts say the FDA’s decision to reject the company’s application for flavours and severely restrict marketing for Solo sent a strong message to the industry about future approvals.

“It was unclear until now if the FDA would take a similar approach to the larger and more powerful companies,” said Desmond Jenson, a lawyer specialising in tobacco at the Mitchell Hamline School of Law. “Now they have . . . That part is very good news for public health.”

But the FDA still has big decisions to make on whether to authorise menthol e-cigarette products, one of the most popular categories, and Juul’s applications, said Jenson.

The American Vaping Association said it welcomed the authorisation of the Vuse Solo product but told the Financial Times it would encourage Reynolds to sue the FDA over its rejection of flavoured products.

Gregory Conley, AVA president, said banning popular flavours would push people to towards grey market products or back to smoking.

Even as regulation is catching up with the e-cigarette industry new competitors are emerging that have so far managed to avoid FDA scrutiny. Puff Bar, a company run by vaping entrepreneurs Patrick Beltran and Nick Minas, is selling products using synthetic nicotine — a substance that is not currently regulated by the FDA.

Critics allege the company markets a host of flavours such as banana, watermelon and mint which are popular among children. It has become the biggest seller of disposable e-cigarettes, generating $155m in sales in the 12 months to September 25, according to Goldman Sachs analysis.

Puff Bar did not immediately reply to a request for comment.

Stifel’s Growe said Puff Bar was now the number one youth brand and the FDA had been caught flat footed again in being unable to regulate the products that were most popular among younger people.

“We remain disappointed in the FDA’s regulatory actions which continue to punish companies following its rules while turning its head on the companies breaking the rules,” said Growe.

Additional reporting by Andrew Edgecliffe-Johnson in New York