Municipal benchmark yield curves were little changed on average trading Wednesday as the primary was the focus while the Investment Company Institute reported another week of inflows into municipal bond mutual funds.

There was some uncertainty and a tentative mood hanging over the market, but traders said the large deals got done. Bids-wanted lists have been on the rise, though haven’t pushed yields higher but a basis point in spots over several sessions.

The benchmark U.S. Treasury bond in 10 years ended at 1.649%, a basis point higher than Tuesday, while the 30-year ended at 2.125%, about four basis points weaker.

Ratios were little changed with the municipal to UST 10-year ratio at 73% and the 30-year at 80%, according to Refinitiv MMD. ICE Data Services had the 10-year at 72% and the 30 at 81%.

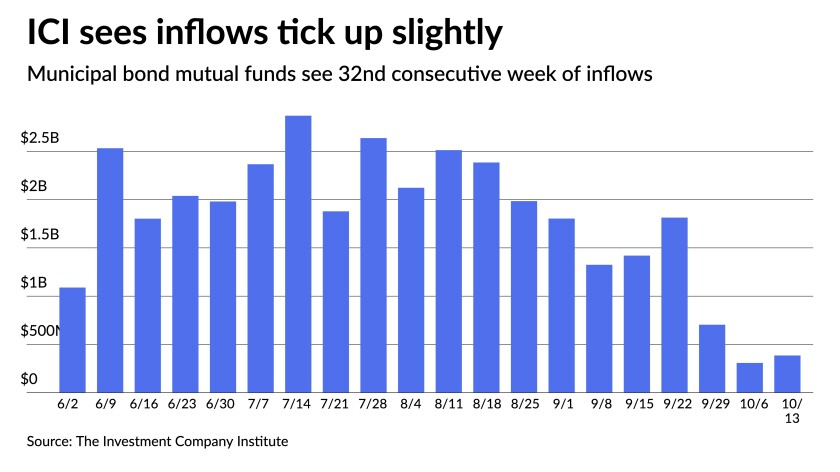

Another round of inflows was reported from the Investment Company Institute — the 32nd consecutive week — coming in at $385 million for the week ending Oct. 13, up from $308 million the week prior.

Exchange-traded funds saw $124 million of inflows after $327 million a week prior. Total inflows have hit $76.6 billion year-to-date.

“I think the consensus is the market feels a little weaker even though benchmarks are mostly unchanged,” he said. “People think that the market is a little cheaper than what some of the indexes are claiming.”

“The market feels weaker than it is on paper, and in the back of people’s minds they are somewhat concerned about rates going forward,” he said, noting many different cross-currents from COVID-19 vaccines to interest rates and state budgets, the economy, and policies in Washington. “Some people are moving to the sidelines.”

One of the largest deals on Wednesday was the $454.2 million Hudson Yards Infrastructure Corporation (Aa2/AA-/A+/ ) Hudson Yards revenue bond Fiscal 2022 Series A green bonds priced by Goldman Sachs & Co. LLC.

Bonds in 2/2026 with a 5% coupon yield 0.51%, 5s of 2031 at 1.34%, 4s of 2036 at 1.69%, 4s of 2041 at 2.03%, and 2.75s of 2047 at 2.74%, callable in 2/1/2032.

“The Hudson Yard deal came at seemingly robust prices and got done,” the New York trader said. “In general business is getting done every day because there’s money out there.”

“I think in general people don’t believe munis at these percentage of Treasuries are really attractive, so they are being really selective,” he added.

Also in the primary, Morgan Stanley & Co. priced for the Southwestern Community College District, San Diego County (Aa2/AA-//) $257.62 million of tax-exempt and taxable general obligation bonds. Bonds in 8/2023 with a 4% coupon yield 0.18%, 4s of 2026 at 0.50%, 4s of 2031 at 1.15%, 4s of 2036 at 1.64%, 3s of 2041 at 2.30%, 4s of 2046 at 2.08% and 2.5s of 2046 at 2.68%, callable in 8/1/2031. The taxable portion, $9.185 million mature in 2/2022 at 0.15% par.

BofA Securities priced for the American Municipal Power, Inc., Ohio (A1/A///) $141.915 million of Prairie State Energy Campus project revenue bonds. Bonds in 2/2030 with a 5% coupon yield 1.46%, 5s of 2031 at 1.58% and 4s of 2036 at 2.07%, callable 2/1/2030.

Tusla, Oklahoma (Aa1/AA//) sold $102.95 million of general obligation bonds to Mesirow Financial. Bonds in 11/2023 with a 0.05% coupon yield 0.45%, 1s of 2026 at 0.85% and 2s of 2030 at 1.55%, noncall.

Informa: Money market muni funds rise

Tax-exempt municipal money market fund assets rise by $158.6 million, bringing their total to $88.51 billion for the week ending Oct. 18, according to the Money Fund Report, a publication of Informa Financial Intelligence.

The average seven-day simple yield for the 150 tax-free and municipal money-market funds sat at 0.01%, the same as the previous week.

Taxable money-fund assets gained by $5.88 billion, bringing total net assets to $4.376 trillion. The average, seven-day simple yield for the 771 taxable reporting funds sat at 0.02%, same as the prior week.

Secondary trading

Tennessee 5s of 2022 at 0.14%-0.13%. Washington 5s of 2022 at 0.10%. Wisconsin 5s of 2022 at 0.14%-0.13%. Mecklenburg County, North Carolina 5s of 2022 at 0.12%.

Maryland 5s of 2023 at 0.20%. Georgia 5s of 2024 at 0.27%.

New York City waters 5s of 2026 at 0.55%. Wisconsin 5s of 2026 at 0.61%-0.59%. Maryland 5s of 2026 at 0.57%-0.55%. California 5s of 2027 at 0.29% versus 0.77% Tuesday.

Georgia 5s of 2031 at 1.22%-1.21% (the same on 10/13).

Ohio 5s of 2040 at 1.61%-1.60%. California 5s of 2041 at 1.66%-1.63% (1.65%-1.64% on 10/7). Washington 5s of 2041 at 1.80%.

Ohio waters 5s of 2046 at 1.85%. New York City waters 5s of 2048 at 2.05% versus 2.04% Tuesday.

AAA scales

According to Refinitiv MMD, short yields were steady at 0.12% in 2022 and at 0.18% in 2023. The yield on the 10-year was steady at 1.19% and the yield on the 30-year sat at 1.68%.

The ICE municipal yield curve showed bonds rise one basis point to 0.14% in 2022 and at 0.19% in 2023. The 10-year maturity sat at 1.15% and the 30-year yield steady at 1.71%.

The IHS Markit municipal analytics curve showed short yields unchanged at 0.12% in 2022 and 0.18% in 2023. The 10-year yield sat at 1.17% and the 30-year yield was steady at 1.68%.

The Bloomberg BVAL curve showed short yields steady at 0.16% in 2022 and 0.17% in 2023. The 10-year yield steady at 1.16% and the 30-year was steady at 1.71%.

In late trading, Treasuries were softer as equities were mixed.

The 10-year Treasury was yielding 1.649% and the 30-year Treasury was yielding 2.131% near the close. The Dow Jones Industrial Average gained 142 points, or 0.40%, the S&P rose 0.31% while the Nasdaq lost 0.07%.

Fed headaches?

While the Federal Open Market Committee is expected to announce at its November meeting that it will cut back on its asset purchases, employment, inflation and economic growth data suggest taper could hurt the recovery.

Governors Randal Quarles and Christopher Waller both said they’d support a taper decision in November.

And while the employment situation is improving and inflation remains high, Quarles said, “I do not see the FOMC as behind the curve, for three reasons: Most of the biggest drivers of the very high current inflation rates will ease in coming quarters, some measures of underlying inflation pressures are less worrisome, and longer-term inflation expectations are anchored, at least for now.”

While he sees inflation remaining above 2% next year, and that would be “too long” to still define inflation as transitory.

Waller said he doesn’t see liftoff right after tapering ends, but if inflation remains “considerably above 2% well into 2022, then I will favor liftoff sooner than I now anticipate.”

“Things are getting a little more difficult for the Fed,” said Peter Cramer, senior managing director of Insurance Asset Management at SLC Management. Two below-expectation jobs reports and declining growth expectations should mean less inflation, but “pockets of inflation are popping up everywhere and policy makers are being pressured to tamp them down,” he said. “It is feared that a meaningful effort to constrain inflation may have a damaging impact to financial markets and the labor recovery.”

While incomes have risen over the past year, they can’t match the rises in prices of food and fuel, Cramer said. “This will put considerable pressure on lower income families, which will in turn create greater political pressure.”

And if supply chain issues are to blame for inflation, he said, “it is unclear if tighter monetary policy is the appropriate prescription. Still, policymakers feel compelled to keep inflation expectations contained and the Fed appears ready to risk economic and market stability to accomplish this. Thus, despite some weakness in economic data, interest rates are traveling higher.”

Indeed, energy price spikes will probably prolong the inflationary spike, said BCA researchers in a strategy report. “This raises the risk that consumers could turn more cautious on spending behavior if they have to devote more of their incomes just to fuel their cars or heat their homes.”

This caution is already showing up in the U.S., they say, with the University of Michigan consumer sentiment report showing one-year inflation expectations at a 13-year high. Other surveys also show consumers expect inflation to outpace growth in the coming years.

This expected contraction in real income, they say, has tamped consumer sentiment “despite favorable US labor market conditions.”

BCA researchers say consumers are “overestimating how much their real incomes will suffer next year from higher inflation.”

The Fed could raise rates in the last quarter of 2022, BCA says.

The Beige Book, released Wednesday, suggested economic activity slowed since the last release, but growth remained modest to moderate.

Uncertainty caused by the Delta variant and supply chain and labor issues all helped slow growth, the report said. While consumer spending gained, low inventory and rising prices snuffed auto sales.

The travel and tourism category was mixed. Employment was modest to moderately better, and while positions were available, not enough people were seeking jobs, the report said.

“Most Districts reported significantly elevated prices, fueled by rising demand for goods and raw materials,” according to the report. “Reports of input cost increases were widespread across industry sectors, driven by product scarcity resulting from supply chain bottlenecks. Price pressures also arose from increased transportation and labor constraints as well as commodity shortages.”

Primary to come

The Hudson Yards Infrastructure Corp. (Aa2/AA-/A+//) is set to price Wednesday $451.985 million of Hudson Yards revenue green bonds, Fiscal 2022 Series A, serials 2026-2047. Goldman Sachs & Co

Banner Health, Arizona, (/AA-/AA-//) is set to price Thursday $424.2 million of corporate CUSIP taxable bonds, Series 2021A. Morgan Stanley & Co.

The University of Wisconsin Hospitals and Clinics Authority (Aa3/AA-///) is set to price Thursday $350.575 million of revenue bonds, Series 2021B green bonds and taxable revenue refunding bonds, Series 2021C. J.P. Morgan Securities.

The Louisiana Public Facilities Authority (non-rated) is set to price Thursday $184.895 million, consisting of: $182.985 million of revenue and refunding revenue bonds, Series 2021A-1 (CommCare Corp. Project) and $1.91 million of taxable revenue bonds, Series 2021A-2 (CommCare Corp. Project). Piper Sandler & Co.

The Triborough Bridge and Tunnel Authority (Aa3/AA-/AA-/AA) is set to price Thursday $163.245 million of MTA Bridges and Tunnels general revenue bonds, Series 2002F & Subseries 2008B-2 (conversion to fixed rate), consisting of $110.61 million, Series 2021 and $52.635 million, Series 2021B. Jefferies.

The Massachusetts Housing Finance Agency (/AA//) is set to price Thursday $149.105 million of housing bonds: consisting of $76.155 million, 2021 Series B-1 (sustainability bonds), serials 2024-2032, terms 2036, 2041, 2046, 2051, 2056, 2061 and 2063; $64.145 million, 2021 Series B-2 (sustainability bonds), serial 2023, terms 2025-2026; and $8.805 million, 2021 Series C, serial 2023. Barclays Capital.

The Bay Area Water Supply & Conservation Agency (Aa3/AA-//) is set to price Thursday $135.115 million of forward delivery refunding revenue bonds (Capital Cost Recovery Prepayment Program), Series 2023A. Goldman Sachs & Co.

The Successor Agency to the Redevelopment Agency of the City and County of San Francisco is set to price Thursday $130 million of 2021 Series A taxable third-lien tax allocation bonds affordable housing projects social bonds. Citigroup Global Markets Inc.

Clovis Unified School District, Fresno County, California, (/AA//) is set to price Thursday $122.725 million of 2021 taxable refunding general obligation bonds, Series B, serials 2022, 2026 and 2028-2039. Stifel, Nicolaus & Company.

Lynne Funk contributed to this report.