The Federal Reserve says not to worry about the 2.6% jump in the CPI. But the bond market is skeptical and it may be time to get yourself some protection.

In the past year:

—house prices have gone up 12%.

—lumber prices have tripled.

—shares of mediocre companies like The New York Times, American Water Works and Duke Energy have climbed to 40 times trailing earnings or more.

Dollars, it seems, aren’t going as far as they used to in the acquisition of hard assets, real estate or business assets. This is not surprising, given how many of those dollars are being manufactured at the Federal Reserve.

The Fed conjures up new money as it expands its collection of Treasury bonds. Its balance sheet has ballooned by $3.4 trillion since the start of last year. The official word for this process is “stimulus.”

Is there any risk that asset inflation could turn into wage inflation and generalized price inflation? That this process could feed on itself? The ministers at the Fed say there is nothing to worry about. Why, the Consumer Price Index is up only 2.6% from a year ago, and even that jump, they say, is a transitory phenomenon. We’re just bouncing off the depressed commodity prices seen early in the pandemic.

Maybe. But maybe that CPI jump was not transitory at all. The Economic Cycle Research Institute, a private consulting service, publishes what it calls a Future Inflation Gauge. (The monitor is calculated from an undisclosed mix of factors that probably include job growth and industrial prices.) The FIG, at 95 in September, has recently shot up to 130. What that means, explains ECRI co-founder Lakshman Achuthan, is that the inflation rate is likely to trend up, not turn back down, over the next six months.

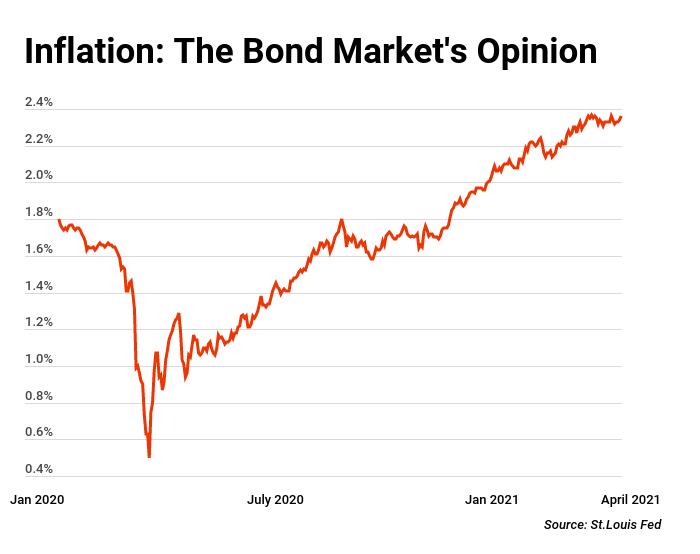

Certain people are putting more faith in the whiffs of inflation they see than in the pronouncements from the Fed. Those would be bond investors. The spread between the yield on conventional 10-year Treasury bonds (1.58%) and the yield on inflation-protected ones (-0.78%) has widened to 2.36%, double what it was a year ago.

That spread, called the 10-year breakeven rate, is very close to the market’s expectation for the inflation rate between now and 2031. (The spread is slightly boosted by a risk premium attached to the conventional bonds and slightly depressed by a lack of liquidity in the inflation-protected bonds.) This graph plots the action in the breakeven rate over the past 16 months:

.

In short, the breakeven rate, depressed at first by the pandemic, has rebounded to the somewhat disturbing level of 2.4%.

A 2.4% annual inflation rate is not horrible, at least not in comparison to the damage to the dollar during the 1970s. Still, it’s enough to double the cost of living over the course of a 30-year retirement.

Monetary Cassandras have been fretting about coming inflation for years. Until a year ago this gang of worriers looked misguided. Now, if that latest uptick proves not to be so transitory, they may be vindicated.

I must confess that I could be accused of crying wolf for a long time. But a list of five inflation hedges promoted here on April 2, 2020 has appreciated 51% over the 13 months since.

The problem is not merely the current rate of inflation. It’s the uncertainty. If the rate climbs from 2.4% to 4.8%, prices quadruple over the course of a retirement. You might want to think about how you would cover the heating bill if that happens.

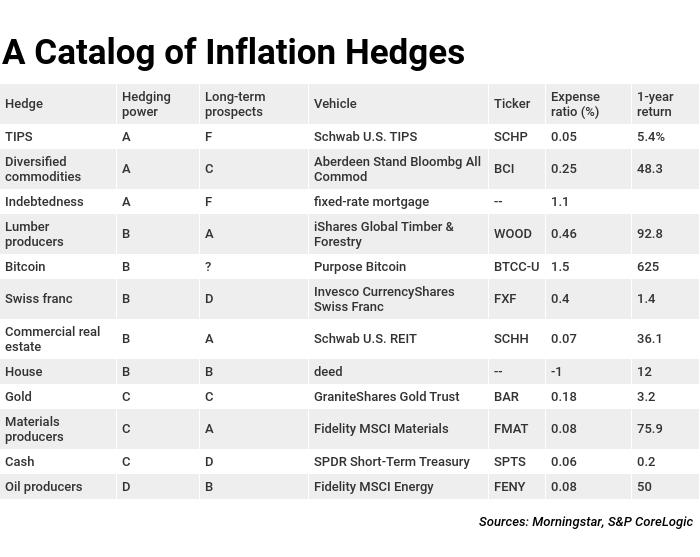

Alas, all inflation hedges have flaws. The ones that are most likely to counteract a jump in the CPI tend to be the ones whose long-term returns are least promising. Still, there is much to be said for putting a portion of your portfolio in inflation hedges as a form of insurance. You’d probably depress your long-term performance somewhat but you’d sleep better. You would be less likely to be devastated by a catastrophic CPI.

Most of the dozen hedges below take the form of exchange-traded funds. Most of the data on past performance comes from Morningstar. The letter grades, based in part on history and in part on what’s in the air, represent author’s hunches.

.

TIPS

Treasury Inflation Protected Securities are the most solid insurance plan against CPI surprises. For that reason they are much sought after. Being sought after, they are expensive. Demand has pushed up their prices and depressed their future returns.

As noted above, the 10-year TIPS gives you a real return in negative territory. The reason you might buy anyway is just to have some savings that can’t be destroyed by the Fed.

There are several TIPS funds to choose from. Schwab’s is one of the more economical.

Diversified commodities

Most of the past decade has seen surprisingly mild inflation and that explains why commodity funds have, until recently, delivered disappointing results.

The ETF recommended here has a very low annual cost, as commodity funds go, but its “K-1 free” format (no partnership paperwork) comes with a hazard warning. Funds organized like this one are positively toxic in a taxable account, since they turn gains into ordinary income and make losses into something that can be neither deducted nor carried forward. Either own this thing in an IRA or stay away from it.

Indebtedness

Debtors get a windfall when the inflation rate delivers an upward surprise. Homeowners who took out a 4% mortgage in the 1960s did very well in the next decade, as they repaid principal with dollars that were worth less and less.

The going annual percentage rate on 30-year fixed-rate mortgages is now 3.3%. If you use borrowed money when you move into a new house, you can laugh when the Fed speeds up its money machine.

Why the F grade for long-term return? Because borrowing money is, apart from the prospect of winning an inflation lottery, a losing proposition. Long-term Treasuries yield 2.2%. The negative 1.1-point spread, shown in the table as an expense burden, reflects the frictional cost of mortgage loan officers, deadbeats and so on.

Taking out a $100,000 mortgage is like selling $100,000 worth of the bonds you hold in a portfolio. Either activity makes you less susceptible to damage from inflation. If you have a choice, selling off bonds from a portfolio is usually a better strategy than incurring or maintaining a mortgage debt.

Young people who expect rising inflation and don’t have a portfolio to liquidate should take out fat mortgages. But if you are retired you should consider the alternative way to hedge.

Do you have a mortgage and also have a retirement portfolio that includes bonds? Then you may be on the losing end of an arbitrage—simultaneously earning 2.2% on your Treasuries and paying 3.3% to the bank. It could make sense to sell the bonds, pay tax on the distribution, and use what’s left of the proceeds to pay down the mortgage. Of course, if you are very persuaded that inflation and higher interest rates are coming, you could double up the bearish bet: both sell the bonds and keep the mortgage.

Lumber producers

Timberland is a long-term anti-inflation play much favored by Ivy League endowment managers. It’s probably not practical for you to buy 10 acres of southern yellow pine, but you could easily buy 1,000 shares of a lumber producer that owns timberland. Or, better, 1,000 shares of an ETF that owns shares of producers.

The iShares fund owns stock in Rayonier, PotlatchDeltic and other forest owners.

Bitcoin

This curious asset would probably hold up well if the government continues to print money with abandon. That’s because a limit on the supply is built into bitcoin.

On the other hand, some change in the virtual currency market could make this coin passé.

Shown in the table is a Canadian ETF that holds bitcoin. If and when a cheaper ETF or a U.S. ETF becomes available, consider switching. There’s more on coin-holding alternatives in How to Buy Bitcoin: A Comparison of 11 Ways.

Swiss franc

The Swiss have a better reputation than we do in the art of currency management. In the past half century the franc has appreciated 4.7-fold against the dollar.

There’s a big downside. It costs money to hold francs, what with interest rates in Zurich something like -0.75%. Add to this loss the 0.4% expense ratio on the fund, and you can expect to be out 1.15% per year if the dollar/franc exchange rate stays put.

A franc position, then, amounts to a bet that the dollar will continue its long downward slide.

Commercial real estate

Real estate investment trusts own assets like office buildings, warehouses, malls, apartments, cell towers and timberland. These assets are volatile, but over a long stretch of inflation their prices and their rental values would probably keep up with the CPI.

House

The house you live in is an inflation hedge, in the same way that a Reit is. This inflation-fighting power is separate from, and in addition to, the hedge you would get from a fixed-rate mortgage.

Owning a home gives you tax-free income in the form of the rental value of the property. Moreover, the rent you’re not paying reflects not just the economic return on the asset but also the frictional cost of the landlord-tenant relationship—the cost of lawyers to evict bum tenants and property managers to oversee plumbers and so on. For that reason I put homeownership in the table with a negative expense ratio.

What’s not to like? Transaction costs. Brokerage fees are stiff.

Long-term prospects are good, but not as good as eager homebuyers think. Over the past century home prices have been climbing at a rate 1% faster than inflation.

Gold

Gold did a terrific job counteracting the upward spurt of the inflation rate during the 1970s. Since then its hedging power has been less evident. That could be because in recent decades there haven’t been the kind of inflation surprises that would really put gold to the test.

Long-term return: tolerable. Over the past century the metal has appreciated at a 1.8% real rate versus 1% for house prices. That makes gold inferior to houses in total return: Houses pay a dividend in the form of living space, while gold has a negative dividend in the form of storage costs. You can expect a total real return on houses of perhaps 4%, on gold of 1.4%.

Materials producers

You could get something roughly equivalent to a diversified commodity basket via the shares of materials producers—companies that mine or manufacture chemicals, industrial gases, gravel, gold, pulp, lithium and so on.

The good: Long-term prospects for commodity producers are as robust as for any sector of the stock market—and better than for commodity futures. Over the long pull, owning a profit-making business is likely to be more rewarding than owning a stockpile of its products.

The bad: This sector fund play is an imperfect offset to inflation. During stagflation, product prices would go up but output would go down. These cyclical companies would be hurt.

Cash

Historically, holding cash-like investments (like Treasury bills) has been a way to just keep up with the cost of living. When inflation went up, yields went up. You could at least tread water.

Recently the pattern has been disturbed by the Fed’s manipulation of interest rates. Inflation is probably near 2%, but your yield hovers around 0%. Who knows how long that mischief will go on.

Still, there’s a case for cash. You hold some in the expectation that, sometime in the next several years, yields on long-term bonds might rise well above the inflation rate, at which point you’d put the cash to work.

The recommended vehicle is a fund that owns two-year Treasuries. It yields slightly more than a money-market fund.

Oil and gas producers

This market sector is a sister to the materials sector described above. It’s kept separate because it’s so huge.

Oil wells held their own nicely in the inflationary 1970s. Lately they have displayed a weaker and more volatile valuation. That’s why the energy business shows up at the bottom of the inflation hedges table.

Politicians have marked this industry for extinction. Still, it won’t go away tomorrow. The International Energy Agency projects that the world’s daily oil production will climb 10% over the next five years.